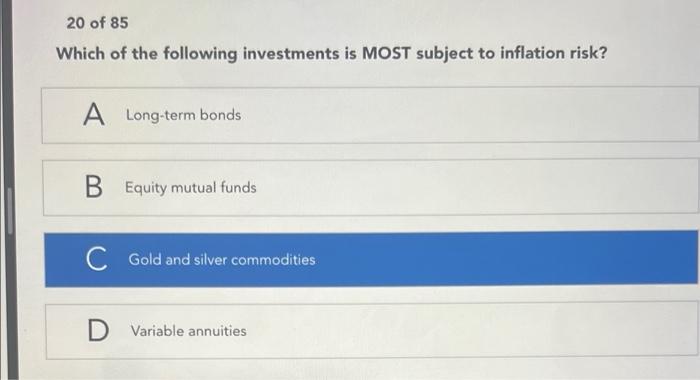

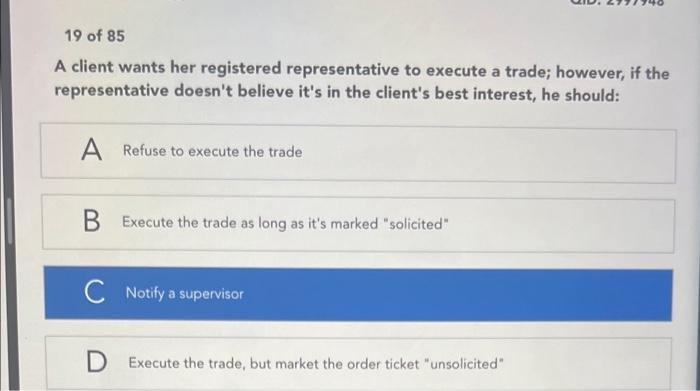

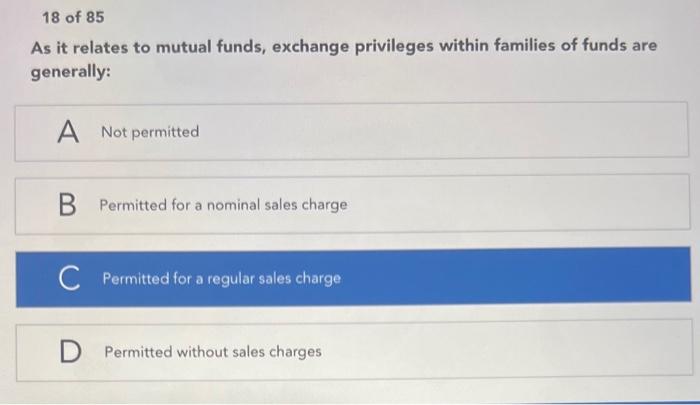

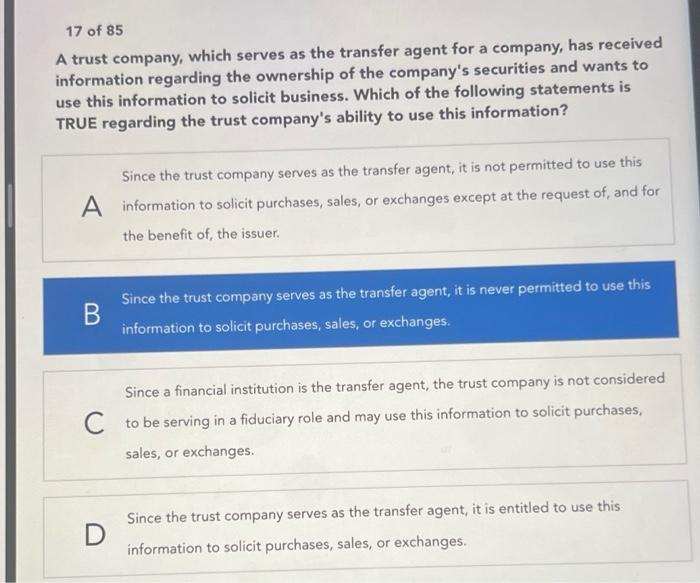

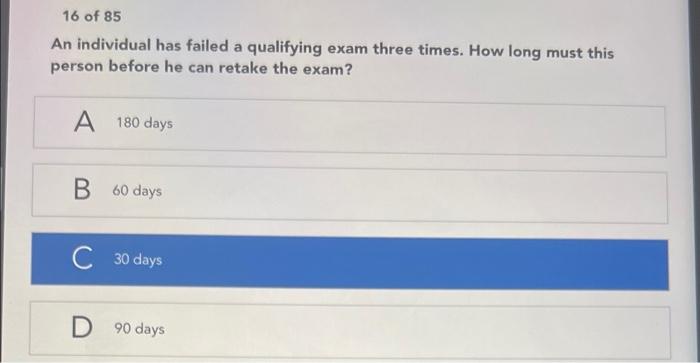

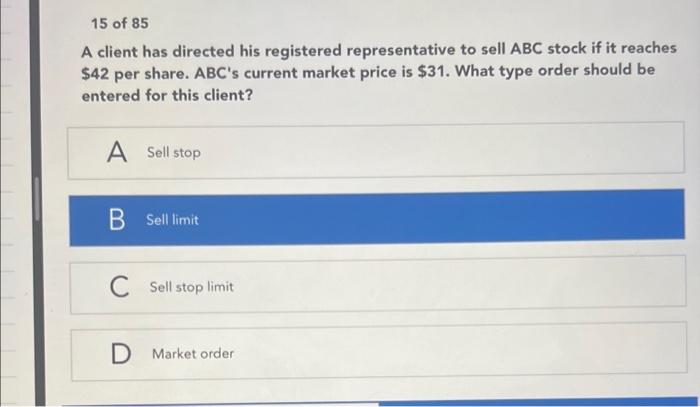

20 of 85 Which of the following investments is MOST subject to inflation risk? A Long-term bonds B Equity mutual funds C Gold and silver commodities D Variable annuities 19 of 85 A client wants her registered representative to execute a trade; however, if the representative doesn't believe it's in the client's best interest, he should: A Refuse to execute the trade B Execute the trade as long as it's marked "solicited" C Notify a supervisor D Execute the trade, but market the order ticket "unsolicited" 18 of 85 As it relates to mutual funds, exchange privileges within families of funds are generally: A Not permitted B Permitted for a nominal sales charge C Permitted for a regular sales charge D Permitted without sales charges a 17 of 85 A trust company, which serves as the transfer agent for a company, has received information regarding the ownership of the company's securities and wants to use this information to solicit business. Which of the following statements is TRUE regarding the trust company's ability to use this information? Since the trust company serves as the transfer agent, it is not permitted to use this A information to solicit purchases, sales, or exchanges except at the request of, and for the benefit of the issuer. B Since the trust company serves as the transfer agent, it is never permitted to use this information to solicit purchases, sales, or exchanges. Since a financial institution is the transfer agent, the trust company is not considered C to be serving in a fiduciary role and may use this information to solicit purchases, sales, or exchanges D Since the trust company serves as the transfer agent, it is entitled to use this information to solicit purchases, sales, or exchanges 16 of 85 An individual has failed a qualifying exam three times. How long must this person before he can retake the exam? A 180 days B 60 days C 30 days D 90 days 15 of 85 A client has directed his registered representative to sell ABC stock if it reaches $42 per share. ABC's current market price is $31. What type order should be entered for this client? A Sell stop B Sell limit Sell stop limit D Market order