Question

2. You collect the following data on the yields of French Government bonds (OATS) and Renault bonds, as well as Renault CDS prices (all

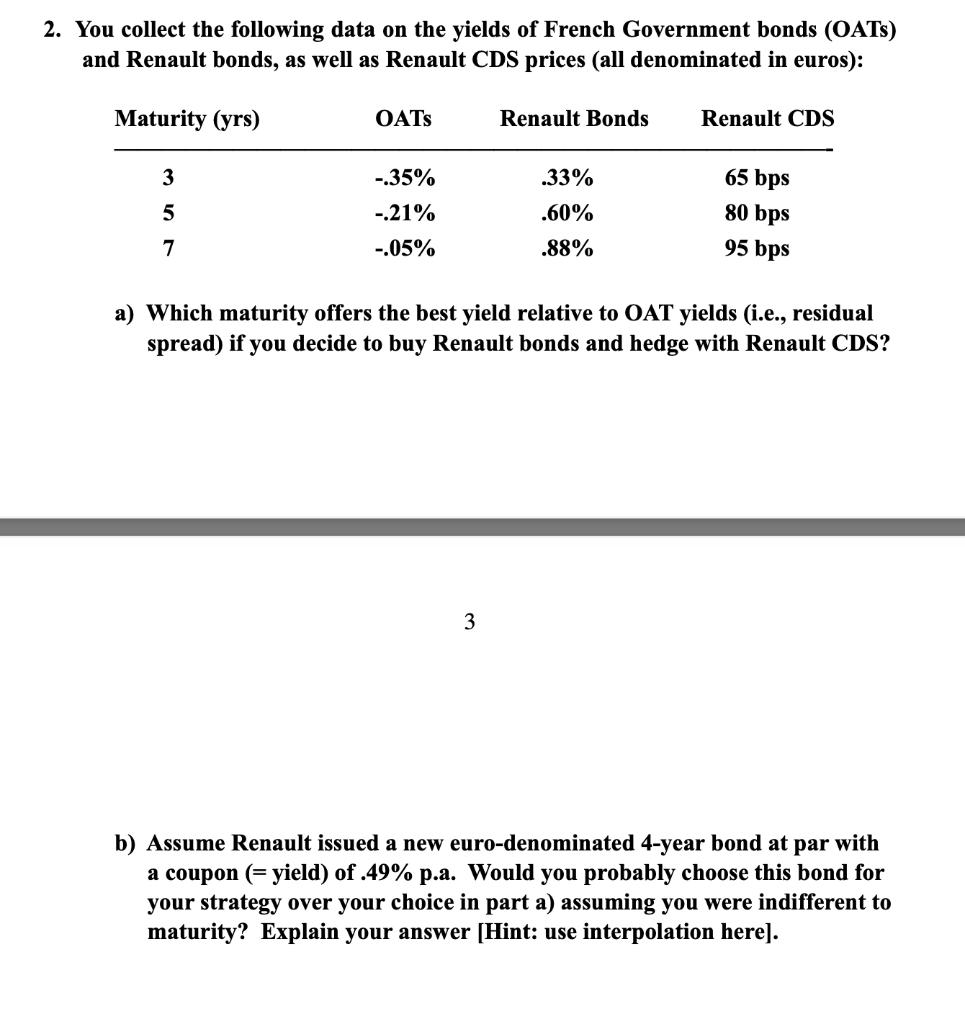

2. You collect the following data on the yields of French Government bonds (OATS) and Renault bonds, as well as Renault CDS prices (all denominated in euros): Maturity (yrs) OATS Renault Bonds Renault CDS 3 5 -.35% .33% 65 bps -.21% .60% 80 bps 7 -.05% .88% 95 bps a) Which maturity offers the best yield relative to OAT yields (i.e., residual spread) if you decide to buy Renault bonds and hedge with Renault CDS? 3 b) Assume Renault issued a new euro-denominated 4-year bond at par with a coupon (yield) of .49% p.a. Would you probably choose this bond for your strategy over your choice in part a) assuming you were indifferent to maturity? Explain your answer [Hint: use interpolation here].

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Using Econometrics A Practical Guide

Authors: A. H. Studenmund

7th edition

013418274X, 978-0134182742

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App