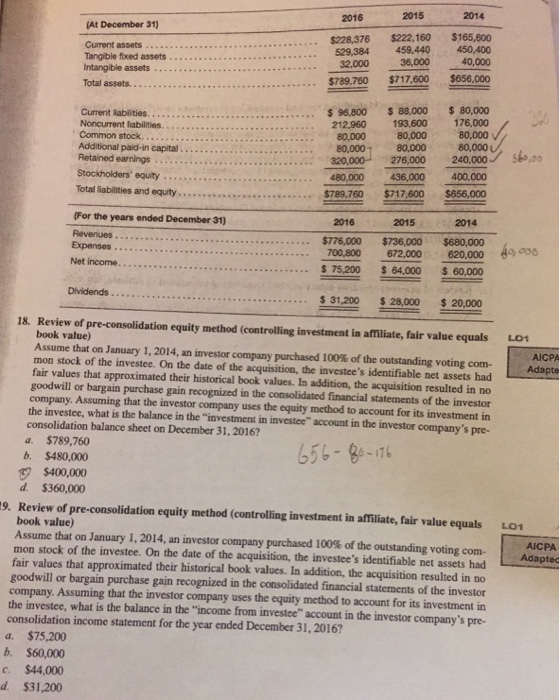

2015 2014 2016 At December 31) Current assets Intangible assets 529,384 459,440 450,400 36,000 40,000 ..$789.760 $717600 $656.,000 s96,B00 $88,000 $80,000 80,00080,000 80,000 80,000 Common stock Additional paid-in capital Retained earnings Stockholders' equity... Total liabilities and equity.... 80,000 80,000 276,000 240,000 56," $789.760$717600 $656,000 2015 $776,000 $736,000 $680,000 s 75,200 64,000 $ 60,000 (For the years ended December 31) 2016 Expenses 700,800 672,000 620,000 6 18. Review of pre-consolidation equity method (controlling investment in affiliate, fair value equals LO1 book value) Assume that on January 1, 2014, an investor company purchased 100% of the outstanding voting con- mon stock of the investee. On the date of the acquisition, the investee's identifiable net assets had fair values that approximated their historical book values. In addition, the acquisition resulted in no goodwill or bargain purchase gain recognized in the consolidated financial statements of the investor company. Assuming that the investor company uses the equity method to account for its investment in the investee, what is the balance in the "investment in investee" account in the investor company's pre- AICPA Adapte consolidation balance sheet on December 31, 2016? a. $789,760 b. $480,000 $400,000 d $360,000 9. Review of pre-consolidation equity method (controlling investment in affiliate, fair value equals LO1 book value) Assume that on January 1, 2014, an investor company purchased 100% of the outstanding voting com- mon stock of the investee. On the date of the acquisition, the investee's identifiable net assets had fair values that approximated their historical book values. In addition, the acquisition resulted in no goodwill or bargain purchase gain recognized in the consolidated financial statements of the investor company. Assuming that the investor company uses the equity method to account for its investment in the investee, what is the balance in the "income from investee" account in the investor company's pre- AICPA consolidation income statement for the year ended December 31,2016? a. $75,200 b. $60,000 c. $44,000 d. $31,200