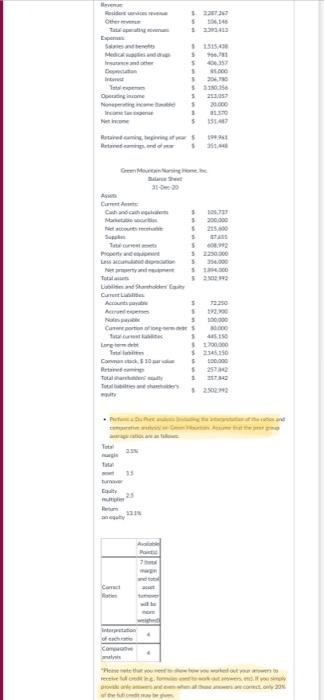

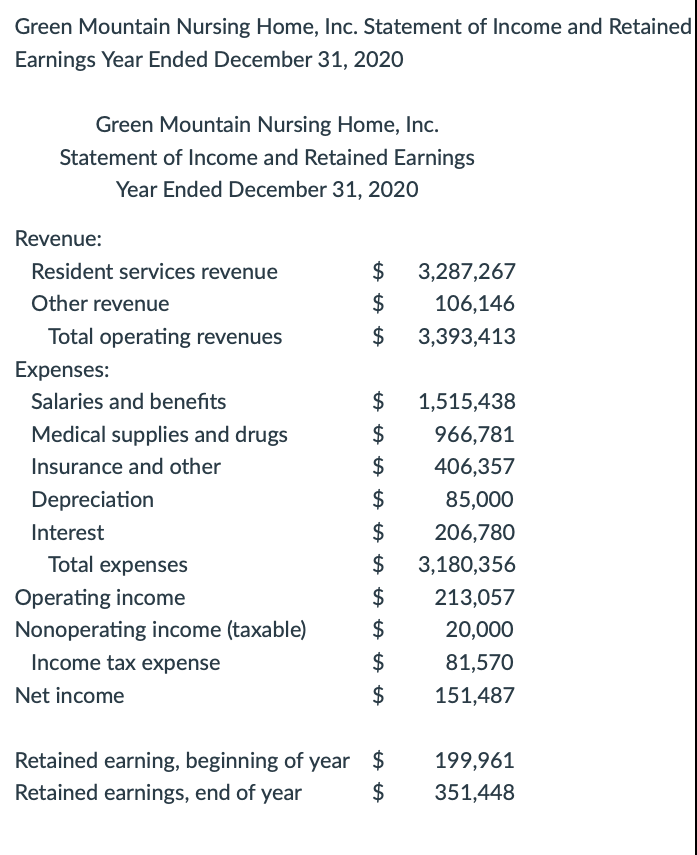

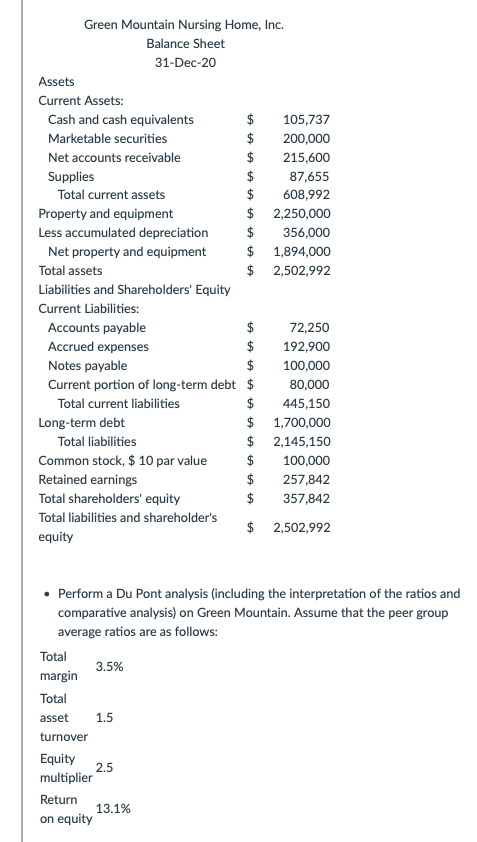

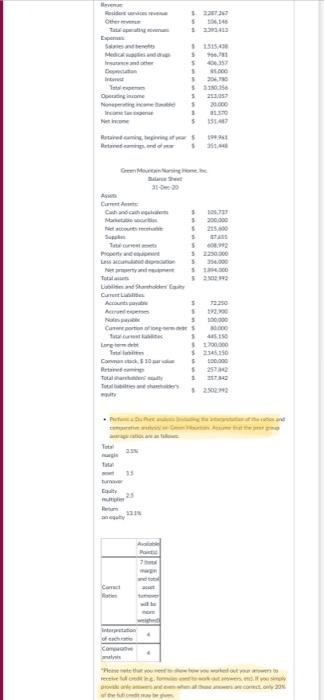

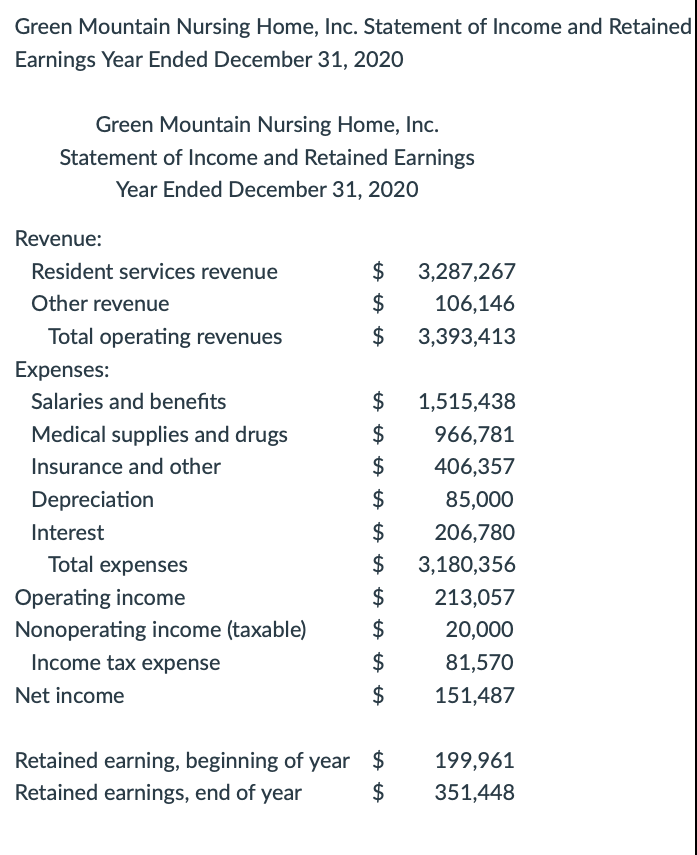

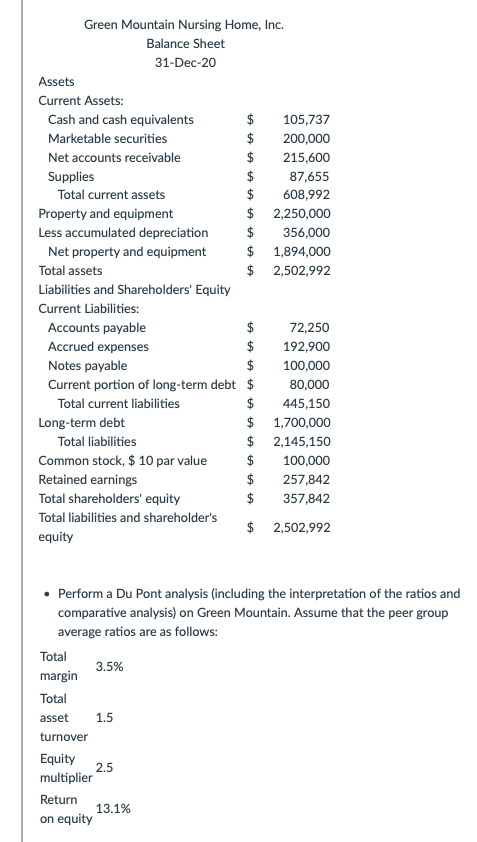

2013 Aaraders and mana determu 5 benet 30:35 Contacting on 20 htination $ 200.000 $ 25,000 522000 angana S. or $2345750 Comman stay, 1 10 anaa 5257 17 fanchata Jaruthi Green Mountain Nursing Home, Inc. Statement of Income and Retained Earnings Year Ended December 31, 2020 Green Mountain Nursing Home, Inc. Statement of Income and Retained Earnings Year Ended December 31, 2020 A A A 3,287,267 106,146 3,393,413 $ $ Revenue: Resident services revenue Other revenue Total operating revenues Expenses: Salaries and benefits Medical supplies and drugs Insurance and other Depreciation Interest Total expenses Operating income Nonoperating income (taxable) Income tax expense Net income ta ta ta ta ta ta ta ta ta 1,515,438 966,781 406,357 85,000 206,780 3,180,356 213,057 20,000 81,570 151,487 Retained earning, beginning of year $ Retained earnings, end of year $ 199,961 351,448 A tA Green Mountain Nursing Home, Inc. Balance Sheet 31-Dec-20 Assets Current Assets: Cash and cash equivalents $ 105,737 Marketable securities $ 200,000 Net accounts receivable $ 215,600 Supplies $ 87,655 Total current assets $ 608,992 Property and equipment $ 2,250,000 Less accumulated depreciation $ 356,000 Net property and equipment $ 1,894,000 Total assets $ 2,502,992 Liabilities and Shareholders' Equity Current Liabilities: Accounts payable $ 72,250 Accrued expenses $ 192,900 Notes payable $ 100,000 Current portion of long-term debt $ 80,000 Total current liabilities $ 445,150 Long-term debt $ 1,700,000 Total liabilities $ 2,145,150 Common stock, $ 10 par value 100,000 Retained earnings $ 257,842 Total shareholders' equity $ 357,842 Total liabilities and shareholder's equity $ 2,502,992 Perform a Du Pont analysis (including the interpretation of the ratios and comparative analysis) on Green Mountain. Assume that the peer group average ratios are as follows: Total 3.5% margin Total asset 1.5 turnover Equity 2.5 multiplier Return 13.1% on equity 2013 Aaraders and mana determu 5 benet 30:35 Contacting on 20 htination $ 200.000 $ 25,000 522000 angana S. or $2345750 Comman stay, 1 10 anaa 5257 17 fanchata Jaruthi Green Mountain Nursing Home, Inc. Statement of Income and Retained Earnings Year Ended December 31, 2020 Green Mountain Nursing Home, Inc. Statement of Income and Retained Earnings Year Ended December 31, 2020 A A A 3,287,267 106,146 3,393,413 $ $ Revenue: Resident services revenue Other revenue Total operating revenues Expenses: Salaries and benefits Medical supplies and drugs Insurance and other Depreciation Interest Total expenses Operating income Nonoperating income (taxable) Income tax expense Net income ta ta ta ta ta ta ta ta ta 1,515,438 966,781 406,357 85,000 206,780 3,180,356 213,057 20,000 81,570 151,487 Retained earning, beginning of year $ Retained earnings, end of year $ 199,961 351,448 A tA Green Mountain Nursing Home, Inc. Balance Sheet 31-Dec-20 Assets Current Assets: Cash and cash equivalents $ 105,737 Marketable securities $ 200,000 Net accounts receivable $ 215,600 Supplies $ 87,655 Total current assets $ 608,992 Property and equipment $ 2,250,000 Less accumulated depreciation $ 356,000 Net property and equipment $ 1,894,000 Total assets $ 2,502,992 Liabilities and Shareholders' Equity Current Liabilities: Accounts payable $ 72,250 Accrued expenses $ 192,900 Notes payable $ 100,000 Current portion of long-term debt $ 80,000 Total current liabilities $ 445,150 Long-term debt $ 1,700,000 Total liabilities $ 2,145,150 Common stock, $ 10 par value 100,000 Retained earnings $ 257,842 Total shareholders' equity $ 357,842 Total liabilities and shareholder's equity $ 2,502,992 Perform a Du Pont analysis (including the interpretation of the ratios and comparative analysis) on Green Mountain. Assume that the peer group average ratios are as follows: Total 3.5% margin Total asset 1.5 turnover Equity 2.5 multiplier Return 13.1% on equity