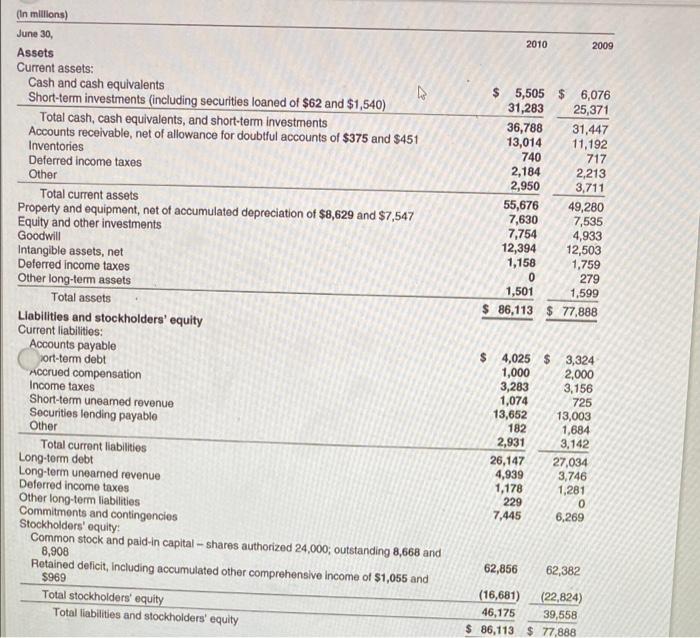

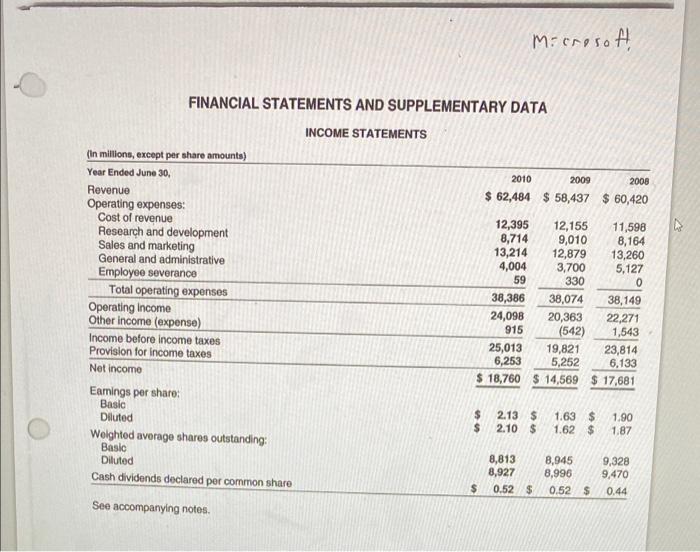

2010 2009 (In millions) June 30, Assets Current assets: Cash and cash equivalents Short-term investments (including securities loaned of $62 and $1,540) Total cash, cash equivalents, and short-term investments Accounts receivable, net of allowance for doubtful accounts of $375 and $451 Inventories Deferred income taxes Other Total current assets Property and equipment, net of accumulated depreciation of $8,629 and $7,547 Equity and other investments Goodwill Intangible assets, net Deferred income taxes Other long-term assets Total assets Liabilities and stockholders' equity Current liabilities: Accounts payable ort-term debt Accrued compensation Income taxes Short-term uneamed revenue Securities lending payable Other Total current liabilities Long-term debt Long-term unearned revenue Deferred income taxes Other long-term liabilities Commitments and contingencies Stockholders' equity: Common stock and paid-in capital - shares authorized 24,000; outstanding 8,668 and 8,908 Retained deficit, including accumulated other comprehensive income of $1,055 and $969 Total stockholders' equity Total liabilities and stockholders' equity $ 5,505 $ 6,076 31,283 25,371 36,788 31,447 13,014 11,192 740 717 2,184 2,213 2,950 3,711 55,676 49,280 7,630 7,535 7,754 4,933 12,394 12,503 1,158 1,759 0 279 1,501 1.599 $ 86,113 $ 77,888 $ 4,025 $ 3,324 1,000 2,000 3,283 3,156 1,074 725 13,652 13,003 182 1,684 2,931 3,142 26,147 27,034 4,939 3,746 1,178 1.281 229 0 7,445 6,269 62,856 62,382 (16,681) (22,824) 46,175 39,558 $ 86,113 $ 77,888 Microsoft FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA INCOME STATEMENTS (In millions, except per share amounts) Year Ended June 30, 2010 2009 2008 Revenue $ 62,484 $ 58,437 $ 60,420 Operating expenses: Cost of revenue 12,395 12,155 11,598 Research and development 8,714 9,010 8,164 Sales and marketing 13,214 12,879 13,260 General and administrative 4,004 3,700 5,127 Employee severance 59 330 0 Total operating expenses 38,386 38,074 38,149 Operating Income 24,098 20,363 22,271 Other income (expense) 915 (542) 1,543 Income before income taxes 25,013 19,821 23,814 Provision for income taxes 6,253 5,252 6,133 Net income $ 18,760 $ 14,569 $ 17,681 Eamings per share: Basic $ 2.13 $ 1.63 $ 1.90 Diluted $ 2.10 $ 1.62 $ 1.87 Weighted average shares outstanding: Basic 8,813 8,945 9,328 Diluted 8,927 8,996 9,470 Cash dividends declared per common share $ 0.52 $ 0.52 $ 0.44 See accompanying notes. Calculate the Return on Equity on Microsoft for 2010. 1 X F A B I EE % 5 S Calculate Inventory Turnover on Microsoft for 2010 0 F A B 1 EE on I Calculate the Current Ratio on Microsoft for 2010 Equity on Microsoft for 2010 1 x Ff AB I E E % 3 &