Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2011 2012 2013 2014 2015 Q11: How does the projected ROE for 2015 compare to 2012? Q12: What is primarily responsible for the projected fall

2011 2012 2013 2014 2015

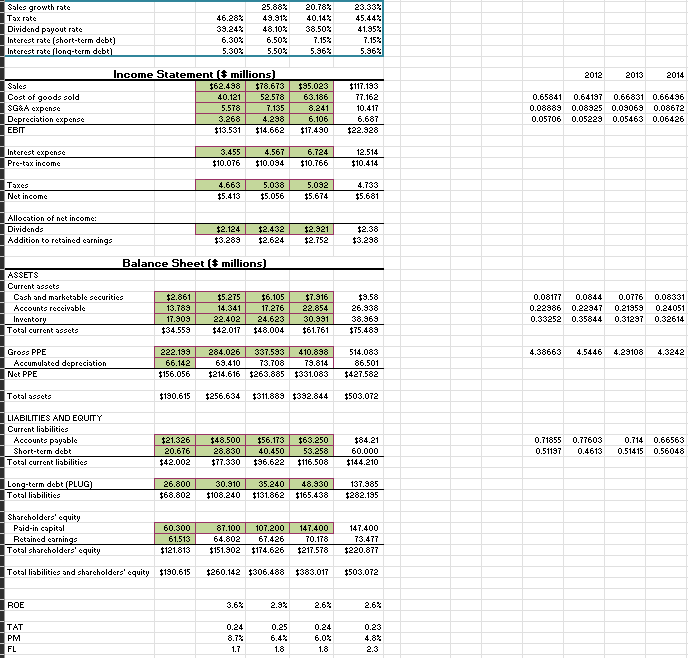

Q11: How does the projected ROE for 2015 compare to 2012?

Q12: What is primarily responsible for the projected fall in ROE in 2015 compared to 2012?

Q13: Why is leverage projected to increase so much for 2015, given that the increase in previous years has been relatively moderate?

\begin{tabular}{|c|c|c|c|c|} \hline Solee growth rote & & 25.86% & 20.78% & 23.33% \\ \hline Tax rate & 46.28% & 49.91% & 40.14% & 45.44% \\ \hline Dividend poyout rate & 39.24% & 48.10% & 38.50% & 41.95% \\ \hline Interest rste (short-term debt) & 6.30% & 6.50% & T.15\% & 7.15% \\ \hline Interest rate [lonq-term debt] & 5.30% & 5.50% & 5.96% & 5.96 \\ \hline \end{tabular} Income Statement [\$ millions] \begin{tabular}{|c|c|c|c|c|} \hline Soles & $62.498 & $78.673 & $95.023 & $117.193 \\ \hline Cost of goods zold & 40.121 & 52.578 & 63.186 & 7.162 \\ \hline SG:A expense & 5.578 & 7.135 & 8.241 & 10.417 \\ \hline Deprecistion expense & 3.268 & 4.298 & 6.106 & 6.687 \\ \hline EB & $13.531 & $14.662 & $17.490 & $22.928 \\ \hline Interest expense & 3.455 & 4.567 & 6.724 & 12.514 \\ \hline Pre-tox income & $10.076 & $10.094 & $10.766 & $10.414 \\ \hline Toxes & 4.663 & 5.038 & 5.092 & 4.733 \\ \hline Net income & $5.413 & $5.056 & $5.674 & $5.681 \\ \hline \multicolumn{5}{|l|}{ Allocstion of net income: } \\ \hline Dividends & $2.124 & $2.432 & $2.921 & $2.38 \\ \hline Addition to retsined earninge & $3.289 & $2.624 & $2.752 & $3.298 \\ \hline \end{tabular} Balance Sheet [\$ millions] \begin{tabular}{|c|c|c|c|c|c|} \hlineASSETS & & & & & \\ \hline Current seecte & & & & & \\ \hline Cosh and marketable eccuritice & $2.861 & $5.275 & $6.105 & $7.916 & $9.58 \\ \hline Accounte receivable & 13.789 & 14.341 & 17.276 & 22.854 & 26.938 \\ \hline Inventory & 17.909 & 22.402 & 24.623 & 30.991 & 38.969 \\ \hline Totol current sezet & $34.559 & $42.017 & $48.004 & $61.761 & $75.489 \\ \hline Grose PPE & 222.199 & 284.026 & 337.593 & 410.898 & 514.083 \\ \hline Accumulated depreciation & 66.142 & 69.410 & 73.706 & 79.814 & 86.501 \\ \hline Net PPE & $156.056 & $214.616 & $263.865 & $331.063 & $427.582 \\ \hline Total sesete & $190.615 & $256.634 & $311.869 & $392.844 & $503.072 \\ \hline LIAEILITIES AND EQUITY & & & & & \\ \hline Current lisbilitice & & & & & \\ \hline Accounte paysble & $21.326 & $48.500 & $56.173 & $63.250 & $84.21 \\ \hline Short-term debt & 20.676 & 28.830 & 40.450 & 53.258 & 60.000 \\ \hline Total current liabilitice & $42.002 & $77.330 & $96.622 & $116.506 & $144.210 \\ \hline Long-term debt (PLUG) & 26.800 & 30.910 & 35.240 & 48.930 & 137.985 \\ \hline Totsl lisbilitice & $68.802 & $108.240 & $131.862 & $165.438 & $282.195 \\ \hline Sharcholders' equity & & & & & \\ \hline Psid-in copital & 60.300 & 87.100 & 107.200 & 147.400 & 147.400 \\ \hline Retsined earninge & 61.513 & 64.802 & 67.426 & 70.178 & 73.477 \\ \hline Total sharcholdere' equity & $121.813 & $151.902 & $174.626 & $217.578 & $220.877 \\ \hline Total lisbilitice and sharcholdere' equity & $190.615 & $260.142 & $306.488 & $383.017 & $503.072 \\ \hline & & & & & \\ \hline ROE & & 3.6% & 2.97 & 2.6% & 2.6% \\ \hline & & & & & \\ \hline TAT & & 0.24 & 0.25 & 0.24 & 0.23 \\ \hline PM & & 8.7% & 6.4% & 6.0% & 4.8% \\ \hline FL & & 1.7 & 1.8 & 1.8 & 2.3 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started