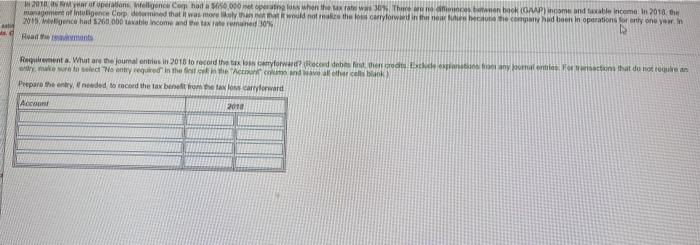

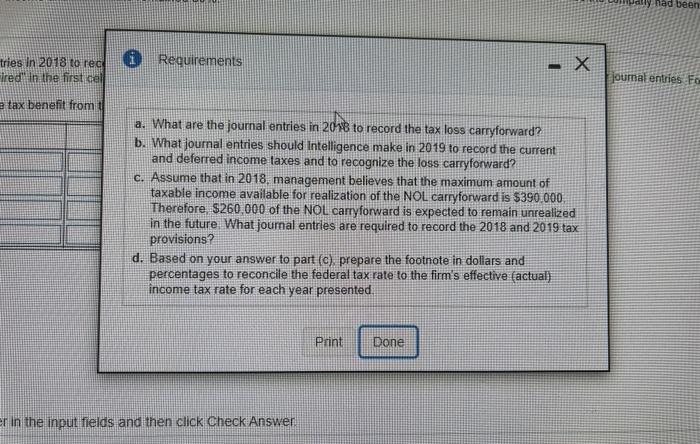

2010 Marof operations. Welligence Co hail 000 met operating on whether there will be book ( OP) income and table income in 2018, the management of Inteligence Comprised that it was would not the low carrylowwin the company had been in operations for only one yew in 2015 Bence had $260.000 avabile income and the wman dhe Renta. What are the joumal entries in 2016 to record the conforward? Read det intended former for that do not require Select Monty required in the intender cell Prepare the entry need to record the tax bent from a los carryforward Account 2018 nad been Requirements tries in 2018 to rec Ired in the first cel joumal entries For tax benefit from a. What are the journal entries in 2018 to record the tax loss carryforward? b. What journal entries should Intelligence make in 2019 to record the current and deferred income taxes and to recognize the loss carryforward? c. Assume that in 2018. management believes that the maximum amount of taxable income available for realization of the NOL carryforward is $390.000 Therefore, $260,000 of the NOL carryforward is expected to remain unrealized in the future What journal entries are required to record the 2018 and 2019 tax provisions? d. Based on your answer to part (c) prepare the footnote in dollars and percentages to reconcile the federal tax rate to the firm's effective (actual) income tax rate for each year presented Print Done er in the input fields and then click Check Answer 2010 Marof operations. Welligence Co hail 000 met operating on whether there will be book ( OP) income and table income in 2018, the management of Inteligence Comprised that it was would not the low carrylowwin the company had been in operations for only one yew in 2015 Bence had $260.000 avabile income and the wman dhe Renta. What are the joumal entries in 2016 to record the conforward? Read det intended former for that do not require Select Monty required in the intender cell Prepare the entry need to record the tax bent from a los carryforward Account 2018 nad been Requirements tries in 2018 to rec Ired in the first cel joumal entries For tax benefit from a. What are the journal entries in 2018 to record the tax loss carryforward? b. What journal entries should Intelligence make in 2019 to record the current and deferred income taxes and to recognize the loss carryforward? c. Assume that in 2018. management believes that the maximum amount of taxable income available for realization of the NOL carryforward is $390.000 Therefore, $260,000 of the NOL carryforward is expected to remain unrealized in the future What journal entries are required to record the 2018 and 2019 tax provisions? d. Based on your answer to part (c) prepare the footnote in dollars and percentages to reconcile the federal tax rate to the firm's effective (actual) income tax rate for each year presented Print Done er in the input fields and then click Check