Answered step by step

Verified Expert Solution

Question

1 Approved Answer

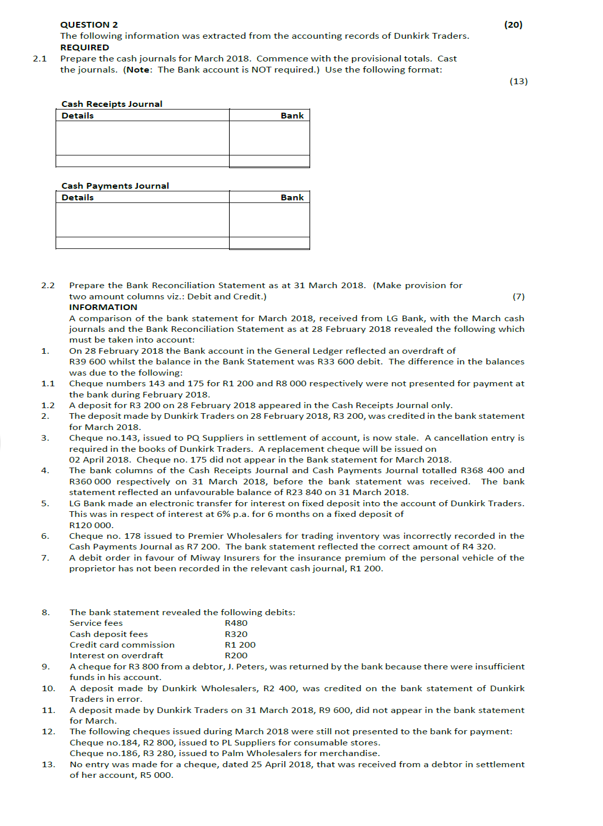

(20) QUESTION 2 The following information was extracted from the accounting records of Dunkirk Traders. REQUIRED Prepare the cash journals for March 2018, Commence with

(20) QUESTION 2 The following information was extracted from the accounting records of Dunkirk Traders. REQUIRED Prepare the cash journals for March 2018, Commence with the provisional totals. Cast the journals. (Note: The Bank account is NOT required.) Use the following format 2.1 (13) Cash Receipts Journal Details Bank Cash Pa Details Journal Bank 2.2 Prepare the Bank Reconciliation Statement as at 31 March 2018. (Make provision for two amount columns viz.: Debit and Credit) INFORMATION A comparison of the bank statement for March 2018, received from LG Bank, with the March cash journals and the Bank Reconciliation Statement as at 28 February 2018 revealed the following which must be taken into account: On 28 February 2018 the Bank account in the General Ledger reflected an overdraft of R39 600 whilst the balance in the Bank Statement was R33 600 debit. The difference in the balances was due to the following: 1. 11 Cheque numbers 143 and 175 for R1 200 and R8 000 respectively were not presented for payment at the bank during February 2018 12 Adeposit for R3 200 on 28 February 2018 appeared in the Cash Receipts Journal only. 2. The deposit made by Dunkirk Traders on 28 February 2018, R3 200, was credited in the bank statement for March 2018 Cheque no.143, issued to PQ Suppliers in settlement of account, is now stale. A cancellation entry is required in the books of Dunkirk Traders. A replacement cheque will be issued on 02 April 2018. Cheque no, 175 did not appear in the Bank statement for March 2018 The bank columns of the Cash Receipts Journal and Cash Payments Journal totalled R368 400 and R360 000 respectively on 31 March 2018, before the bank statement was received. The bank statement reflected an unfavourable balance of R23 840 on 31 March 2018. 3. 4. S LG Bank made an electronic transfer for interest on fixed deposit into the account of Dunkirk Traders. This was in respect of interest at 6% p.a. for 6 months on a fixed deposit of R120 000. Cheque no. 178 issued to Premier Wholesalers for trading inventory was incorrectly recorded in the Cash Payments Journal as R7 200. The bank statement reflected the correct amount of R4 320 A debit order in favour of Miway Insurers for the insurance premium of the personal vehicle of the proprietor has not been recorded in the relevant cash journal, R1 200. 6. 7. 8 The bank statement revealed the following debits: Service fees Cash deposit fees Credit card commission Interest on overdraft A cheque for R3 800 from a debtor, J. Peters, was returned by the bank because there were insufficient funds in his account. A deposit made by Dunkirk Wholesalers, R2 400, was credited on the bank statement of Dunkirk Traders in error A deposit made by Dunkirk Traders on 31 March 2018, R9 600, did not appear in the bank statement for March. The following cheques issued during March 2018 were still not presented to the bank for payment: Cheque no.184, R2 800, issued to PL Suppliers for consumable stores Cheque no.186, R3 280, issued to Palm Wholesalers for merchandise No entry was made for a cheque, dated 25 April 2018, that was received from a debtor in settlement of her account, R5 000. 9. 10. 11. 12 13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started