Answered step by step

Verified Expert Solution

Question

1 Approved Answer

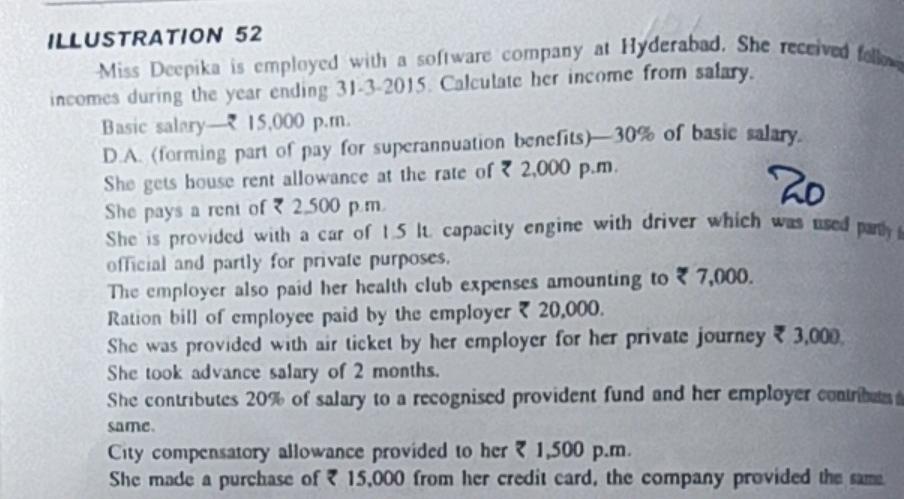

20 ILLUSTRATION 52 Miss Deepika is employed with a software company at Hyderabad. She received follos incomes during the year ending 31-3-2015. Calculate her income

20 ILLUSTRATION 52 Miss Deepika is employed with a software company at Hyderabad. She received follos incomes during the year ending 31-3-2015. Calculate her income from salary. Basic salary - 15.000 p.m. D.A. (forming part of pay for superannuation benefits)30% of basic salary. She gets house rent allowance at the rate of ? 2,000 p.m. She pays a rent of 2.500 pm She is provided with a car of 15 lt capacity engine with driver which was used party official and partly for private purposes. The employer also paid her health club expenses amounting to 37,000. Ration bill of employee paid by the employer 20,000. She was provided with air ticket by her employer for her private journey 3,000, She took advance salary of 2 months. She contributes 20% of salary to a recognised provident fund and her employer contribute same City compensatory allowance provided to her 1,500 p.m. She made a purchase of 15,000 from her credit card, the company provided the same

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started