Answered step by step

Verified Expert Solution

Question

1 Approved Answer

20 25 30 September 15, 2020 Sold yoga mats for $500 in cash. You were running low on cash, so you borrowed $8,000 in

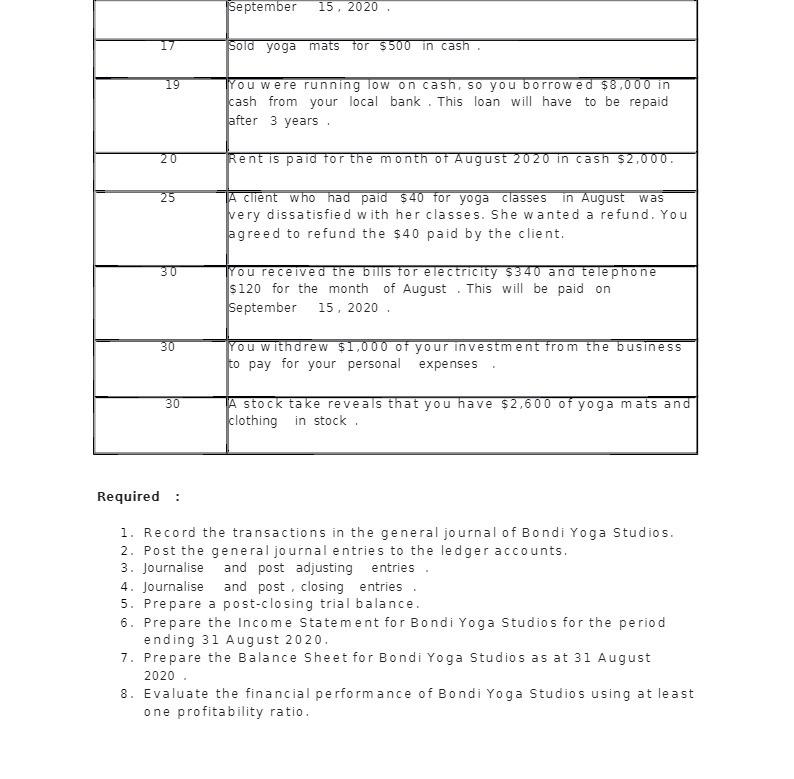

20 25 30 September 15, 2020 Sold yoga mats for $500 in cash. You were running low on cash, so you borrowed $8,000 in cash from your local bank. This loan will have to be repaid after 3 years. Rent is paid for the month of August 2020 in cash $2,000. A client who had paid $40 for yoga classes in August was very dissatisfied with her classes. She wanted a refund. You agreed to refund the $40 paid by the client. You received the bills for electricity $340 and telephone $120 for the month of August This will be paid on September 15, 2020. . You withdrew $1,000 of your investment from the business to pay for your personal expenses A stock take reveals that you have $2,600 of yoga mats and clothing in stock. Required: 1. Record the transactions in the general journal of Bondi Yoga Studios. 2. Post the general journal entries to the ledger accounts. 3. Journalise and post adjusting entries. 4. Journalise and post closing entries. 5. Prepare a post-closing trial balance.. 6. Prepare the Income Statement for Bondi Yoga Studios for the period ending 31 August 2020. 7. Prepare the Balance Sheet for Bondi Yoga Studios as at 31 August 2020 8. Evaluate the financial performance of Bondi Yoga Studios using at least one profitability ratio.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Record the transactions in the general journal of Bondi Yoga Studios Date Account Debit Credit Sep 17 Cash 500 Sales Revenue 500 Sep 19 Cash 8000 Notes Payable 8000 Sep 20 Rent Expense 2000 Cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started