Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your task is to estimate expected shortfall (ES) for an equity portfolio using the historical simulation approach. Suppose you have invested in two of

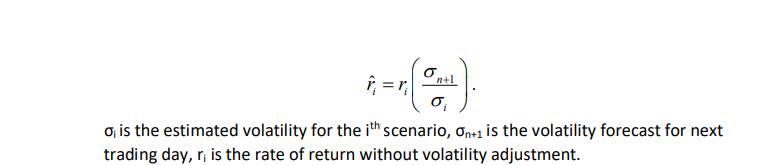

Your task is to estimate expected shortfall (ES) for an equity portfolio using the "historical simulation" approach. Suppose you have invested in two of the Fama-French factors, namely Mkt-RF and HML. You are provided with the daily returns for the last five years. a. Use the "exponential weighting" method (Section 13.3.1) to estimate the one-day 97.5% ES for the portfolio. Note: in our context each scenario is represented by the "rate of return" instead of "value". Therefore, the ES should also be estimated as a rate of return. b. Use the "volatility-scaling" method (Section 13.3.2) to estimate the one-day 97.5% ES for the portfolio. The daily volatilities for Mkt-RF and HML should be estimated by GARCH (1,1). You may assume the initial variance (v) for the first daily return and the long-run variance (V) are both equal to the sample variance. The parameters, a and B, should be estimated by maximum likelihood method for each market variable. Note: As in Part (a), each scenario should be represented by rate of return. In the case of volatility-scaling, the simulated rate of return under the ith scenario is given by n+1 i o is the estimated volatility for the ith scenario, On+1 is the volatility forecast for next trading day, r, is the rate of return without volatility adjustment.

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Estimating Expected Shortfall ES for an Equity Portfolio While I cannot execute the calculations involved due to the lack of specific data on daily returns and volatilities I can guide you through the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started