Answered step by step

Verified Expert Solution

Question

1 Approved Answer

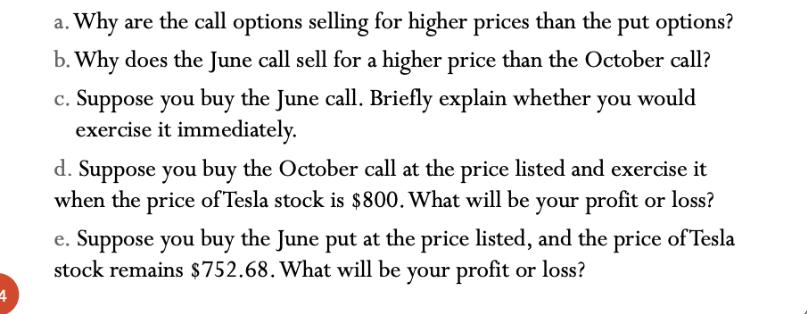

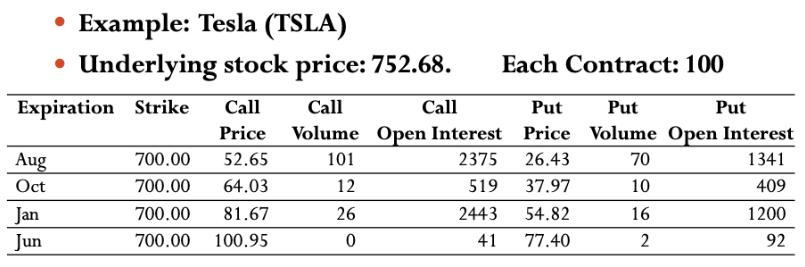

4 a. Why are the call options selling for higher prices than the put options? b. Why does the June call sell for a

4 a. Why are the call options selling for higher prices than the put options? b. Why does the June call sell for a higher price than the October call? c. Suppose you buy the June call. Briefly explain whether you would exercise it immediately. d. Suppose you buy the October call at the price listed and exercise it when the price of Tesla stock is $800. What will be your profit or loss? e. Suppose you buy the June put at the price listed, and the price of Tesla stock remains $752.68. What will be your profit or loss? Expiration Strike Call Call Example: Tesla (TSLA) Underlying stock price: 752.68. Call Each Contract: 100 Put Put Put Price Volume Open Interest Price Volume Open Interest Aug Oct 700.00 52.65 101 2375 26.43 70 1341 700.00 64.03 12 519 37.97 10 409 Jan Jun 700.00 81.67 26 2443 54.82 16 1200 700.00 100.95 0 41 77.40 2 92

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Call options are selling for higher prices than put options because call options give the h...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642a7ab46fcd_976727.pdf

180 KBs PDF File

6642a7ab46fcd_976727.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started