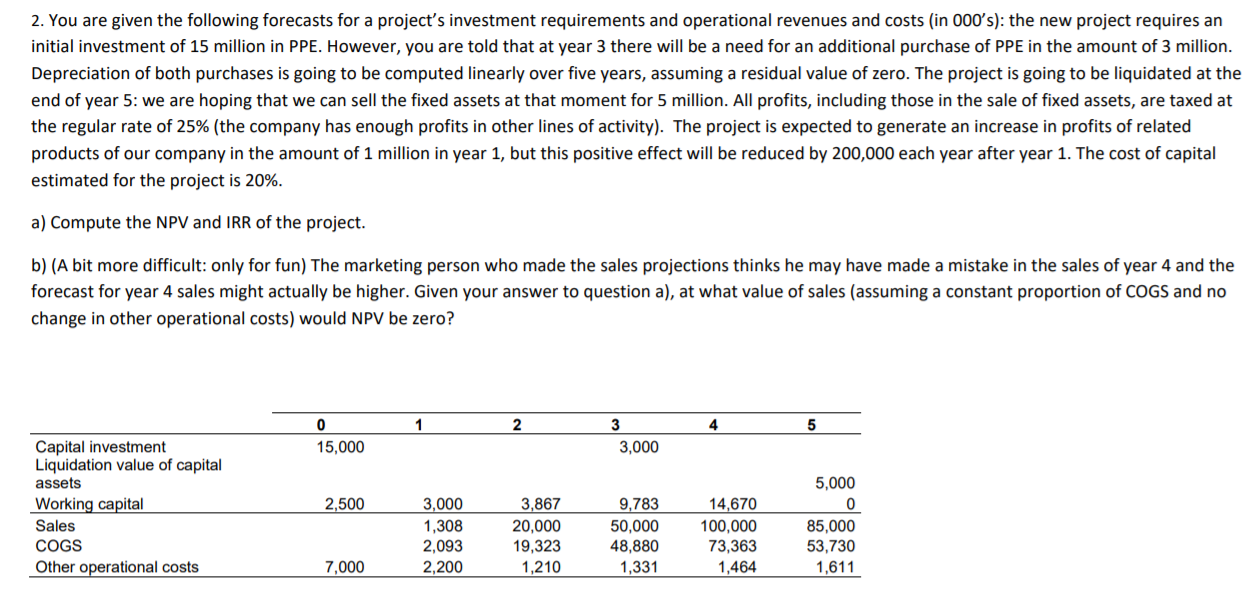

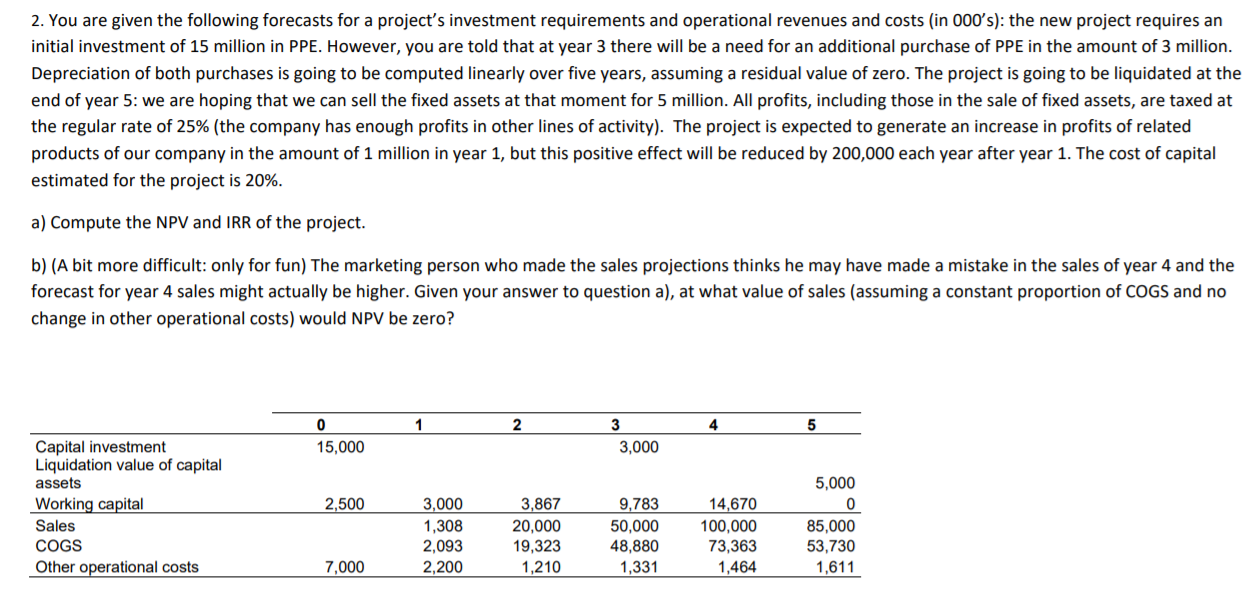

2. You are given the following forecasts for a project's investment requirements and operational revenues and costs (in 000's): the new project requires an initial investment of 15 million in PPE. However, you are told that at year 3 there will be a need for an additional purchase of PPE in the amount of 3 million. Depreciation of both purchases is going to be computed linearly over five years, assuming a residual value of zero. The project is going to be liquidated at the end of year 5: we are hoping that we can sell the fixed assets at that moment for 5 million. All profits, including those in the sale of fixed assets, are taxed at the regular rate of 25% (the company has enough profits in other lines of activity). The project is expected to generate an increase in profits of related products of our company in the amount of 1 million in year 1, but this positive effect will be reduced by 200,000 each year after year 1. The cost of capital estimated for the project is 20%. a) Compute the NPV and IRR of the project. b) (A bit more difficult: only for fun) The marketing person who made the sales projections thinks he may have made a mistake in the sales of year 4 and the forecast for year 4 sales might actually be higher. Given your answer to question a), at what value of sales (assuming a constant proportion of COGS and no change in other operational costs) would NPV be zero? 1 2 4 5 0 15,000 3 3,000 Capital investment Liquidation value of capital assets Working capital Sales COGS Other operational costs 2,500 3,000 1,308 2,093 2,200 3,867 20,000 19,323 1,210 9,783 50,000 48,880 1,331 14,670 100,000 73,363 1,464 5,000 0 85,000 53,730 1,611 7,000 2. You are given the following forecasts for a project's investment requirements and operational revenues and costs (in 000's): the new project requires an initial investment of 15 million in PPE. However, you are told that at year 3 there will be a need for an additional purchase of PPE in the amount of 3 million. Depreciation of both purchases is going to be computed linearly over five years, assuming a residual value of zero. The project is going to be liquidated at the end of year 5: we are hoping that we can sell the fixed assets at that moment for 5 million. All profits, including those in the sale of fixed assets, are taxed at the regular rate of 25% (the company has enough profits in other lines of activity). The project is expected to generate an increase in profits of related products of our company in the amount of 1 million in year 1, but this positive effect will be reduced by 200,000 each year after year 1. The cost of capital estimated for the project is 20%. a) Compute the NPV and IRR of the project. b) (A bit more difficult: only for fun) The marketing person who made the sales projections thinks he may have made a mistake in the sales of year 4 and the forecast for year 4 sales might actually be higher. Given your answer to question a), at what value of sales (assuming a constant proportion of COGS and no change in other operational costs) would NPV be zero? 1 2 4 5 0 15,000 3 3,000 Capital investment Liquidation value of capital assets Working capital Sales COGS Other operational costs 2,500 3,000 1,308 2,093 2,200 3,867 20,000 19,323 1,210 9,783 50,000 48,880 1,331 14,670 100,000 73,363 1,464 5,000 0 85,000 53,730 1,611 7,000