Answered step by step

Verified Expert Solution

Question

1 Approved Answer

20. Suppose there is only one risky asset in the world, with an uncertain return that is expected to be higher than the risk-free return.

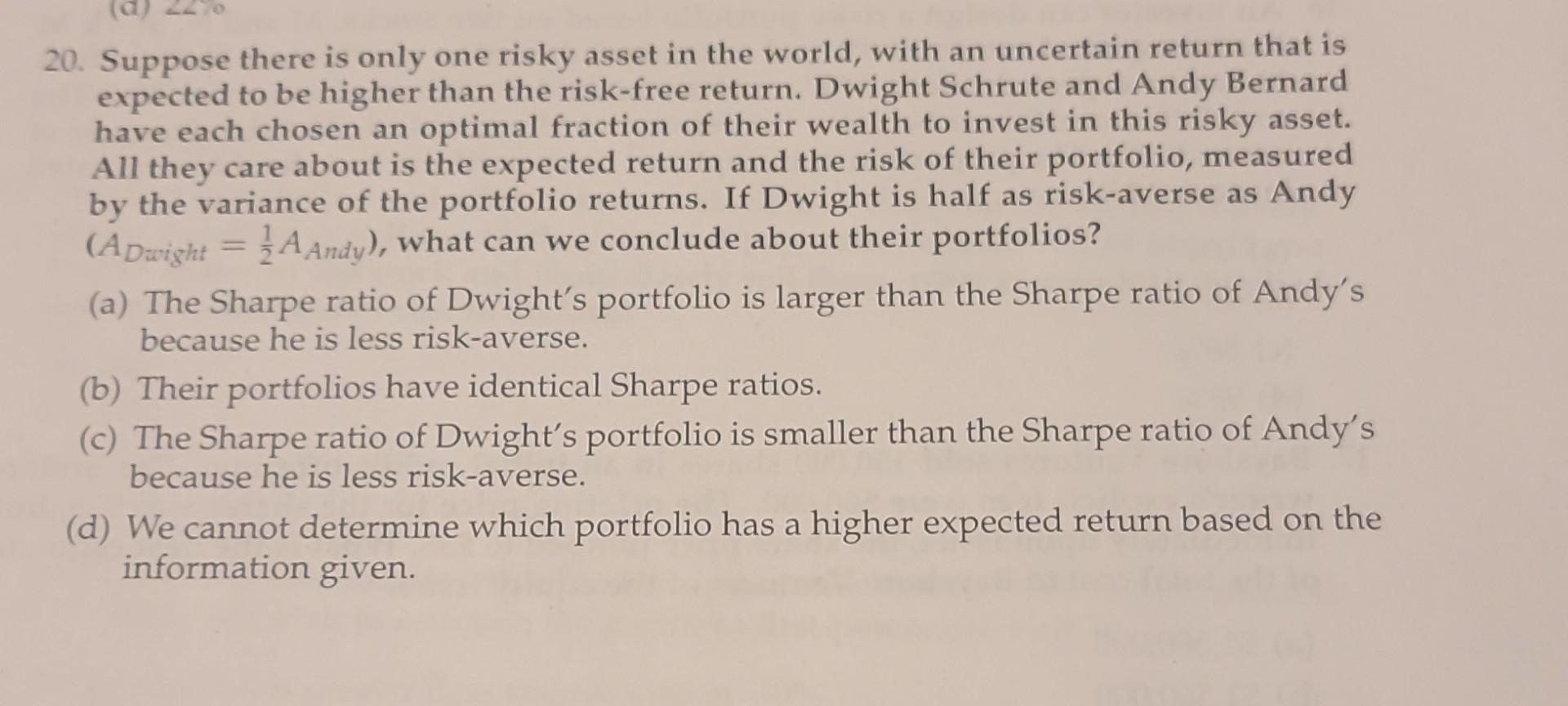

20. Suppose there is only one risky asset in the world, with an uncertain return that is expected to be higher than the risk-free return. Dwight Schrute and Andy Bernard have each chosen an optimal fraction of their wealth to invest in this risky asset. All they care about is the expected return and the risk of their portfolio, measured by the variance of the portfolio returns. If Dwight is half as risk-averse as Andy (ADwight=21AAndy), what can we conclude about their portfolios? (a) The Sharpe ratio of Dwight's portfolio is larger than the Sharpe ratio of Andy's because he is less risk-averse. (b) Their portfolios have identical Sharpe ratios. (c) The Sharpe ratio of Dwight's portfolio is smaller than the Sharpe ratio of Andy's because he is less risk-averse. (d) We cannot determine which portfolio has a higher expected return based on the information given

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started