Answered step by step

Verified Expert Solution

Question

1 Approved Answer

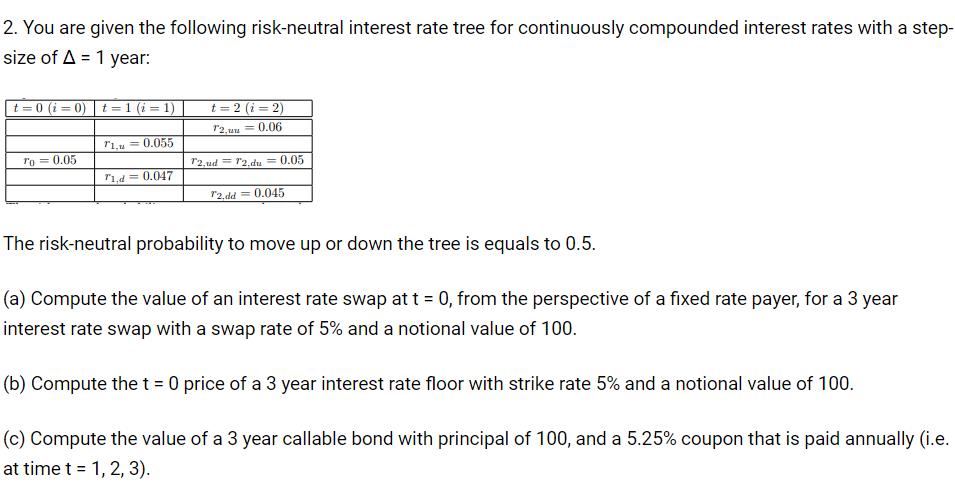

2. You are given the following risk-neutral interest rate tree for continuously compounded interest rates with a step- size of A = 1 year:

2. You are given the following risk-neutral interest rate tree for continuously compounded interest rates with a step- size of A = 1 year: t=0 (i=0)| t= 1 (i=1) T1.u 0.055 To 0.05 = Tid=0.047 t=2(i=2) 72,-0.06 12,ud 12.du= 0.05 12.dd = 0.045 The risk-neutral probability to move up or down the tree is equals to 0.5. (a) Compute the value of an interest rate swap at t = 0, from the perspective of a fixed rate payer, for a 3 year interest rate swap with a swap rate of 5% and a notional value of 100. (b) Compute the t = 0 price of a 3 year interest rate floor with strike rate 5% and a notional value of 100. (c) Compute the value of a 3 year callable bond with principal of 100, and a 5.25% coupon that is paid annually (i.e. at time t = 1, 2, 3).

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To compute the values of the financial instruments we need to use the riskneutral pricing approach based on the given interest rate tree a Value of an ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started