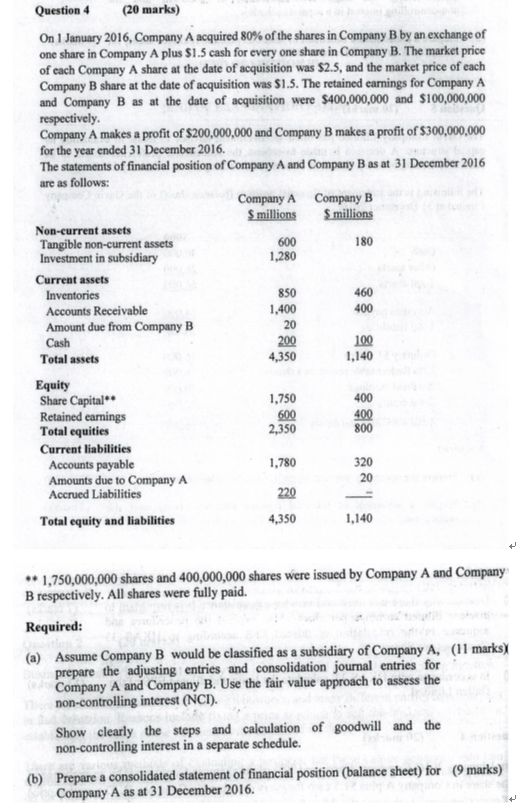

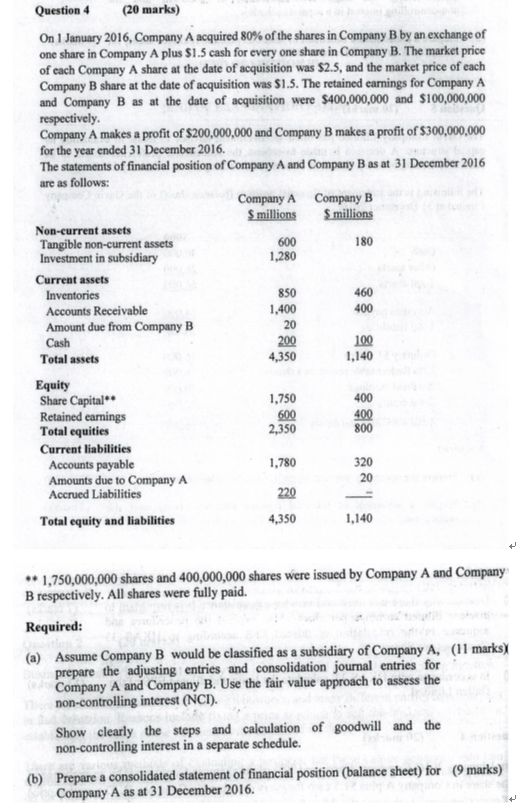

(20 marks) Question 4 On 1 January 2016, Company A acquired 80% of the shares in Company B by an exchange of one share in Company A plus $1.5 cash for every one share in Company B. The market price of each Company A share at the date of acquisition was $2.5, and the market price of each Company B share at the date of acquisition was $1.5. The retained earnings for Company A and Company B as at the date of acquisition were $400,000,000 and S100,000,000 Company A makes a profit of $200,000,000 and Company B makes a profit of $300,000,000 for the year ended 31 December 2016. The statements of financial position of Company A and Company B as at 31 December 2016 are as follows: Company B S millions 180 Company A S millions 600 1,280 Non-current assets Tangible non-current assets Investment in subsidiary Current assets 850 460 400 1,400 20 Accounts Receivable Amount due from Company B Cash Total assets 1,140 4,350 Equity Share Capital Retained earnings Total equities Current liabilities 1,750 2,350 1,780 400 400 800 320 20 Accounts payable Amounts due to Company A Accrued Liabilities Total equity and liabilities 4,350 1,750,000,000 shares and 400,000,000 shares were issued by Company A and Company B respectively. All shares were fully paid Required (a) Assume Company B would be classified as a subsidiary of Company A, (11 marks) prepare the adjusting entries and consolidation journal entries for Company A and Company B. Use the fair value approach to assess the non-controlling interest (NCI. Show clearly the steps and calculation of goodwill and the non-controlling interest in a separate schedule. marks) (b) Prepare a consolidated statement of financial position (balance stheety for Company A as at 31 December 2016. (20 marks) Question 4 On 1 January 2016, Company A acquired 80% of the shares in Company B by an exchange of one share in Company A plus $1.5 cash for every one share in Company B. The market price of each Company A share at the date of acquisition was $2.5, and the market price of each Company B share at the date of acquisition was $1.5. The retained earnings for Company A and Company B as at the date of acquisition were $400,000,000 and S100,000,000 Company A makes a profit of $200,000,000 and Company B makes a profit of $300,000,000 for the year ended 31 December 2016. The statements of financial position of Company A and Company B as at 31 December 2016 are as follows: Company B S millions 180 Company A S millions 600 1,280 Non-current assets Tangible non-current assets Investment in subsidiary Current assets 850 460 400 1,400 20 Accounts Receivable Amount due from Company B Cash Total assets 1,140 4,350 Equity Share Capital Retained earnings Total equities Current liabilities 1,750 2,350 1,780 400 400 800 320 20 Accounts payable Amounts due to Company A Accrued Liabilities Total equity and liabilities 4,350 1,750,000,000 shares and 400,000,000 shares were issued by Company A and Company B respectively. All shares were fully paid Required (a) Assume Company B would be classified as a subsidiary of Company A, (11 marks) prepare the adjusting entries and consolidation journal entries for Company A and Company B. Use the fair value approach to assess the non-controlling interest (NCI. Show clearly the steps and calculation of goodwill and the non-controlling interest in a separate schedule. marks) (b) Prepare a consolidated statement of financial position (balance stheety for Company A as at 31 December 2016