Answered step by step

Verified Expert Solution

Question

1 Approved Answer

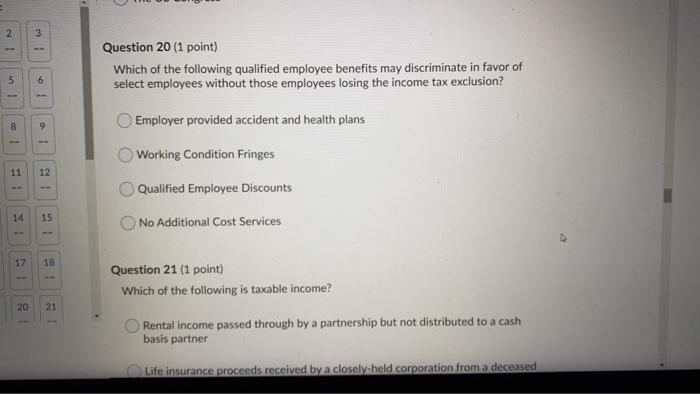

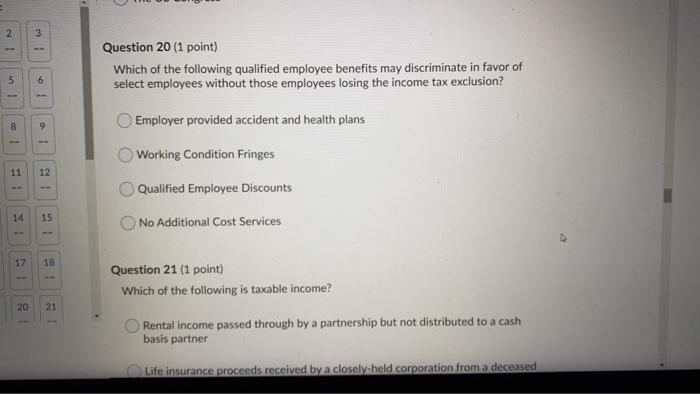

20 2 3 Question 20 (1 point) Which of the following qualified employee benefits may discriminate in favor of select employees without those employees losing

20

2 3 Question 20 (1 point) Which of the following qualified employee benefits may discriminate in favor of select employees without those employees losing the income tax exclusion? 5 10 Employer provided accident and health plans 8 9 Working Condition Fringes 11 12 Qualified Employee Discounts 14 15 No Additional Cost Services 17 18 20 21 Question 21 (1 point) Which of the following is taxable income? Rental income passed through by a partnership but not distributed to a cash basis partner Life insurance proceeds received by a closely held corporation from a deceased

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started