Question

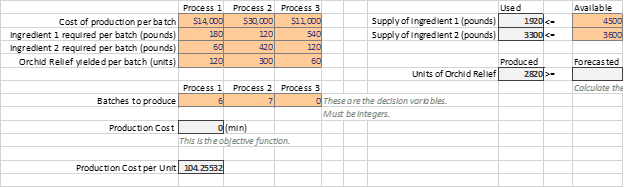

20% Consider a possible shortage of ingredients in the following week. What would the optimized production process look like if Eli Orchid could only procure

20%

Consider a possible shortage of ingredients in the following week. What would the optimized production process look like if Eli Orchid could only procure 4320 pounds of ingredient 1 and 1440 pounds of ingredient 2?

Follow these steps:

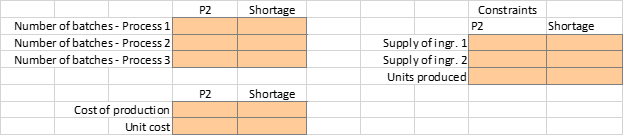

1. In the appropriate cells below type in the numbers obtained from the original optimal solution (no shortage) produced in P2.

2. In the Constraints table label each constraint in the original solution as binding or not-binding (select from the drop-down list).

3. Go back to P2, introduce the appropriate modifications that reflect the shortage situation described above and re-run the analysis.

4. Write down the new numbers (resulting from the shortage situation) in the appropriate cells below (Shortage column).

5. In the Constraints table (Shortage column) label each constraint in the new solution as binding or not-binding (select from the drop-down list).

PREVIOUS

PREVIOUS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started