Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2015 2016 2017 Posted by Detra Leshue Basics H-Section1 att if you havenT had a chance to post your introduction please ferl sehap then there

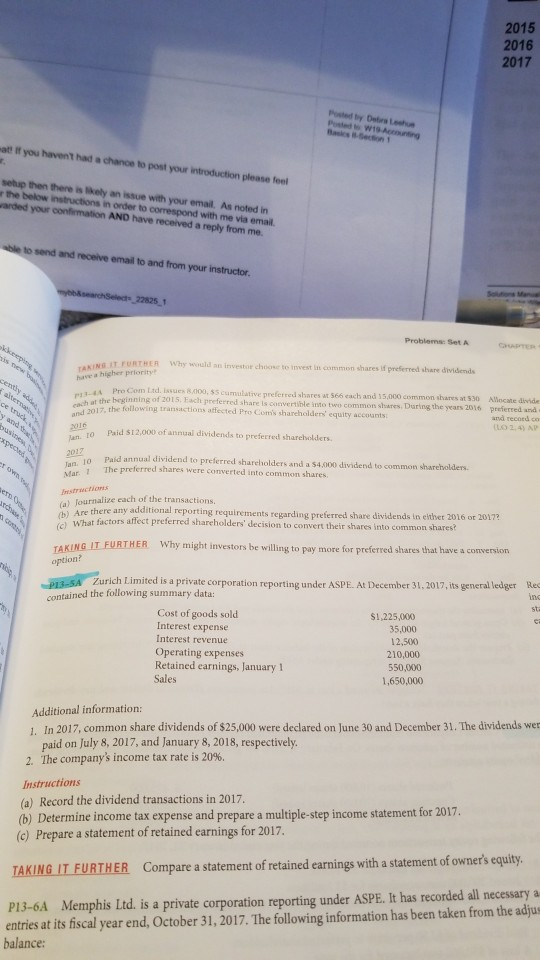

2015 2016 2017 Posted by Detra Leshue Basics H-Section1 att if you havenT had a chance to post your introduction please ferl sehap then there is ikely an issue with your email. As noted in r the below instructions in order to correspond with me via email. arded your confirmation AND have received a reply from me. to send and receive email to and from your instructor Problems: Set A ING AT FURTHER Why would an investor choose have a higher priority o invest in common shares if preferred share dividends In s cumulative bcusverntihle intequity accounts Pro Corn Ltd. issues 8.000, $5 c the following transactions affected Pro Coms shareholders' equity accounts 3-4A d shares at 566 each and 35,000 common shares at 530 Allocate diside shares. Daring the years 2016 preferred and and record co LO 2, 4)AP of 2015, Each preferred share is convertible into twe common el tO Paid $12,000 of annuai dividends to preferred shareholders Paid annual dividend to preferred shareholders and a $4,000 dividend to common shareholders. : 1oes an The preferred shares were converted into common shares. a) lournalize each of the transactions. Are there any additional What factors affect preferred shareholders' rting requirements regarding preferred share dividends in eithet 2016 or 20172 regardi decision to convert their shares into common shares? TAKING IT FURTHER Why might investors be willingto pay more for preferred shares that have a comversion option? Zurich Limited is a private corporation reporting under ASPE. At December 31, 2017,its general ledger Res ine contained the following summary data: Cost of goods sold Interest expense Interest revenue Operating expenses Retained earnings, January 1 Sales 12,500 210,000 550,000 Additional information: ]. In 2017, common share dividends of $25,000 were declared on June 30 and December 31. The dividends wer paid on July 8, 2017, and January 8, 2018, respectively 2. The company's income tax rate is 20%. Instructions (a) Record the dividend transactions in 2017 Determine income tax expense and prepare a multiple-step income statement for 2017 (c) Prepare a statement of retained earnings for 2017. TAKING IT FURTHER Compare a statement of retained earnings with a statement of owner's equity P13-6A Memphis Ltd. is a private corporation reporting under ASPE. It has recorded all necessary a entries at its fiscal year end, October 31, 2017. The following information has been taken from the adjus balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started