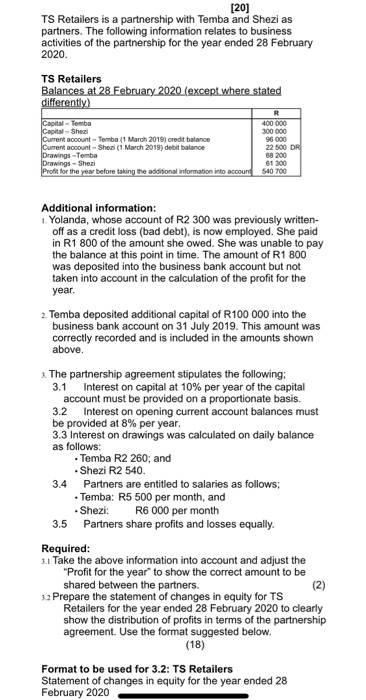

[20] TS Retailers is a partnership with Temba and Shezi as partners. The following information relates to business activities of the partnership for the year ended 28 February 2020. TS Retailers Balances at 28 February 2020 (except where stated differently) R Capital - Temba 400 000 Capital - She 300 000 Current account - Temba 1 March 2019) credit balance 96 000 Current account - Shezi (1 March 2019) debit balance 22 500 OR Drawings -Temba 68 200 61 300 Profit for the year before taking the additional information into account 540 700 Additional information: 1. Yolanda, whose account of R2 300 was previously written- off as a credit loss (bad debt), is now employed. She paid in R1 800 of the amount she owed. She was unable to pay the balance at this point in time. The amount of R1 800 was deposited into the business bank account but not taken into account in the calculation of the profit for the year 2. Temba deposited additional capital of R100 000 into the business bank account on 31 July 2019. This amount was correctly recorded and is included in the amounts shown above. 3. The partnership agreement stipulates the following: 3.1 Interest on capital at 10% per year of the capital account must be provided on a proportionate basis. 3.2 Interest on opening current account balances must be provided at 8% per year. 3.3 Interest on drawings was calculated on daily balance as follows: Temba R2 260; and Shezi R2 540 Partners are entitled to salaries as follows; Temba: R5 500 per month, and Shezi: R6 000 per month 3.5 Partners share profits and losses equally. Required: 3. Take the above information into account and adjust the "Profit for the year to show the correct amount to be shared between the partners. (2) 3.2 Prepare the statement of changes in equity for TS Retailers for the year ended 28 February 2020 to clearly show the distribution of profits in terms of the partnership agreement. Use the format suggested below. (18) Format to be used for 3.2: TS Retailers Statement of changes in equity for the year ended 28 February 2020 3.4