20 pts

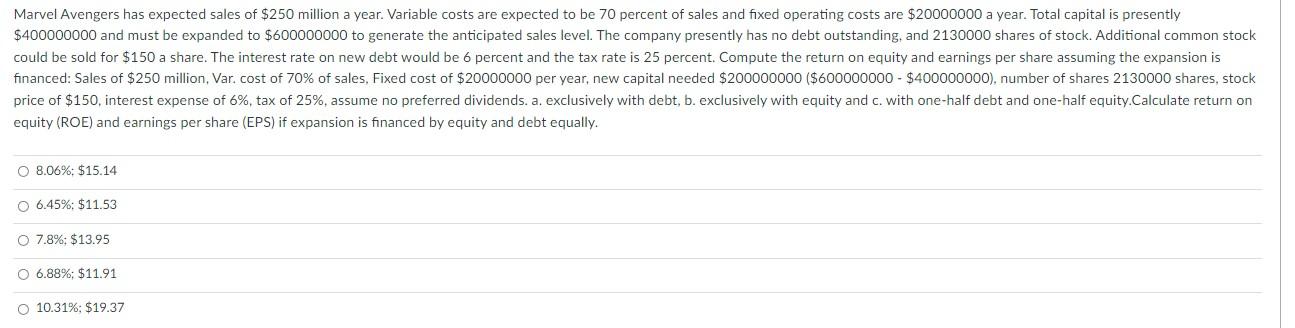

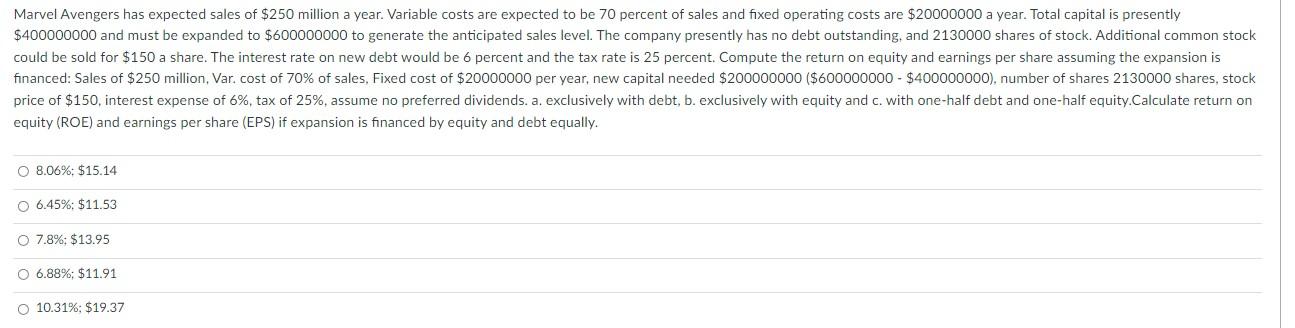

Marvel Avengers has expected sales of $250 million a year. Variable costs are expected to be 70 percent of sales and fixed operating costs are $20000000 a year. Total capital is presently $400000000 and must be expanded to $600000000 to generate the anticipated sales level. The company presently has no debt outstanding, and 2130000 shares of stock. Additional common stock could be sold for $150 a share. The interest rate on new debt would be 6 percent and the tax rate is 25 percent. Compute the return on equity and earnings per share assuming the expansion is financed: Sales of $250 million, Var, cost of 70% of sales, Fixed cost of $20000000 per year, new capital needed $200000000 ($600000000 - $400000000), number of shares 2130000 shares, stock price of $150, interest expense of 6%, tax of 25%, assume no preferred dividends. a. exclusively with debt, b. exclusively with equity and c. with one-half debt and one-half equity.Calculate return on equity (ROE) and earnings per share (EPS) if expansion is financed by equity and debt equally. 8.06%: $15.14 6.45%: $11.53 0 7.8%: $13.95 6.88%; $11.91 10.31%: $19.37 Marvel Avengers has expected sales of $250 million a year. Variable costs are expected to be 70 percent of sales and fixed operating costs are $20000000 a year. Total capital is presently $400000000 and must be expanded to $600000000 to generate the anticipated sales level. The company presently has no debt outstanding, and 2130000 shares of stock. Additional common stock could be sold for $150 a share. The interest rate on new debt would be 6 percent and the tax rate is 25 percent. Compute the return on equity and earnings per share assuming the expansion is financed: Sales of $250 million, Var, cost of 70% of sales, Fixed cost of $20000000 per year, new capital needed $200000000 ($600000000 - $400000000), number of shares 2130000 shares, stock price of $150, interest expense of 6%, tax of 25%, assume no preferred dividends. a. exclusively with debt, b. exclusively with equity and c. with one-half debt and one-half equity.Calculate return on equity (ROE) and earnings per share (EPS) if expansion is financed by equity and debt equally. 8.06%: $15.14 6.45%: $11.53 0 7.8%: $13.95 6.88%; $11.91 10.31%: $19.37