Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Peter is taking seven modules for his 2nd year University examination: a) Module 1 Probability of Passing 0.60 2 3 4 5

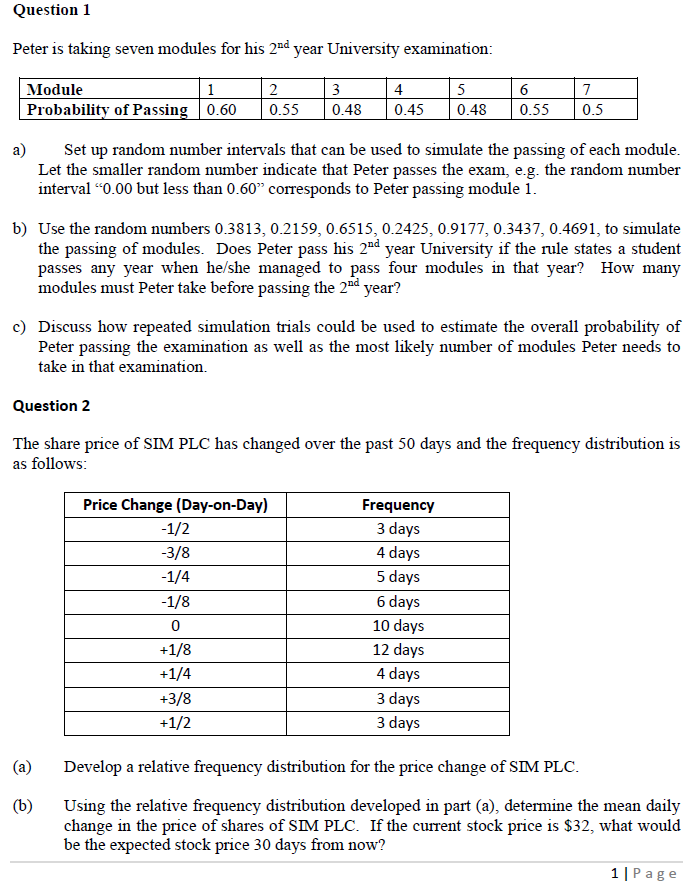

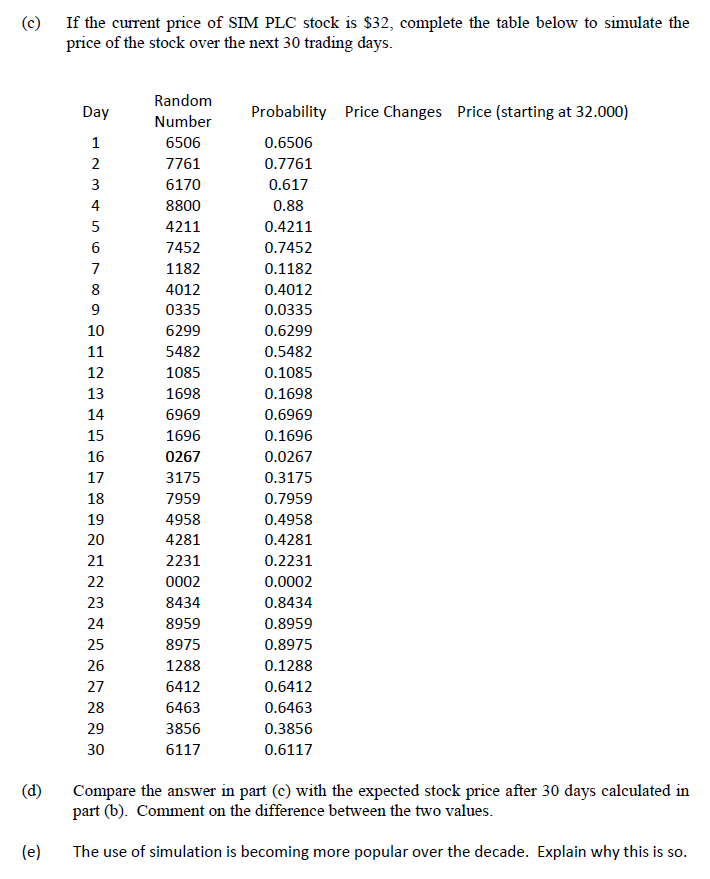

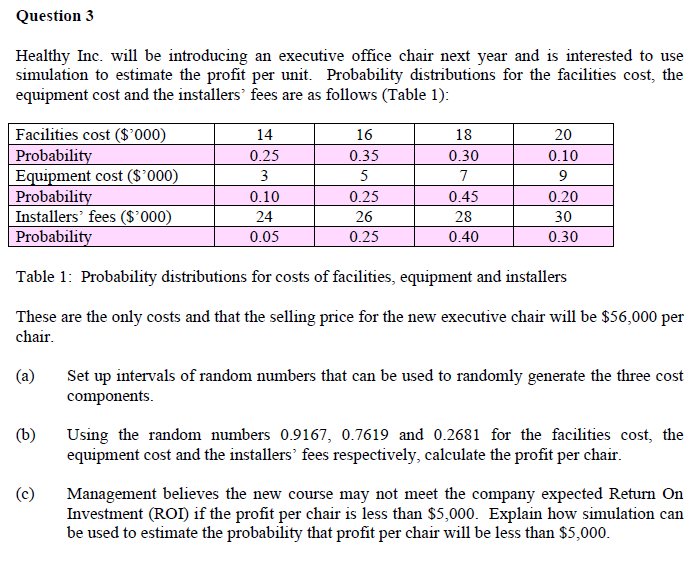

Question 1 Peter is taking seven modules for his 2nd year University examination: a) Module 1 Probability of Passing 0.60 2 3 4 5 6 7 0.55 0.48 0.45 0.48 0.55 0.5 Set up random number intervals that can be used to simulate the passing of each module. Let the smaller random number indicate that Peter passes the exam, e.g. the random number interval "0.00 but less than 0.60" corresponds to Peter passing module 1. b) Use the random numbers 0.3813, 0.2159, 0.6515, 0.2425, 0.9177, 0.3437, 0.4691, to simulate the passing of modules. Does Peter pass his 2nd year University if the rule states a student passes any year when he/she managed to pass four modules in that year? How many modules must Peter take before passing the 2nd year? c) Discuss how repeated simulation trials could be used to estimate the overall probability of Peter passing the examination as well as the most likely number of modules Peter needs to take in that examination. Question 2 The share price of SIM PLC has changed over the past 50 days and the frequency distribution is as follows: Price Change (Day-on-Day) Frequency -1/2 3 days -3/8 4 days -1/4 5 days -1/8 6 days 0 10 days +1/8 12 days +1/4 4 days +3/8 +1/2 3 days 3 days (a) Develop a relative frequency distribution for the price change of SIM PLC. (b) Using the relative frequency distribution developed in part (a), determine the mean daily change in the price of shares of SIM PLC. If the current stock price is $32, what would be the expected stock price 30 days from now? 1| Page (c) If the current price of SIM PLC stock is $32, complete the table below to simulate the price of the stock over the next 30 trading days. Random Day Probability Price Changes Price (starting at 32.000) Number 123456 a 6506 0.6506 7761 0.7761 6170 0.617 8800 0.88 4211 0.4211 7452 0.7452 7 1182 0.1182 8 4012 0.4012 9 0335 0.0335 10 6299 0.6299 11 5482 0.5482 12 1085 0.1085 13 1698 0.1698 14 6969 0.6969 15 1696 0.1696 16 0267 0.0267 17 3175 0.3175 18 7959 0.7959 19 4958 0.4958 20 4281 0.4281 21 2231 0.2231 22 0002 0.0002 23 8434 0.8434 24 8959 0.8959 25 8975 0.8975 26 1288 0.1288 27 6412 0.6412 28 6463 0.6463 29 3856 0.3856 30 6117 0.6117 (d) (e) Compare the answer in part (c) with the expected stock price after 30 days calculated in part (b). Comment on the difference between the two values. The use of simulation is becoming more popular over the decade. Explain why this is so. Question 3 Healthy Inc. will be introducing an executive office chair next year and is interested to use simulation to estimate the profit per unit. Probability distributions for the facilities cost, the equipment cost and the installers' fees are as follows (Table 1): Facilities cost ($'000) 14 16 18 20 Probability 0.25 0.35 0.30 0.10 Equipment cost ($2000) 3 5 7 9 Probability 0.10 0.25 0.45 0.20 Installers' fees ($2000) 24 26 28 30 Probability 0.05 0.25 0.40 0.30 Table 1: Probability distributions for costs of facilities, equipment and installers These are the only costs and that the selling price for the new executive chair will be $56,000 per chair. (a) (b) (c) Set up intervals of random numbers that can be used to randomly generate the three cost components. Using the random numbers 0.9167, 0.7619 and 0.2681 for the facilities cost, the equipment cost and the installers' fees respectively, calculate the profit per chair. Management believes the new course may not meet the company expected Return On Investment (ROI) if the profit per chair is less than $5,000. Explain how simulation can be used to estimate the probability that profit per chair will be less than $5,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started