Answered step by step

Verified Expert Solution

Question

1 Approved Answer

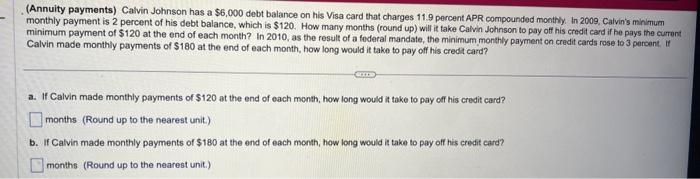

20 q . (Annuity payments) Calvin Johnson has a $6,000 debt balance on his Visa card that charges 11.9 percent APR compounded monthy. In 2009,

20 q

. (Annuity payments) Calvin Johnson has a $6,000 debt balance on his Visa card that charges 11.9 percent APR compounded monthy. In 2009, Calvin's minimum monthly payment is 2 percent of his debt balance, which is $120. How many months (round up) will it take Calvin Johnson to pay off his credit card if he pays the curent minimum payment of $120 at the end of each month? In 2010 , as the result of a foderal mandate, the minimum monthly payment cn credit cards rose to 3 percent. If Calvin made monthly payments of $180 at the end of each month, how long would it take to pay off his credit card? 3. If Calvin made monthly payments of $120 at the end of each month, how long would it take to pay off his credit card? months (Round up to the nearest unit.) b. If Calvin made monthly payments of $180 at the end of each month, how long would is take to pay off his credit card? months (Round up to the nearest unit.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started