Answered step by step

Verified Expert Solution

Question

1 Approved Answer

20. Company Theta operates in an economy with the following fiscal system: shareholders are taxed 25% when they receive dividends, shareholders are not taxed when

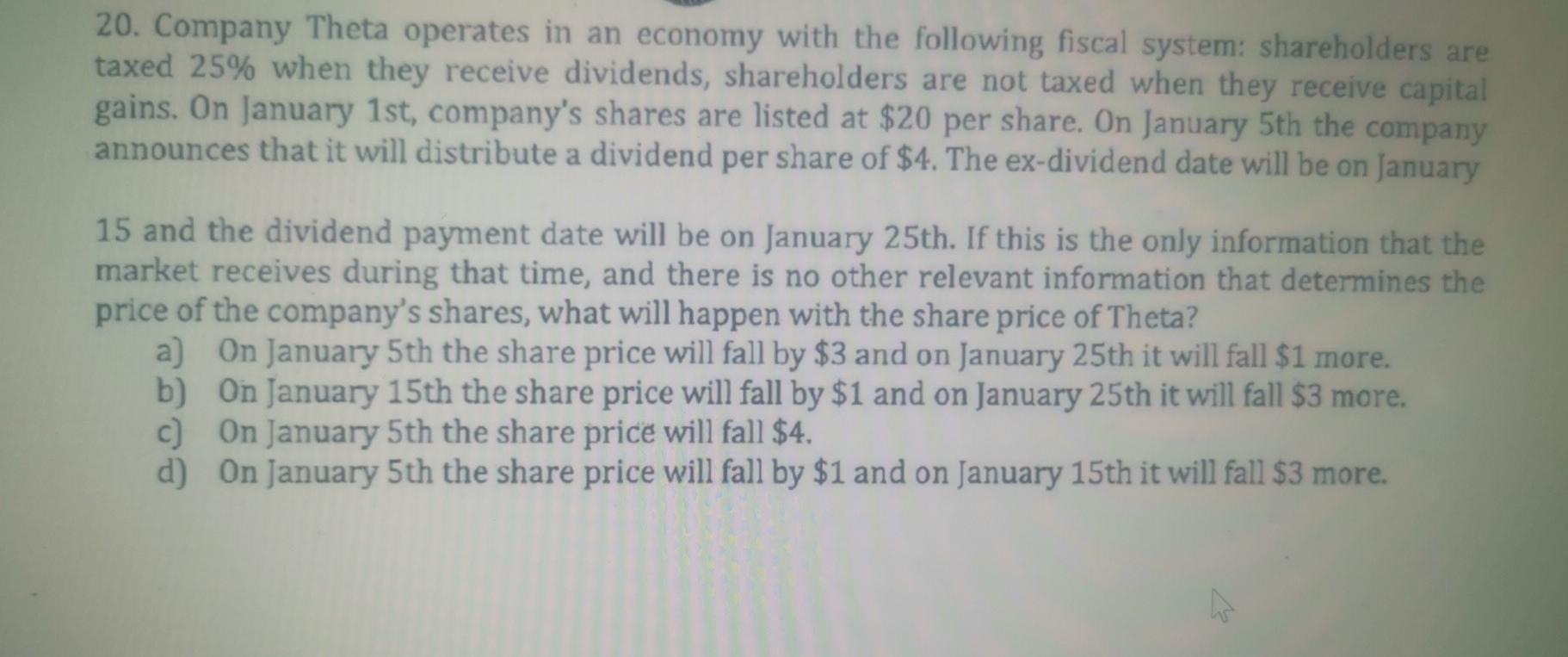

20. Company Theta operates in an economy with the following fiscal system: shareholders are taxed 25% when they receive dividends, shareholders are not taxed when they receive capital gains. On January 1st, company's shares are listed at $20 per share. On January 5th the company announces that it will distribute a dividend per share of $4. The ex-dividend date will be on January 15 and the dividend payment date will be on January 25th. If this is the only information that the market receives during that time, and there is no other relevant information that determines the price of the company's shares, what will happen with the share price of Theta? a) On January 5th the share price will fall by $3 and on January 25th it will fall $1 more. b) On January 15th the share price will fall by $1 and on January 25th it will fall $3 more. c) On January 5th the share price will fall $4. d) On January 5th the share price will fall by $1 and on January 15th it will fall $3 more

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started