Answered step by step

Verified Expert Solution

Question

1 Approved Answer

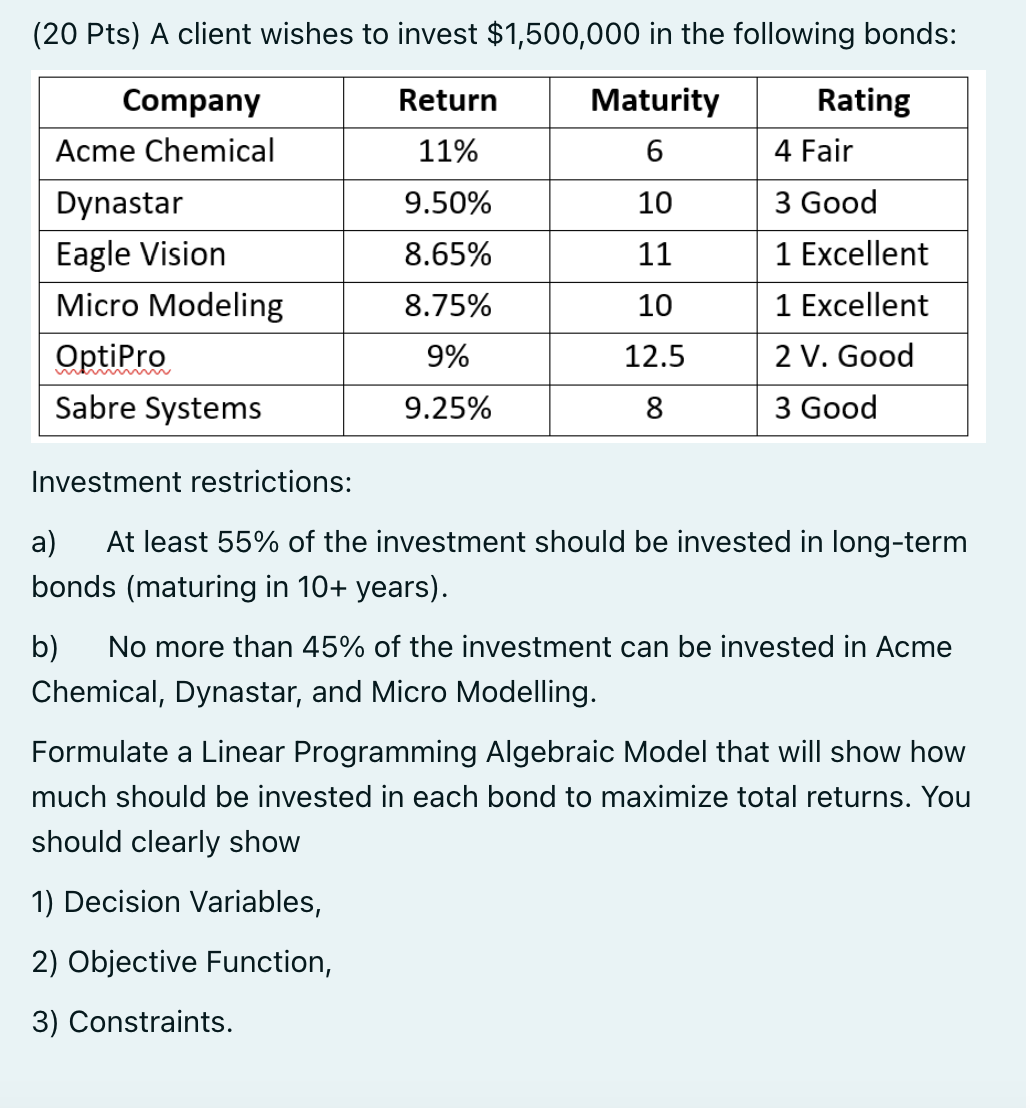

(20 Pts) A client wishes to invest $1,500,000 in the following bonds: Company Return Maturity Rating Acme Chemical 11% 6 4 Fair Dynastar 9.50%

(20 Pts) A client wishes to invest $1,500,000 in the following bonds: Company Return Maturity Rating Acme Chemical 11% 6 4 Fair Dynastar 9.50% 10 3 Good Eagle Vision 8.65% 11 1 Excellent Micro Modeling 8.75% 10 1 Excellent OptiPro 9% 12.5 2 V. Good mmmm Sabre Systems 9.25% 8 3 Good Investment restrictions: a) At least 55% of the investment should be invested in long-term bonds (maturing in 10+ years). b) No more than 45% of the investment can be invested in Acme Chemical, Dynastar, and Micro Modelling. Formulate a Linear Programming Algebraic Model that will show how much should be invested in each bond to maximize total returns. You should clearly show 1) Decision Variables, 2) Objective Function, 3) Constraints.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To formulate the Linear Programming Algebraic Model for this investment problem we need to de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642a79f80815_976728.pdf

180 KBs PDF File

6642a79f80815_976728.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started