Answered step by step

Verified Expert Solution

Question

1 Approved Answer

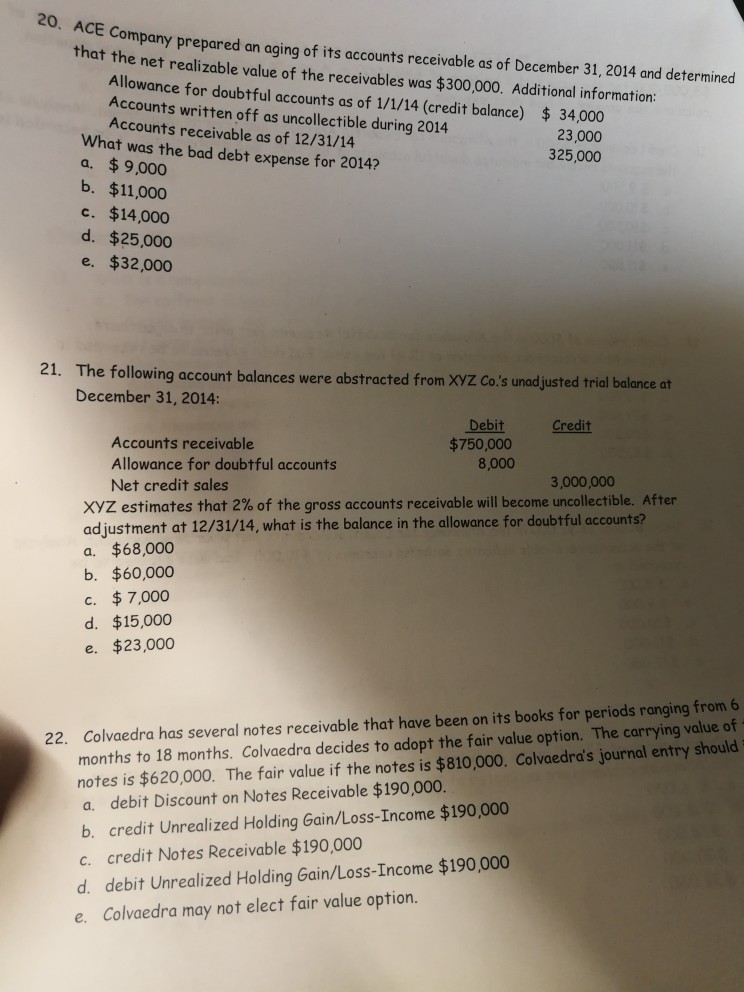

20. ACE Company pr prepared an aging of its accounts receivable as of December 31, 2014 and determined that the net realizable value of the

20. ACE Company pr prepared an aging of its accounts receivable as of December 31, 2014 and determined that the net realizable value of the receivables was $300,000. Additional information: Allowance for doubtful accounts as of 1/1/14 (credit balance) Accounts written off as uncollectible during 2014 34,000 Accounts receivable as of 12/31/14 What was the bad debt expense for 2014? a. $9,000 b. $11,000 c. $14,000 d $25,000 e $32,000 23,000 325,000 21. The following account balances were abstracted from XVZ Co's unad justed trial balance at December 31, 2014: Credit Debit $750,000 Accounts receivable Allowance for doubtful accounts 8,000 3,000,000 Net credit sales XYZ estimates that 2% of the gross accounts receivable will become uncollectible. After adjustment at 12/31/14, what is the balance in the allowance for doubtful accounts? a $68,000 b. $60,000 c. $7,000 d $15,000 e $23,000 Colvaedra has several notes receivable that have been on its books for periods ranging from6 months to 18 months. Colvaedra decides to adopt the fair value option. The carrying value of notes is $620,000. The fair value if the notes is $810,000. Colvaedra's journal entry should a. debit Discount on Notes Receivable $190,000. b. credit Unrealized Holding Gain/Loss-Income $190,000 c. credit Notes Receivable $190,000 d. debit Unrealized Holding Gain/Loss-Income $190,000 e. Colvaedra may not elect fair value option. 22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started