Question

. (20 pts) Stacey believes that Microsoft is overvalued at S=$10. She believes it will decrease in the next year and has $10,000 in

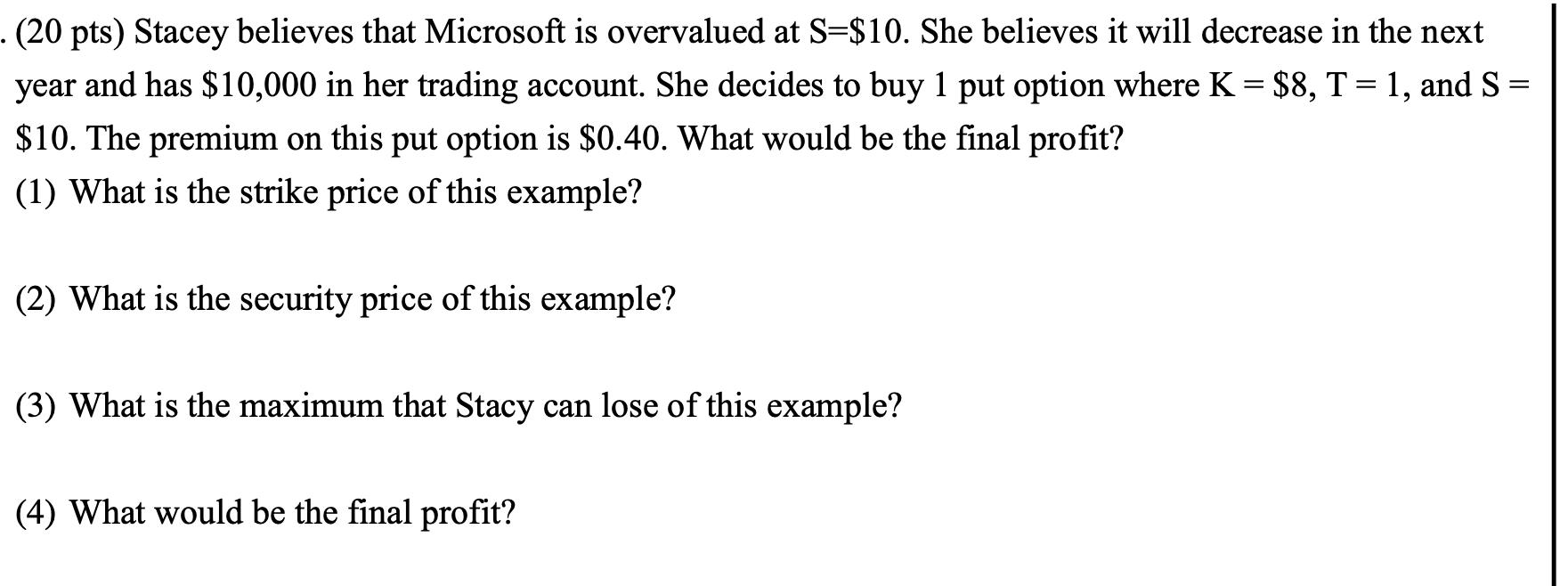

. (20 pts) Stacey believes that Microsoft is overvalued at S=$10. She believes it will decrease in the next year and has $10,000 in her trading account. She decides to buy 1 put option where K = $8, T = 1, and S = $10. The premium on this put option is $0.40. What would be the final profit? (1) What is the strike price of this example? (2) What is the security price of this example? (3) What is the maximum that Stacy can lose of this example? (4) What would be the final profit?

Step by Step Solution

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

I see youve provided an image containing a question about options trading Let me go through each question step by step 1 What is the strike price of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

A Pathway To Introductory Statistics

Authors: Jay Lehmann

1st Edition

0134107179, 978-0134107172

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App