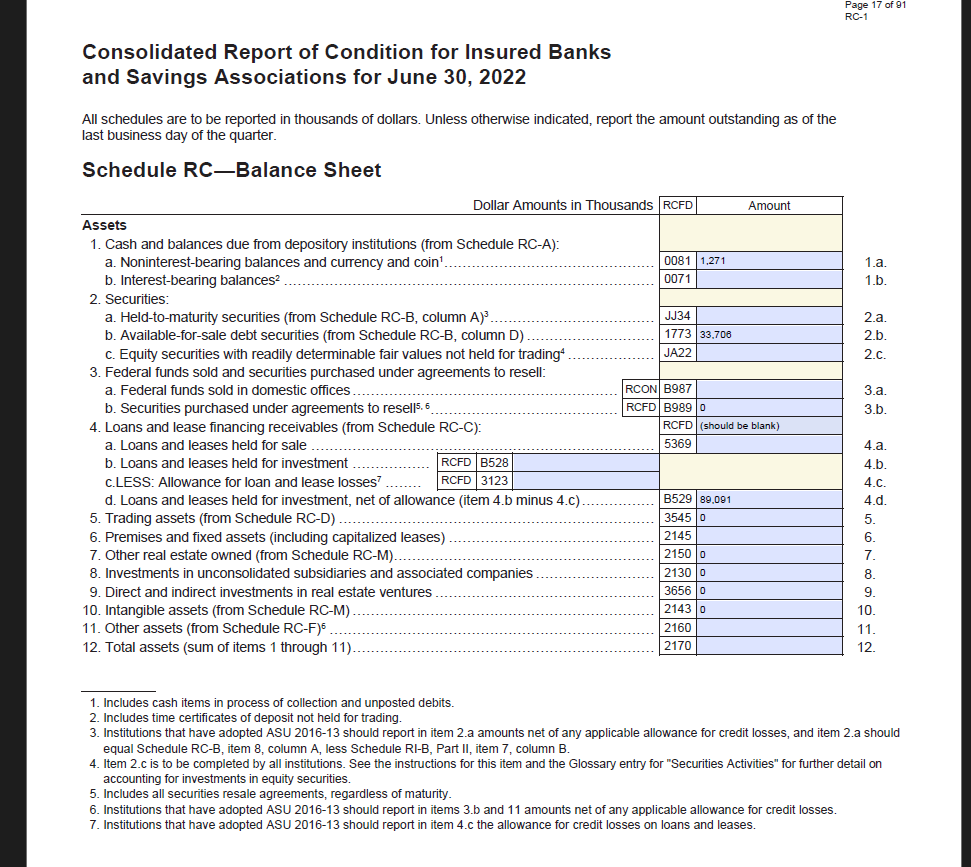

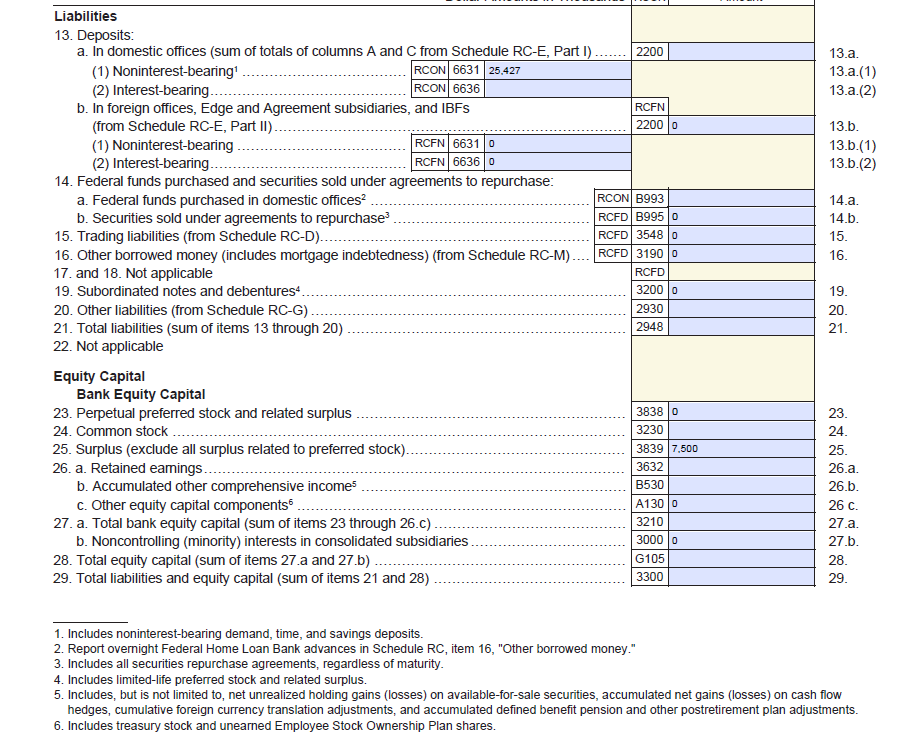

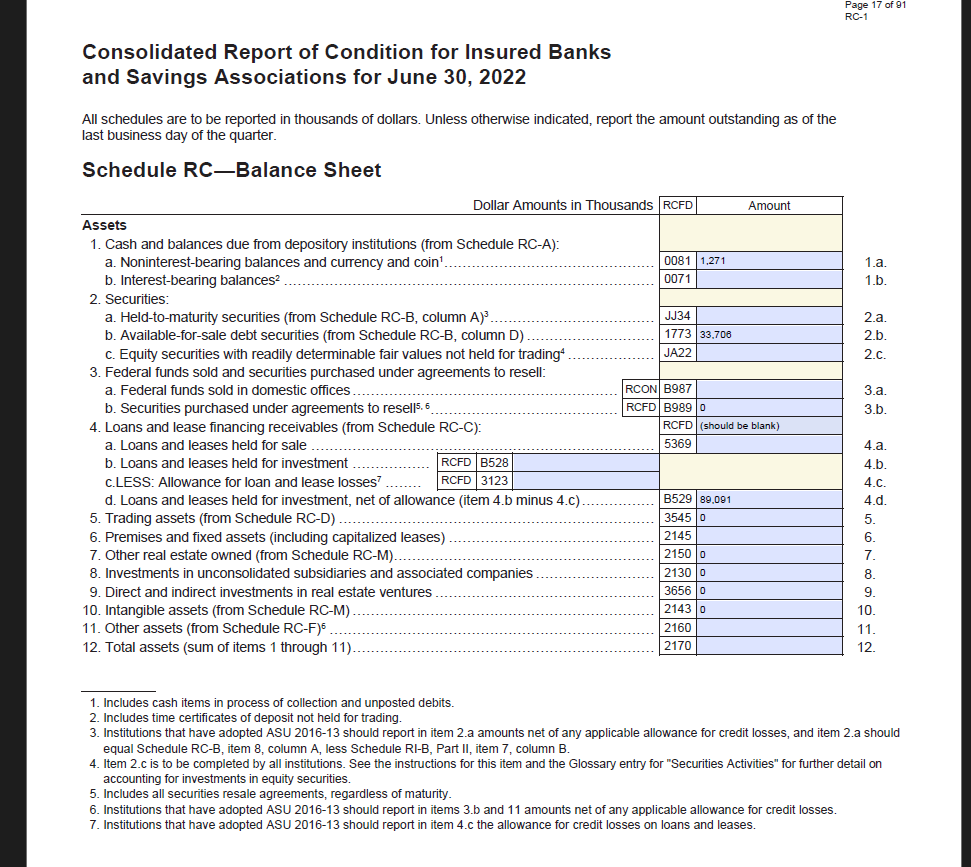

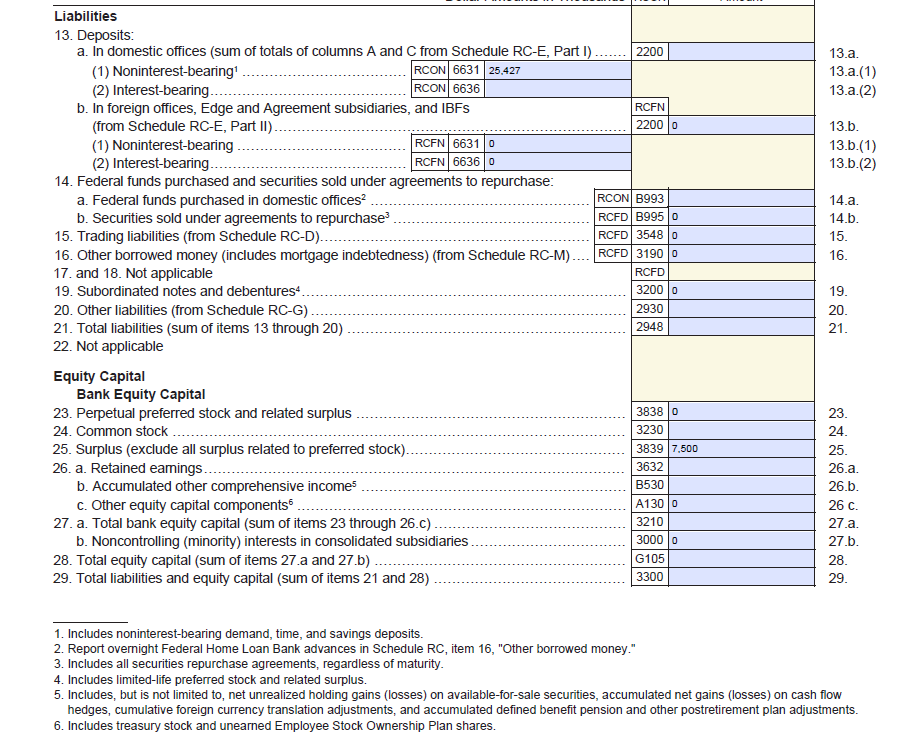

2. You will fill in the details below that I provide for a real bank: - Total cash and balances due from depository institutions =$4,26 - Securities considered Held-to-maturity =$11 - Total securities =$33,779 - This bank has a Fed Funds sold position of $14,300 - This bank does not have any leases or loans held for resale. - The allowance for loan and lease losses =$1,525 - Fixed assets =$1,163 - Other Assets =$1,840 - Total deposits in domestic offices =$125,929 - This bank is not in a fed funds purchased position. - Other liabilities =$784 - Common stock =$125 - Retained Earnings =$11,322 - Accumulated other comprehensive income =$1,261 - Line 27a= line 28a Consolidated Report of Condition for Insured Banks and Savings Associations for June 30, 2022 All schedules are to be reported in thousands of dollars. Unless otherwise indicated, report the amount outstanding as of the last business day of the quarter. Schedule RC-Balance Sheet 1. Includes cash items in process of collection and unposted debits. 2. Includes time certificates of deposit not held for trading. 3. Institutions that have adopted ASU 2016-13 should report in item 2.a amounts net of any applicable allowance for credit losses, and item 2.a should equal Schedule RC-B, item 8, column A, less Schedule RI-B, Part II, item 7, column B. 4. Item 2.c is to be completed by all institutions. See the instructions for this item and the Glossary entry for "Securities Activities" for further detail on accounting for investments in equity securities. 5. Includes all securities resale agreements, regardless of maturity. 6. Institutions that have adopted ASU 2016-13 should report in items 3.b and 11 amounts net of any applicable allowance for credit losses. 7. Institutions that have adopted ASU 2016-13 should report in item 4.c the allowance for credit losses on loans and leases. 2. Report overnight Federal Home Loan Bank advances in Schedule RC, item 16, "Other borrowed money." 3. Includes all securities repurchase agreements, regardless of maturity. 4. Includes limited-life preferred stock and related surplus. 5. Includes, but is not limited to, net unrealized holding gains (losses) on available-for-sale securities, accumulated net gains (losses) on cash flow hedges, cumulative foreign currency translation adjustments, and accumulated defined benefit pension and other postretirement plan adjustments. 6. Includes treasury stock and unearned Employee Stock Ownership Plan shares. 2. You will fill in the details below that I provide for a real bank: - Total cash and balances due from depository institutions =$4,26 - Securities considered Held-to-maturity =$11 - Total securities =$33,779 - This bank has a Fed Funds sold position of $14,300 - This bank does not have any leases or loans held for resale. - The allowance for loan and lease losses =$1,525 - Fixed assets =$1,163 - Other Assets =$1,840 - Total deposits in domestic offices =$125,929 - This bank is not in a fed funds purchased position. - Other liabilities =$784 - Common stock =$125 - Retained Earnings =$11,322 - Accumulated other comprehensive income =$1,261 - Line 27a= line 28a Consolidated Report of Condition for Insured Banks and Savings Associations for June 30, 2022 All schedules are to be reported in thousands of dollars. Unless otherwise indicated, report the amount outstanding as of the last business day of the quarter. Schedule RC-Balance Sheet 1. Includes cash items in process of collection and unposted debits. 2. Includes time certificates of deposit not held for trading. 3. Institutions that have adopted ASU 2016-13 should report in item 2.a amounts net of any applicable allowance for credit losses, and item 2.a should equal Schedule RC-B, item 8, column A, less Schedule RI-B, Part II, item 7, column B. 4. Item 2.c is to be completed by all institutions. See the instructions for this item and the Glossary entry for "Securities Activities" for further detail on accounting for investments in equity securities. 5. Includes all securities resale agreements, regardless of maturity. 6. Institutions that have adopted ASU 2016-13 should report in items 3.b and 11 amounts net of any applicable allowance for credit losses. 7. Institutions that have adopted ASU 2016-13 should report in item 4.c the allowance for credit losses on loans and leases. 2. Report overnight Federal Home Loan Bank advances in Schedule RC, item 16, "Other borrowed money." 3. Includes all securities repurchase agreements, regardless of maturity. 4. Includes limited-life preferred stock and related surplus. 5. Includes, but is not limited to, net unrealized holding gains (losses) on available-for-sale securities, accumulated net gains (losses) on cash flow hedges, cumulative foreign currency translation adjustments, and accumulated defined benefit pension and other postretirement plan adjustments. 6. Includes treasury stock and unearned Employee Stock Ownership Plan shares