Question

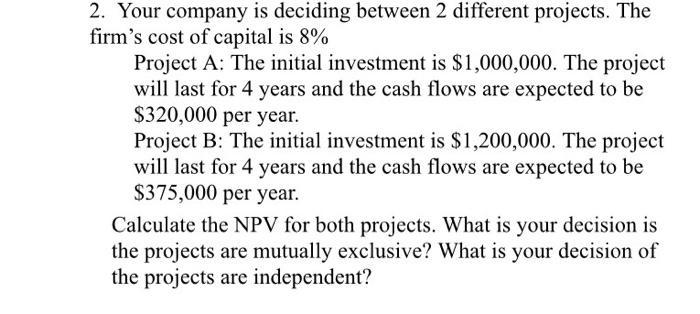

2. Your company is deciding between 2 different projects. The firm's cost of capital is 8% Project A: The initial investment is $1,000,000. The

2. Your company is deciding between 2 different projects. The firm's cost of capital is 8% Project A: The initial investment is $1,000,000. The project will last for 4 years and the cash flows are expected to be $320,000 per year. Project B: The initial investment is $1,200,000. The project will last for 4 years and the cash flows are expected to be $375,000 per year. Calculate the NPV for both projects. What is your decision is the projects are mutually exclusive? What is your decision of the projects are independent?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Project A Initial investment 1000000 Expected annual cash flow 320000 Project duration ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Managerial Finance

Authors: Lawrence J. Gitman, Chad J. Zutter, Wajeeh Elali, Amer Al Roubaix

Arab World Edition

1408271583, 978-1408271582

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App