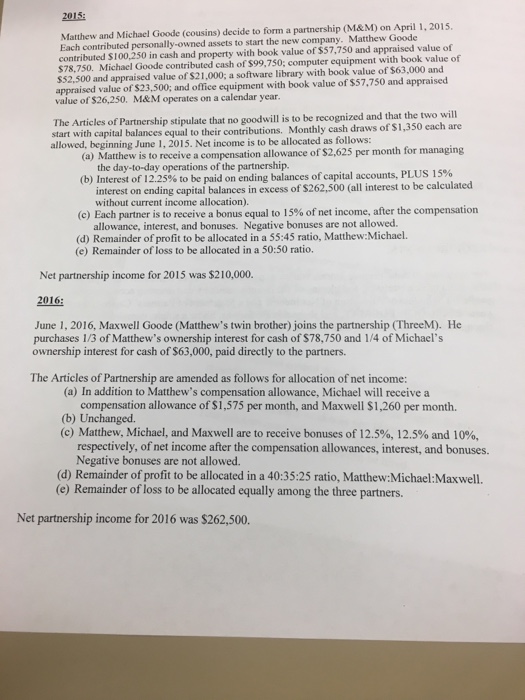

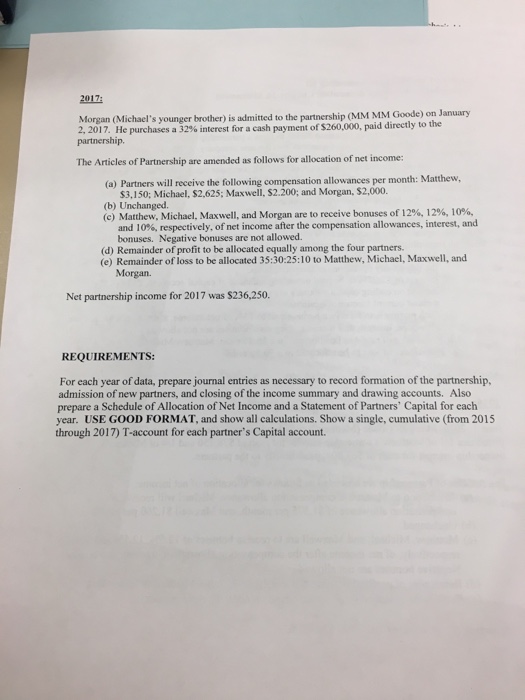

2015 Matthew and Michael Goode (cousins) decide to form a partnership (M&M) on April 1, 201:s Each contributed personally-owned assets to start the new company. Matthew Goode contributed $100,250 in cash and property with book value of $57,750 and appraised value of $78,750. Michael Goode contributed cash of $99,750; computer equipment with book value of $52,500 and appraised value of $21,000; a software library with book value of $63,000 and appraised value of $23,500; and office equipment with book value of $57,750 and appraised value of $26,250. M&M operates on a calendar year. The Articles of Partnership stipulate that no goodwill is to be recognized and that the two will start with capital balances equal to their contributions. Monthly cash draws of $1,350 each are allowed, beginning Ju ne 1, 2015. Net income is to be allocated as follows: (a) Matthew is to receive a compensation allowance ofs the day-to-day operations of the partnership. (b) Interest of 12.25% to be paid on ending balances of capital accounts, PLUS 15% interest on ending capital balances in excess of $262,500 (all interest to be calculated without current income allocation). (c) Each partner is to receive a bonus equal to 15% of net income, after the compensation allowance, interest, and bonuses. Negative bonuses are not allowed. (d) Remainder of profit to be allocated in a 55:45 ratio, Matthew:Michael. (e) Remainder of loss to be allocated in a 50:50 ratio. Net partnership income for 2015 was $210,000. 2016 June 1, 2016, Maxwell Goode (Matthew's twin brother) joins the partnership (ThreeM). He purchases 1/3 of Matthew's ownership interest for cash of $78,750 and 1/4 of Michael's ownership interest for cash of $63,000, paid directly to the partners. The Articles of Partnership are amended as follows for allocation of net income: (a) In addition to Matthew's compensation allowance, Michael will receive a compensation allowance of S1,575 per month, and Maxwell $1,260 per month. (b) Unchanged. (c) Matthew, Michael, and Maxwell are to receive bonuses of 12.5%, 12.5% and 10%, respectively, of net income after the compensation allowances, interest, and bonuses. Negative bonuses are not allowed. (d) Remainder of profit to be allocated in a 40:35:25 ratio, Matthew:Michael:Maxwell. (e) Remainder of loss to be allocated equally among the three partners. Net partnership income for 2016 was $262,500. 2015 Matthew and Michael Goode (cousins) decide to form a partnership (M&M) on April 1, 201:s Each contributed personally-owned assets to start the new company. Matthew Goode contributed $100,250 in cash and property with book value of $57,750 and appraised value of $78,750. Michael Goode contributed cash of $99,750; computer equipment with book value of $52,500 and appraised value of $21,000; a software library with book value of $63,000 and appraised value of $23,500; and office equipment with book value of $57,750 and appraised value of $26,250. M&M operates on a calendar year. The Articles of Partnership stipulate that no goodwill is to be recognized and that the two will start with capital balances equal to their contributions. Monthly cash draws of $1,350 each are allowed, beginning Ju ne 1, 2015. Net income is to be allocated as follows: (a) Matthew is to receive a compensation allowance ofs the day-to-day operations of the partnership. (b) Interest of 12.25% to be paid on ending balances of capital accounts, PLUS 15% interest on ending capital balances in excess of $262,500 (all interest to be calculated without current income allocation). (c) Each partner is to receive a bonus equal to 15% of net income, after the compensation allowance, interest, and bonuses. Negative bonuses are not allowed. (d) Remainder of profit to be allocated in a 55:45 ratio, Matthew:Michael. (e) Remainder of loss to be allocated in a 50:50 ratio. Net partnership income for 2015 was $210,000. 2016 June 1, 2016, Maxwell Goode (Matthew's twin brother) joins the partnership (ThreeM). He purchases 1/3 of Matthew's ownership interest for cash of $78,750 and 1/4 of Michael's ownership interest for cash of $63,000, paid directly to the partners. The Articles of Partnership are amended as follows for allocation of net income: (a) In addition to Matthew's compensation allowance, Michael will receive a compensation allowance of S1,575 per month, and Maxwell $1,260 per month. (b) Unchanged. (c) Matthew, Michael, and Maxwell are to receive bonuses of 12.5%, 12.5% and 10%, respectively, of net income after the compensation allowances, interest, and bonuses. Negative bonuses are not allowed. (d) Remainder of profit to be allocated in a 40:35:25 ratio, Matthew:Michael:Maxwell. (e) Remainder of loss to be allocated equally among the three partners. Net partnership income for 2016 was $262,500