Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. You observe three zero-coupon Treasury bonds in the market. Treasury bond of 18 months to maturity is about to be issued with a coupon

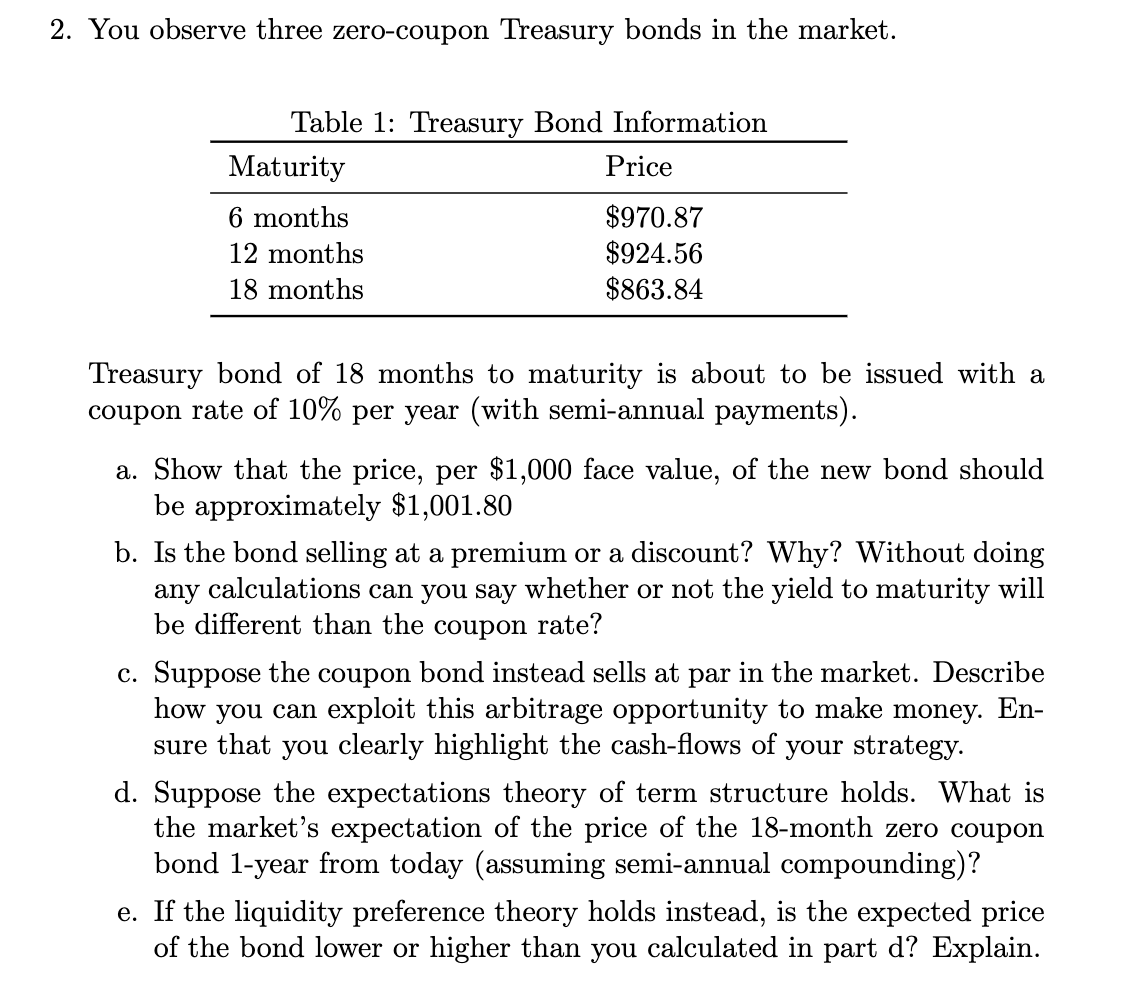

2. You observe three zero-coupon Treasury bonds in the market. Treasury bond of 18 months to maturity is about to be issued with a coupon rate of 10% per year (with semi-annual payments). a. Show that the price, per $1,000 face value, of the new bond should be approximately $1,001.80 b. Is the bond selling at a premium or a discount? Why? Without doing any calculations can you say whether or not the yield to maturity will be different than the coupon rate? c. Suppose the coupon bond instead sells at par in the market. Describe how you can exploit this arbitrage opportunity to make money. Ensure that you clearly highlight the cash-flows of your strategy. d. Suppose the expectations theory of term structure holds. What is the market's expectation of the price of the 18-month zero coupon bond 1-year from today (assuming semi-annual compounding)? e. If the liquidity preference theory holds instead, is the expected price of the bond lower or higher than you calculated in part d? Explain

2. You observe three zero-coupon Treasury bonds in the market. Treasury bond of 18 months to maturity is about to be issued with a coupon rate of 10% per year (with semi-annual payments). a. Show that the price, per $1,000 face value, of the new bond should be approximately $1,001.80 b. Is the bond selling at a premium or a discount? Why? Without doing any calculations can you say whether or not the yield to maturity will be different than the coupon rate? c. Suppose the coupon bond instead sells at par in the market. Describe how you can exploit this arbitrage opportunity to make money. Ensure that you clearly highlight the cash-flows of your strategy. d. Suppose the expectations theory of term structure holds. What is the market's expectation of the price of the 18-month zero coupon bond 1-year from today (assuming semi-annual compounding)? e. If the liquidity preference theory holds instead, is the expected price of the bond lower or higher than you calculated in part d? Explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started