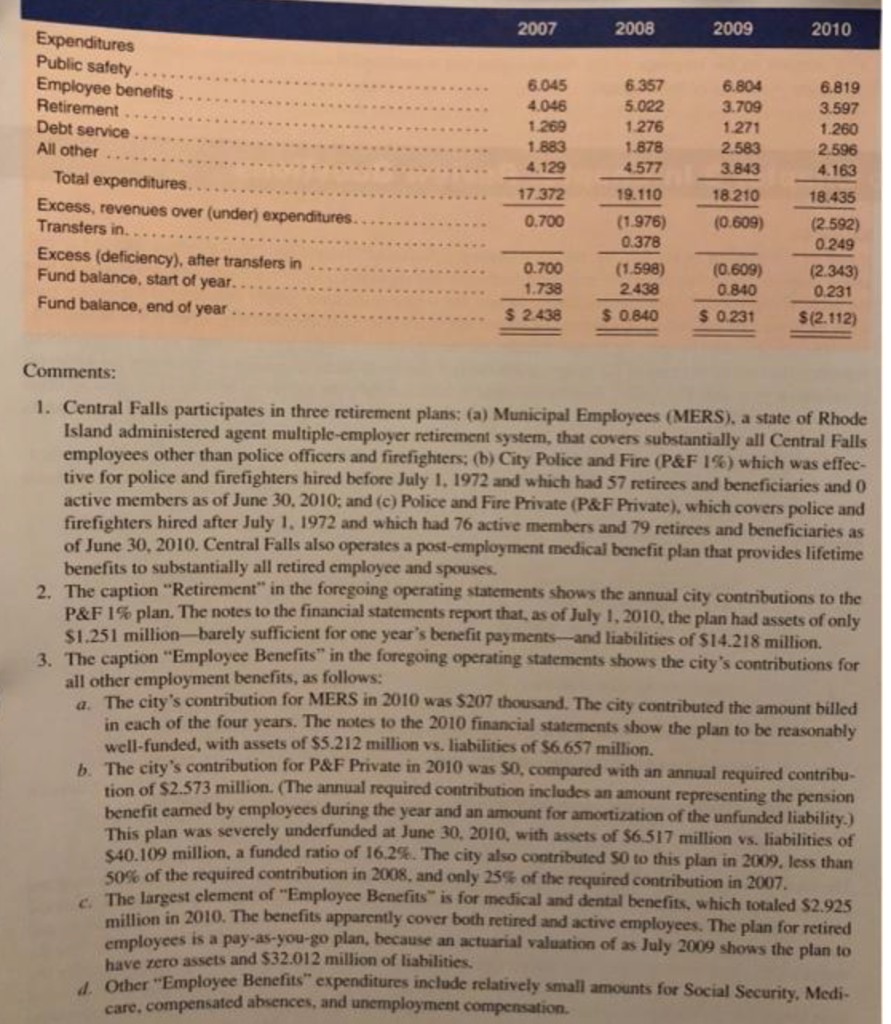

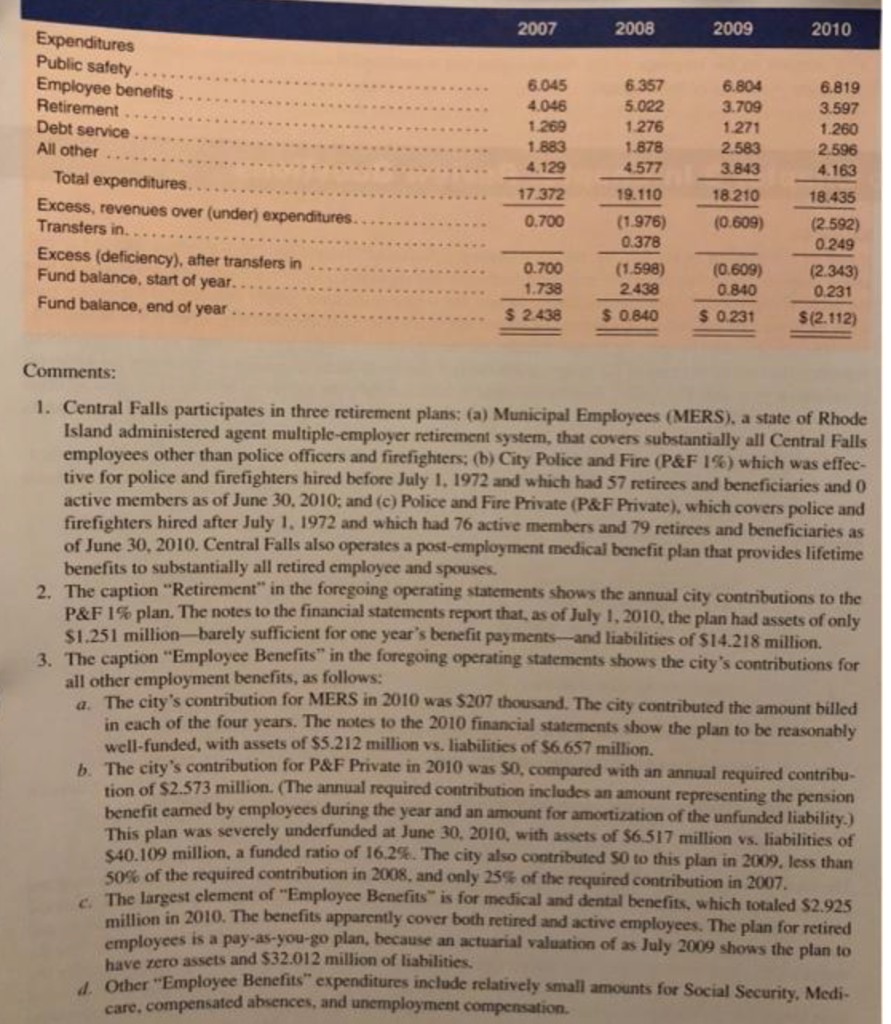

2007 2008 2009 2010 Expenditures Public safety Employee benefits Retirement Debt service All other Total expenditures Excess, revenues over (under) expenditures. Transfers in Excess (deficiency), after transfers in Fund balance, start of year. Fund balance, end of year 6.045 4.046 1 269 1.883 4.129 6.804 3.709 1.271 2.583 3.843 18 210 (0.609) 6.819 3.597 1.260 2.596 4.163 6 357 5.022 1 276 1.878 4.577 19.110 (1976) 0.378 (1.598) 2438 $ 0.840 17.372 0.700 18.435 (2.592) 0.249 (2.343) 0.231 0.700 1.738 $ 2438 (0.609) 0.840 $ 0.231 $(2.112) Comments: 1. Central Falls participates in three retirement plans: (a) Municipal Employees (MERS), a state of Rhode Island administered agent multiple-employer retirement system, that covers substantially all Central Falls employees other than police officers and firefighters; (b) City Police and Fire (P&F 1%) which was effec- tive for police and firefighters hired before July 1, 1972 and which had 57 retirees and beneficiaries and 0 active members as of June 30, 2010; and (c) Police and Fire Private (P&F Private), which covers police and firefighters hired after July 1, 1972 and which had 76 active members and 79 retirees and beneficiaries as of June 30, 2010. Central Falls also operates a post-employment medical benefit plan that provides lifetime benefits to substantially all retired employee and spouses. 2. The caption "Retirement in the foregoing operating statements shows the annual city contributions to the P&F 1% plan. The notes to the financial statements report that, as of July 1, 2010, the plan had assets of only $1.251 million-barely sufficient for one year's benefit payments and liabilities of $14.218 million 3. The caption "Employee Benefits in the foregoing operating statements shows the city's contributions for all other employment benefits, as follows: a. The city's contribution for MERS in 2010 was $207 thousand. The city contributed the amount billed in each of the four years. The notes to the 2010 financial statements show the plan to be reasonably well-funded, with assets of $5.212 million vs. liabilities of $6.657 million. b. The city's contribution for P&F Private in 2010 was SO, compared with an annual required contribu- tion of $2.573 million. (The annual required contribution includes an amount representing the pension benefit earned by employees during the year and an amount for amortization of the unfunded liability.) This plan was severely underfunded at June 30, 2010, with assets of $6.517 million vs. liabilities of $40.109 million, a funded ratio of 16.2%. The city also contributed SO to this plan in 2009. less than 50% of the required contribution in 2008, and only 25% of the required contribution in 2007. The largest element of Employee Benefits" is for medical and dental benefits, which totaled S2.925 million in 2010. The benefits apparently cover both retired and active employees. The plan for retired employees is a pay-as-you-go plan, because an actuarial valuation of as July 2009 shows the plan to have zero assets and $32.012 million of liabilities. 4. Other "Employee Benefits" expenditures include relatively small amounts for Social Security, Medi- care, compensated absences, and unemployment compensation. 2007 2008 2009 2010 Expenditures Public safety Employee benefits Retirement Debt service All other Total expenditures Excess, revenues over (under) expenditures. Transfers in Excess (deficiency), after transfers in Fund balance, start of year. Fund balance, end of year 6.045 4.046 1 269 1.883 4.129 6.804 3.709 1.271 2.583 3.843 18 210 (0.609) 6.819 3.597 1.260 2.596 4.163 6 357 5.022 1 276 1.878 4.577 19.110 (1976) 0.378 (1.598) 2438 $ 0.840 17.372 0.700 18.435 (2.592) 0.249 (2.343) 0.231 0.700 1.738 $ 2438 (0.609) 0.840 $ 0.231 $(2.112) Comments: 1. Central Falls participates in three retirement plans: (a) Municipal Employees (MERS), a state of Rhode Island administered agent multiple-employer retirement system, that covers substantially all Central Falls employees other than police officers and firefighters; (b) City Police and Fire (P&F 1%) which was effec- tive for police and firefighters hired before July 1, 1972 and which had 57 retirees and beneficiaries and 0 active members as of June 30, 2010; and (c) Police and Fire Private (P&F Private), which covers police and firefighters hired after July 1, 1972 and which had 76 active members and 79 retirees and beneficiaries as of June 30, 2010. Central Falls also operates a post-employment medical benefit plan that provides lifetime benefits to substantially all retired employee and spouses. 2. The caption "Retirement in the foregoing operating statements shows the annual city contributions to the P&F 1% plan. The notes to the financial statements report that, as of July 1, 2010, the plan had assets of only $1.251 million-barely sufficient for one year's benefit payments and liabilities of $14.218 million 3. The caption "Employee Benefits in the foregoing operating statements shows the city's contributions for all other employment benefits, as follows: a. The city's contribution for MERS in 2010 was $207 thousand. The city contributed the amount billed in each of the four years. The notes to the 2010 financial statements show the plan to be reasonably well-funded, with assets of $5.212 million vs. liabilities of $6.657 million. b. The city's contribution for P&F Private in 2010 was SO, compared with an annual required contribu- tion of $2.573 million. (The annual required contribution includes an amount representing the pension benefit earned by employees during the year and an amount for amortization of the unfunded liability.) This plan was severely underfunded at June 30, 2010, with assets of $6.517 million vs. liabilities of $40.109 million, a funded ratio of 16.2%. The city also contributed SO to this plan in 2009. less than 50% of the required contribution in 2008, and only 25% of the required contribution in 2007. The largest element of Employee Benefits" is for medical and dental benefits, which totaled S2.925 million in 2010. The benefits apparently cover both retired and active employees. The plan for retired employees is a pay-as-you-go plan, because an actuarial valuation of as July 2009 shows the plan to have zero assets and $32.012 million of liabilities. 4. Other "Employee Benefits" expenditures include relatively small amounts for Social Security, Medi- care, compensated absences, and unemployment compensation