Answered step by step

Verified Expert Solution

Question

1 Approved Answer

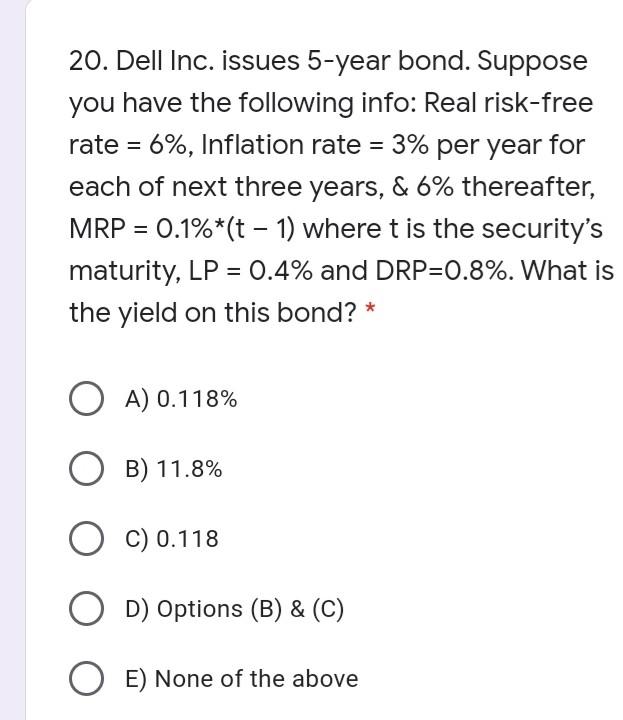

20. Dell Inc. issues 5-year bond. Suppose you have the following info: Real risk-free rate = 6%, Inflation rate = 3% per year for each

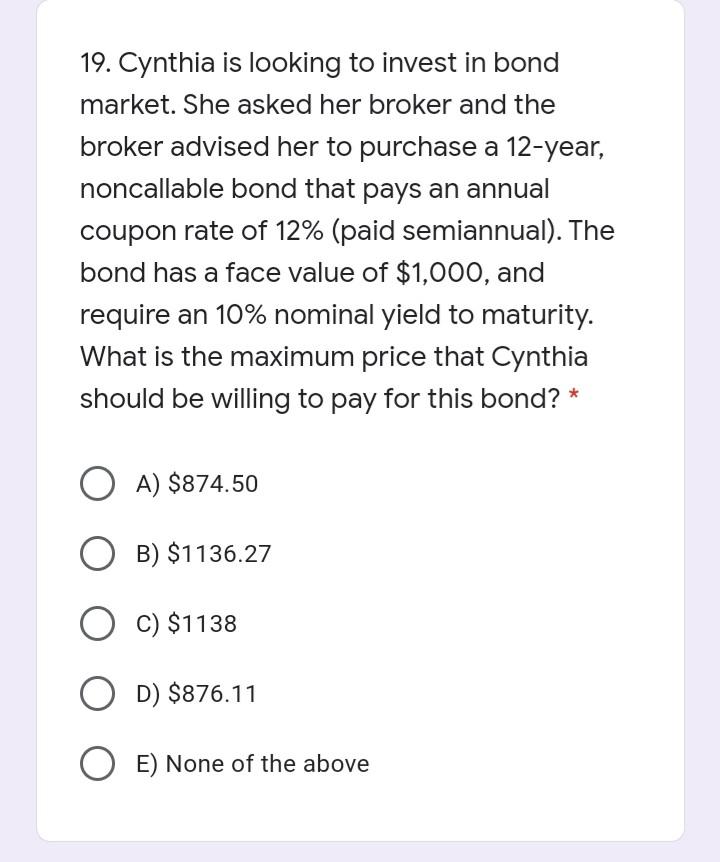

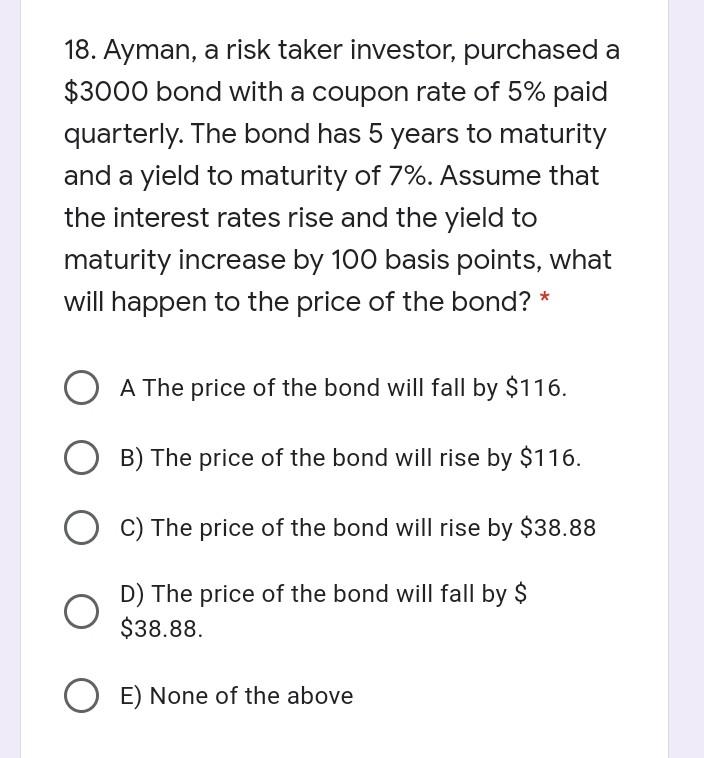

20. Dell Inc. issues 5-year bond. Suppose you have the following info: Real risk-free rate = 6%, Inflation rate = 3% per year for each of next three years, & 6% thereafter, MRP = 0.1%*(t - 1) where t is the security's maturity, LP = 0.4% and DRP=0.8%. What is the yield on this bond? * O A) 0.118% B) 11.8% C) 0.118 OD) Options (B) & (C) O E) None of the above 19. Cynthia is looking to invest in bond market. She asked her broker and the broker advised her to purchase a 12-year, noncallable bond that pays an annual coupon rate of 12% (paid semiannual). The bond has a face value of $1,000, and require an 10% nominal yield to maturity. What is the maximum price that Cynthia should be willing to pay for this bond? * O A) $874.50 O B) $1136.27 O c) $1138 O D) $876.11 O E) None of the above 18. Ayman, a risk taker investor, purchased a $3000 bond with a coupon rate of 5% paid quarterly. The bond has 5 years to maturity and a yield to maturity of 7%. Assume that the interest rates rise and the yield to maturity increase by 100 basis points, what will happen to the price of the bond? * O A The price of the bond will fall by $116. B) The price of the bond will rise by $116. O C) The price of the bond will rise by $38.88 D) The price of the bond will fall by $ $38.88. OE) None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started