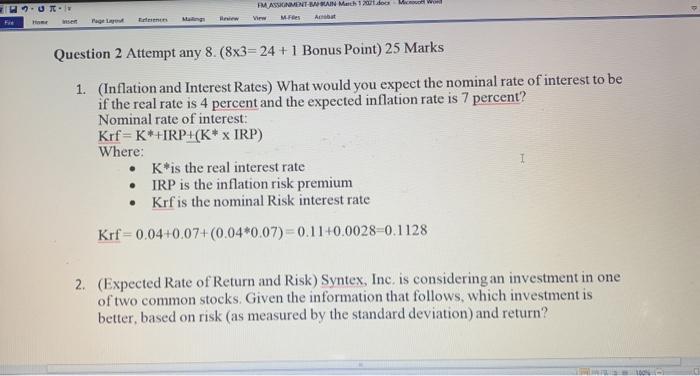

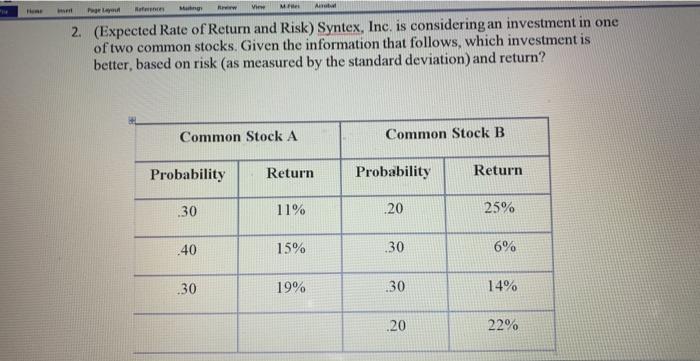

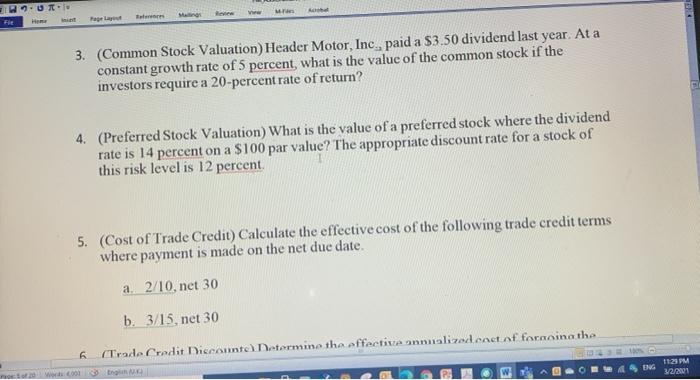

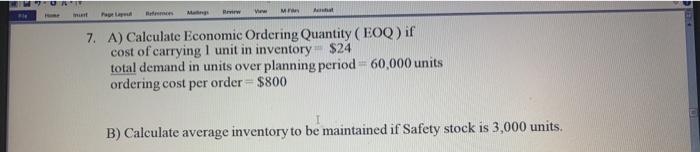

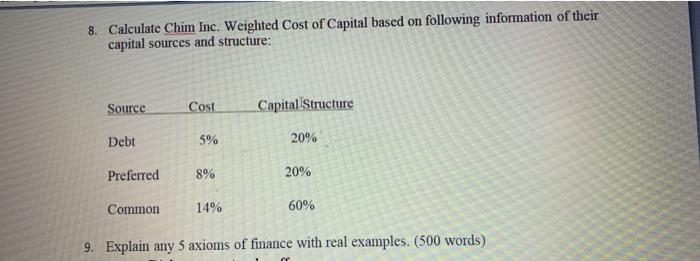

2.0 FM ASSIMMENT-IWAIN March 2012. W View Achat Rage M Question 2 Attempt any 8. (8x3= 24 + 1 Bonus Point) 25 Marks 1. (Inflation and Interest Rates) What would you expect the nominal rate of interest to be if the real rate is 4 percent and the expected inflation rate is 7 percent? Nominal rate of interest: Krf=K*HRPF(K* X IRP) Where: 1 K is the real interest rate IRP is the inflation risk premium Krf is the nominal Risk interest rate Krf -0.04+0.07+(0.04*0.07)=0.11+0.0028 0.1128 2. (Expected Rate of Return and Risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on risk (as measured by the standard deviation) and return? Nefer Magy View Mei Anul 2. (Expected Rate of Return and Risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on risk (as measured by the standard deviation) and return? Common Stock A Common Stock B Probability Return Probability Return 30 11% .20 25% .40 15% .30 6% .30 19% .30 14% .20 22% R.U. Www FE H Page 3. (Common Stock Valuation) Header Motor, Inc., paid a $3.50 dividend last year. At a constant growth rate of 5 percent, what is the value of the common stock if the investors require a 20-percent rate of return? 4. (Preferred Stock Valuation) What is the value of a preferred stock where the dividend rate is 14 percent on a $100 par value? The appropriate discount rate for a stock of this risk level is 12 percent 5. (Cost of Trade Credit) Calculate effective cost of the following trade credit terms where payment is made on the net due date. a. 2/10, net 30 b. 3/15, net 30 6. (Trade Credit Discount Determine the effective analized.cact of forcing the wordt 11:29 PM 3/2/2011 IMAMENT EN HAN Mash Merwe ) 6. (Trade Credit Discounts) Determine the effective annualized cost of forgoing the trade credit discount on the following terms: 5 5 Al Tareeqah Management Studies - 2021 a 1/10 net 20 b. 2/10 net 30 OR Rw M 7. A) Calculate Economic Ordering Quantity (EOQ) if cost of carrying 1 unit in inventory $24 total demand in units over planning period 60,000 units ordering cost per order = $800 B) Calculate average inventory to be maintained if Safety stock is 3,000 units. 8. Calculate Chim Inc. Weighted Cost of Capital based on following information of their capital sources and structure: Source Cost Capital Structure Debt 5% 20% Preferred 8% 20% Common 14% 60% 9. Explain any 5 axioms of finance with real examples. (500 words) 10. "Finance managers spend up to 60 percent of their time in working capital management." Explain the importance of working capital management.(500 words) 2.0 FM ASSIMMENT-IWAIN March 2012. W View Achat Rage M Question 2 Attempt any 8. (8x3= 24 + 1 Bonus Point) 25 Marks 1. (Inflation and Interest Rates) What would you expect the nominal rate of interest to be if the real rate is 4 percent and the expected inflation rate is 7 percent? Nominal rate of interest: Krf=K*HRPF(K* X IRP) Where: 1 K is the real interest rate IRP is the inflation risk premium Krf is the nominal Risk interest rate Krf -0.04+0.07+(0.04*0.07)=0.11+0.0028 0.1128 2. (Expected Rate of Return and Risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on risk (as measured by the standard deviation) and return? Nefer Magy View Mei Anul 2. (Expected Rate of Return and Risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on risk (as measured by the standard deviation) and return? Common Stock A Common Stock B Probability Return Probability Return 30 11% .20 25% .40 15% .30 6% .30 19% .30 14% .20 22% R.U. Www FE H Page 3. (Common Stock Valuation) Header Motor, Inc., paid a $3.50 dividend last year. At a constant growth rate of 5 percent, what is the value of the common stock if the investors require a 20-percent rate of return? 4. (Preferred Stock Valuation) What is the value of a preferred stock where the dividend rate is 14 percent on a $100 par value? The appropriate discount rate for a stock of this risk level is 12 percent 5. (Cost of Trade Credit) Calculate effective cost of the following trade credit terms where payment is made on the net due date. a. 2/10, net 30 b. 3/15, net 30 6. (Trade Credit Discount Determine the effective analized.cact of forcing the wordt 11:29 PM 3/2/2011 IMAMENT EN HAN Mash Merwe ) 6. (Trade Credit Discounts) Determine the effective annualized cost of forgoing the trade credit discount on the following terms: 5 5 Al Tareeqah Management Studies - 2021 a 1/10 net 20 b. 2/10 net 30 OR Rw M 7. A) Calculate Economic Ordering Quantity (EOQ) if cost of carrying 1 unit in inventory $24 total demand in units over planning period 60,000 units ordering cost per order = $800 B) Calculate average inventory to be maintained if Safety stock is 3,000 units. 8. Calculate Chim Inc. Weighted Cost of Capital based on following information of their capital sources and structure: Source Cost Capital Structure Debt 5% 20% Preferred 8% 20% Common 14% 60% 9. Explain any 5 axioms of finance with real examples. (500 words) 10. "Finance managers spend up to 60 percent of their time in working capital management." Explain the importance of working capital management.(500 words)