Question

(20/100 points ) Dividend Growth Model. Deja Brew Coffee Manufacturing Corporation is expected to pay the following dividends over the next six years: $5, $13,

- (20/100 points ) Dividend Growth Model. Deja Brew Coffee Manufacturing Corporation is expected to pay the following dividends over the next six years: $5, $13, $18, $11, $21 and $3.45. Afterward, the company pledges to maintain a constant 7 percent growth rate in dividends, forever. If the required return on the stock is 9% percent, what is the share price in year 6, P6? What is the current share price, P0?

Your Answer:

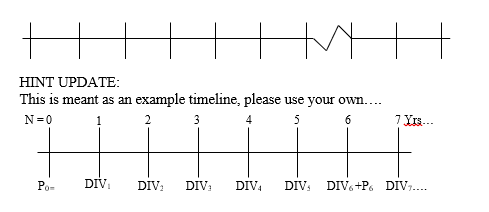

Below is an example timeline, as included in the other problems as well, feel free to use your own or start with this one (directly below with the squiggle mark on it). The one below that is meant as a hint, and an assist. Thank you.

At year 6, the dividends begin to grow at a constant rate, hence you will want to calculate the P6, for the new constant growth rate which will continue into the future. The discount or take the present value of P6 and all dividend payments and then sum them to arrive at the current bond price P0.

Please do not copy the hints I gave you but you are welcomed to write your own or type your own, as I am sure it will be much more creative and better looking than mine.

P6=DIV6*1+g=DIV7(R-g)

P0=DIV1(1+R)1++DIV51+R5+DIV6+ P61+R6

Your answer for the horizon value stock price, at period 6, (when growth of dividends changes to a constant rate) P6, should be between $183 and $186. Your answer for P0 should be between $162 and $163. Again, if I dont see work, I cannot not give credit, (I love eraser marks, for it allows me to see you were working hard)

H + th HINT UPDATE: This is meant as an example timeline, please use your own.... N=0 2 3 4 5 6 7 Yrs... 11 Po- DIV DIV: DIV: DIVA DIV DIV+P DIV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started