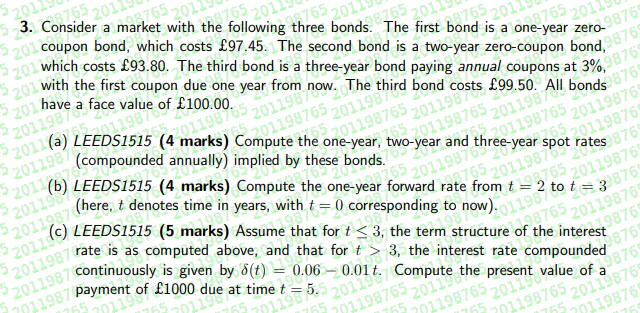

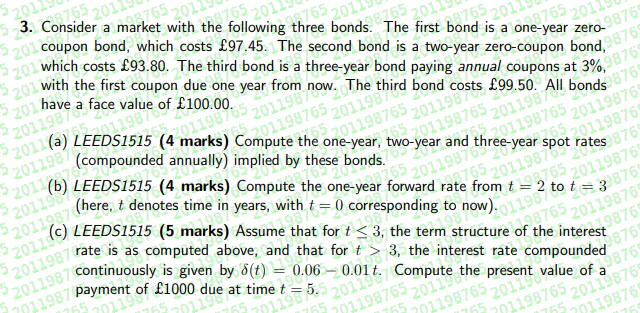

2011 2201 2010 6765201 53. Consider a market with the following three bonds. The first bond is a one-year zero 98765 765201 coupon bond, which costs 97.45. The second bond is a two-year zero-coupon bond 08755 520which costs 93.80. The third bond is a three-year bond paying annual coupons at 3%98755 520 with the first coupon due one year from 20 have a face value of 100.00. 1989 320119 20119573 5 ...165.2012 075 207 165201 5201(a) LEEDS1515 (4 marks) Como1 198765 2017 third bondo 201198 how. The t the oneve 01.198765, 201198719 99.50. All bonds 8769 5 -2017 th 201198 stes 3765 5-2011 201198 4 20119876 220119870 Its 25 20119876 2011987033765 and (compounded annually) implied by these bonds. (b) LEEDS1515 (4 marks) Compute the one-year forward rate from (here, t denotes time in years, with t = 0 corresponding to now). (C) LEEDS1515 (5 marks) Assume that for t 3, the interest rate compounded 5201198 continuously is given by 8(t) = 0.00 present value of a 2011 (6) 20119 520112 0765 20119876 9876 9876 2011987 ce the 791198 Payment of 1000 due at time t = 5. 791198765 201198765 2014 1765 701198765 20119676 175579119876 2011 2201 2010 6765201 53. Consider a market with the following three bonds. The first bond is a one-year zero 98765 765201 coupon bond, which costs 97.45. The second bond is a two-year zero-coupon bond 08755 520which costs 93.80. The third bond is a three-year bond paying annual coupons at 3%98755 520 with the first coupon due one year from 20 have a face value of 100.00. 1989 320119 20119573 5 ...165.2012 075 207 165201 5201(a) LEEDS1515 (4 marks) Como1 198765 2017 third bondo 201198 how. The t the oneve 01.198765, 201198719 99.50. All bonds 8769 5 -2017 th 201198 stes 3765 5-2011 201198 4 20119876 220119870 Its 25 20119876 2011987033765 and (compounded annually) implied by these bonds. (b) LEEDS1515 (4 marks) Compute the one-year forward rate from (here, t denotes time in years, with t = 0 corresponding to now). (C) LEEDS1515 (5 marks) Assume that for t 3, the interest rate compounded 5201198 continuously is given by 8(t) = 0.00 present value of a 2011 (6) 20119 520112 0765 20119876 9876 9876 2011987 ce the 791198 Payment of 1000 due at time t = 5. 791198765 201198765 2014 1765 701198765 20119676 175579119876