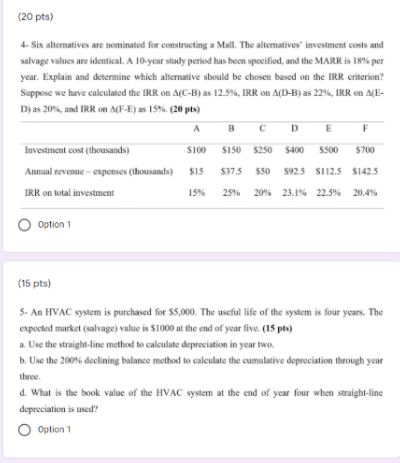

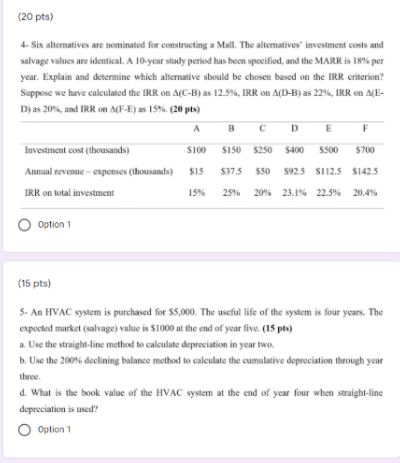

(20 pts) 4- Six alternatives are nominated for constructing a Mall. The alteratives investment costs and salvage values are identical. A 10-year study period has been specified, and the MARR is 18% per year. Explain and determine which alternative should be chosen based on the IRR criterion? Suppose we have calculated the IRR on (C-B) as 12.5%, IRR on A(D-B) as 22%, IRR on AE- D) as 20%, and IRR on AF-E) as 15%. (20 pts) B C D E F Investment cost (thousands) S100 $150 $250 $400 $500 $700 Annual revenue - expenses (thousands) $15 $37.5 550 592.5 $112.5 $142.5 IRR on total investment 15% 25% 20% 20% % 23.1% 22.5% 20.4% Option 1 (15 pts) 5- An HVAC system is purchased for $5,000. The useful life of the system is four years. The expected market (salvage) value is $1000 at the end of year five. (15 pts) 1. Use the straight-line method to calculate depreciation in year two. b. Use the 200% declining balance method to calculate the cumulative depreciation through year three. d. What is the book value of the HVAC system at the end of year four when straight-line depreciation is used? Option 1 (20 pts) 4- Six alternatives are nominated for constructing a Mall. The alteratives investment costs and salvage values are identical. A 10-year study period has been specified, and the MARR is 18% per year. Explain and determine which alternative should be chosen based on the IRR criterion? Suppose we have calculated the IRR on (C-B) as 12.5%, IRR on A(D-B) as 22%, IRR on AE- D) as 20%, and IRR on AF-E) as 15%. (20 pts) B C D E F Investment cost (thousands) S100 $150 $250 $400 $500 $700 Annual revenue - expenses (thousands) $15 $37.5 550 592.5 $112.5 $142.5 IRR on total investment 15% 25% 20% 20% % 23.1% 22.5% 20.4% Option 1 (15 pts) 5- An HVAC system is purchased for $5,000. The useful life of the system is four years. The expected market (salvage) value is $1000 at the end of year five. (15 pts) 1. Use the straight-line method to calculate depreciation in year two. b. Use the 200% declining balance method to calculate the cumulative depreciation through year three. d. What is the book value of the HVAC system at the end of year four when straight-line depreciation is used? Option 1