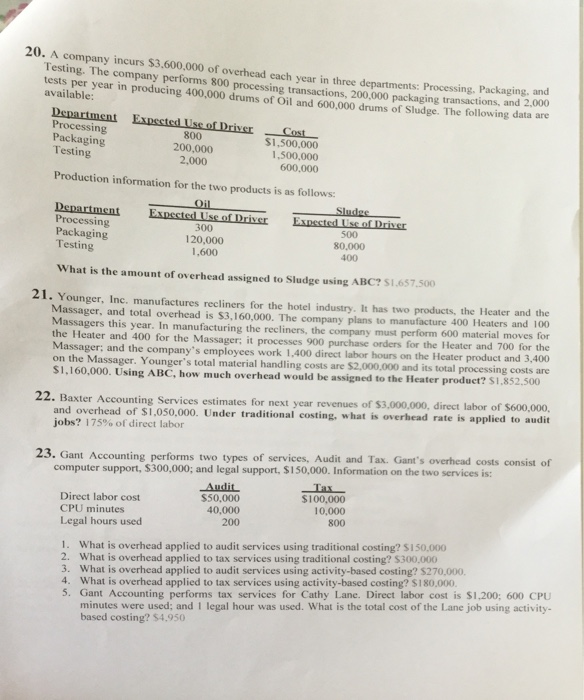

20. A company incurs $3,600,000 of overhead each year in three departments: Processing. Packaging Testing. The company performs 800 processing transactions, 200,000 packaging transactions, an tests per year in producing 400,000 drums of Oil and 600,000 drums of S available: and ludge. The following data are Processing Packaging Testing 800 200,000 2,000 $1,500,000 1,500,000 600,000 Production information for the two products is as follows: Processing Packaging Testing 300 120,000 1,600 500 80,000 400 What is the amount of overhead assigned to Sludge using ABC? $1.657.500 21. Younger, Inc. manufactures recliners for the hotel industry. It has two products, the Heater and the 400 Heaters and 100 the Heater and 700 for the total material handling costs are $2,000,000 and its total processing costs are Massager, and total overhead is S3,160,000. The company plans to manufacture Massagers this year. In manufacturing the recliners, the company must perform 600 material moves for the Heater and 400 for the Massager: it processes 900 purchase orders for the Heater and 700 for the Massager: and the company's employees work 1,400 direct labor hours on the Heater product and 3,400 on the Massager. Younger's S1,160,000. Using ABC, how much overhead would be assigned to the Heater product? $1,852.500 of $3,000,000, direct labor of $600,000, 22. Baxter Accounting Services estimates for next year revenues and overhead of $1.0s0.000. Under traditional costing, what is overhead rate is applied to audit jobs? 175% of direct labor 23. Gant Accounting performs two types of services, Audit and Tax. Gant's overhead costs consist of computer support, $300,000; and legal support, $150,000. Information on the two services is: Audit Direct labor cost CPU minutes Legal hours used $50,000 40,000 200 $100,000 10,000 800 1. What is overhead applied to audit services using traditional costing? $150.000 2. What is overhead applied to tax services using traditional costing? $300,000 3. What is overhead applied to audit services using activity-based costing? $270,000. 4. What is overhead applied to tax services using activity-based costing? $180.000 5. Gant Accounting performs tax services for Cathy Lane. Direct labor cost is $1,200; 600 CPU minutes were used; and 1 legal hour was used. What is the total cost of the Lane job using activity- based costing? $4,950 20. A company incurs $3,600,000 of overhead each year in three departments: Processing. Packaging Testing. The company performs 800 processing transactions, 200,000 packaging transactions, an tests per year in producing 400,000 drums of Oil and 600,000 drums of S available: and ludge. The following data are Processing Packaging Testing 800 200,000 2,000 $1,500,000 1,500,000 600,000 Production information for the two products is as follows: Processing Packaging Testing 300 120,000 1,600 500 80,000 400 What is the amount of overhead assigned to Sludge using ABC? $1.657.500 21. Younger, Inc. manufactures recliners for the hotel industry. It has two products, the Heater and the 400 Heaters and 100 the Heater and 700 for the total material handling costs are $2,000,000 and its total processing costs are Massager, and total overhead is S3,160,000. The company plans to manufacture Massagers this year. In manufacturing the recliners, the company must perform 600 material moves for the Heater and 400 for the Massager: it processes 900 purchase orders for the Heater and 700 for the Massager: and the company's employees work 1,400 direct labor hours on the Heater product and 3,400 on the Massager. Younger's S1,160,000. Using ABC, how much overhead would be assigned to the Heater product? $1,852.500 of $3,000,000, direct labor of $600,000, 22. Baxter Accounting Services estimates for next year revenues and overhead of $1.0s0.000. Under traditional costing, what is overhead rate is applied to audit jobs? 175% of direct labor 23. Gant Accounting performs two types of services, Audit and Tax. Gant's overhead costs consist of computer support, $300,000; and legal support, $150,000. Information on the two services is: Audit Direct labor cost CPU minutes Legal hours used $50,000 40,000 200 $100,000 10,000 800 1. What is overhead applied to audit services using traditional costing? $150.000 2. What is overhead applied to tax services using traditional costing? $300,000 3. What is overhead applied to audit services using activity-based costing? $270,000. 4. What is overhead applied to tax services using activity-based costing? $180.000 5. Gant Accounting performs tax services for Cathy Lane. Direct labor cost is $1,200; 600 CPU minutes were used; and 1 legal hour was used. What is the total cost of the Lane job using activity- based costing? $4,950