Question

2. You observe the following two pending mergers today and you are considering adding them to a merger arbitrage portfolio. [A1] List the trade(s) necessary

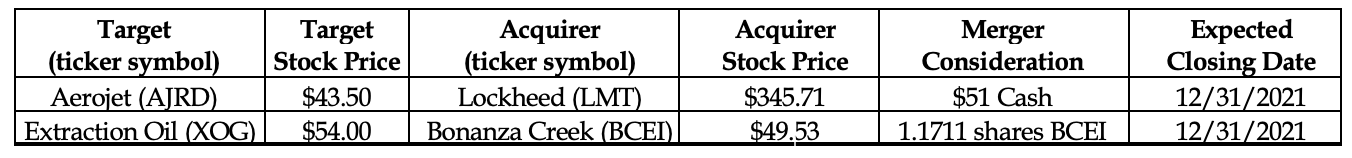

2.  You observe the following two pending mergers today and you are considering adding them to a merger arbitrage portfolio.

You observe the following two pending mergers today and you are considering adding them to a merger arbitrage portfolio.

[A1] List the trade(s) necessary to invest on the Aerojet (AJRD) merger. What is the merger arbitrage spread (rate of return) and approximate annualized return?

[A2] List the trade(s) necessary to invest on the Extraction Oil (XOG) merger. What is the merger arbitrage spread (rate of return) and approximate annualized return?

[B] Are these trades eventually guaranteed to be profitable? Briefly explain two important things that could happen such that either of these positions will not be profitable.

Target (ticker symbol) Aerojet (AJRD) Extraction Oil (XOG) Target Stock Price $43.50 $54.00 Acquirer (ticker symbol) Lockheed (LMT) Bonanza Creek (BCEI) Acquirer Stock Price $345.71 $49.53 Merger Consideration $51 Cash 1.1711 shares BCEI Expected Closing Date 12/31/2021 12/31/2021 Target (ticker symbol) Aerojet (AJRD) Extraction Oil (XOG) Target Stock Price $43.50 $54.00 Acquirer (ticker symbol) Lockheed (LMT) Bonanza Creek (BCEI) Acquirer Stock Price $345.71 $49.53 Merger Consideration $51 Cash 1.1711 shares BCEI Expected Closing Date 12/31/2021 12/31/2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started