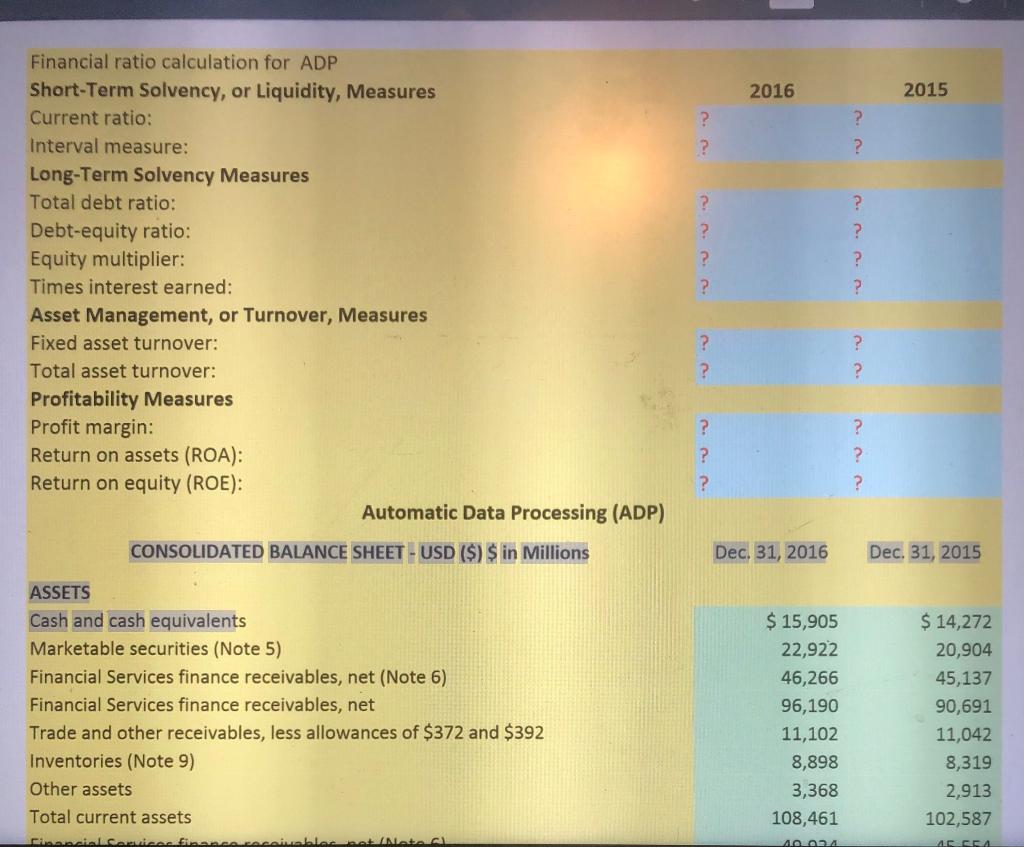

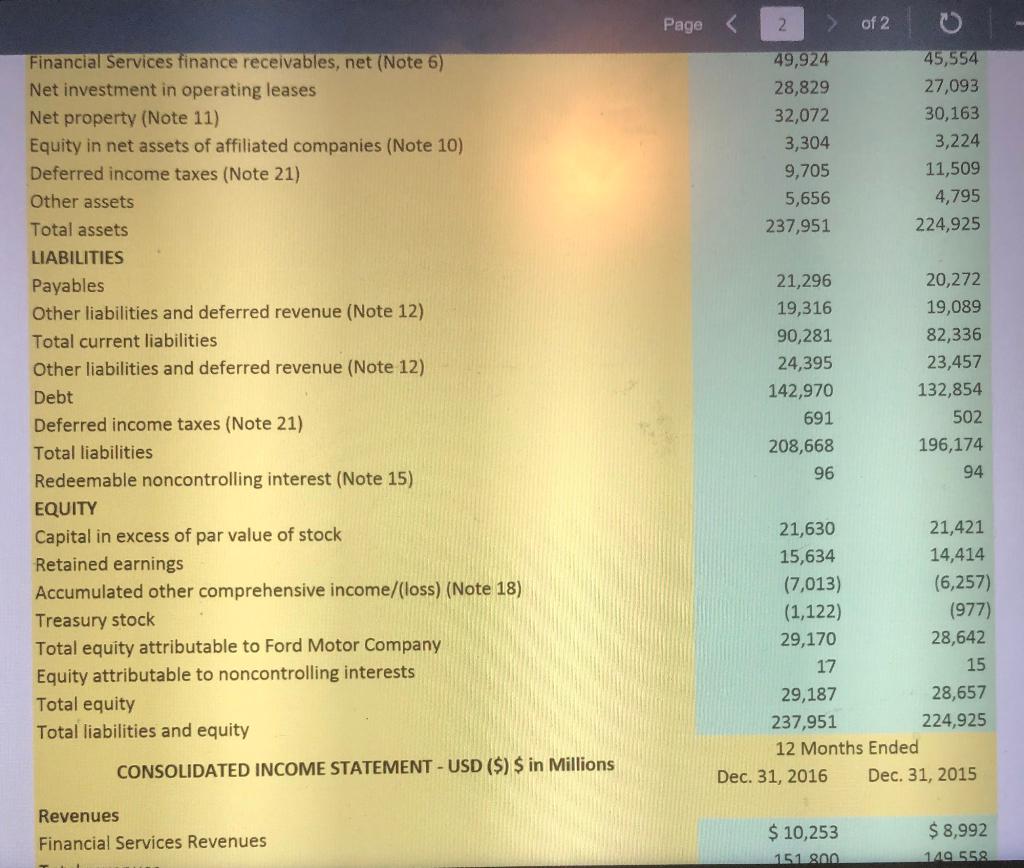

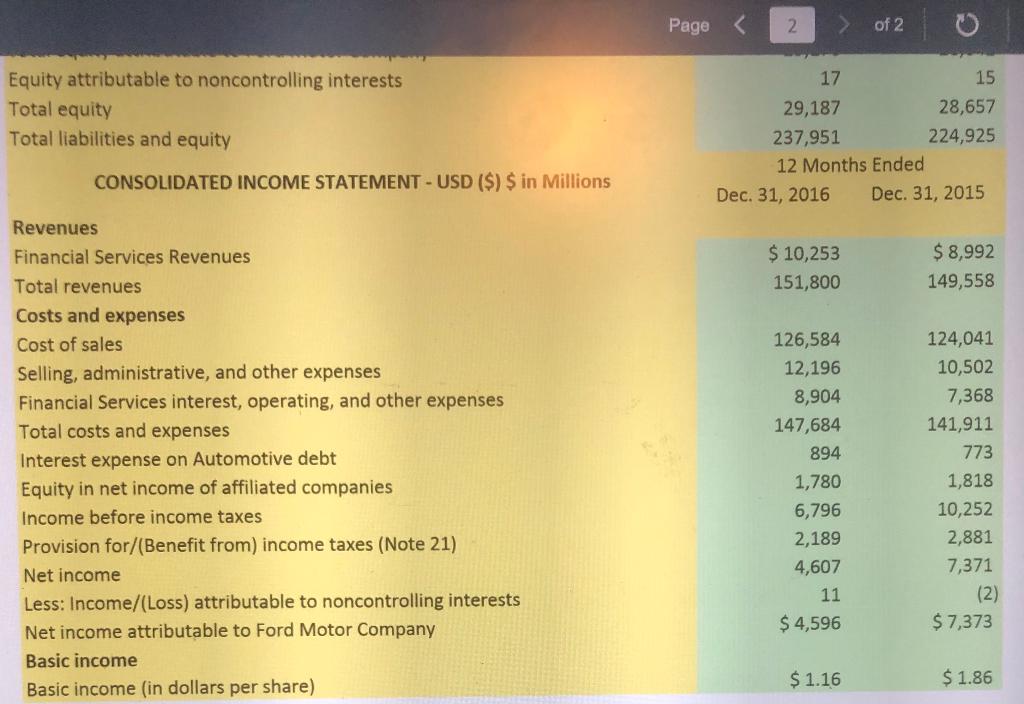

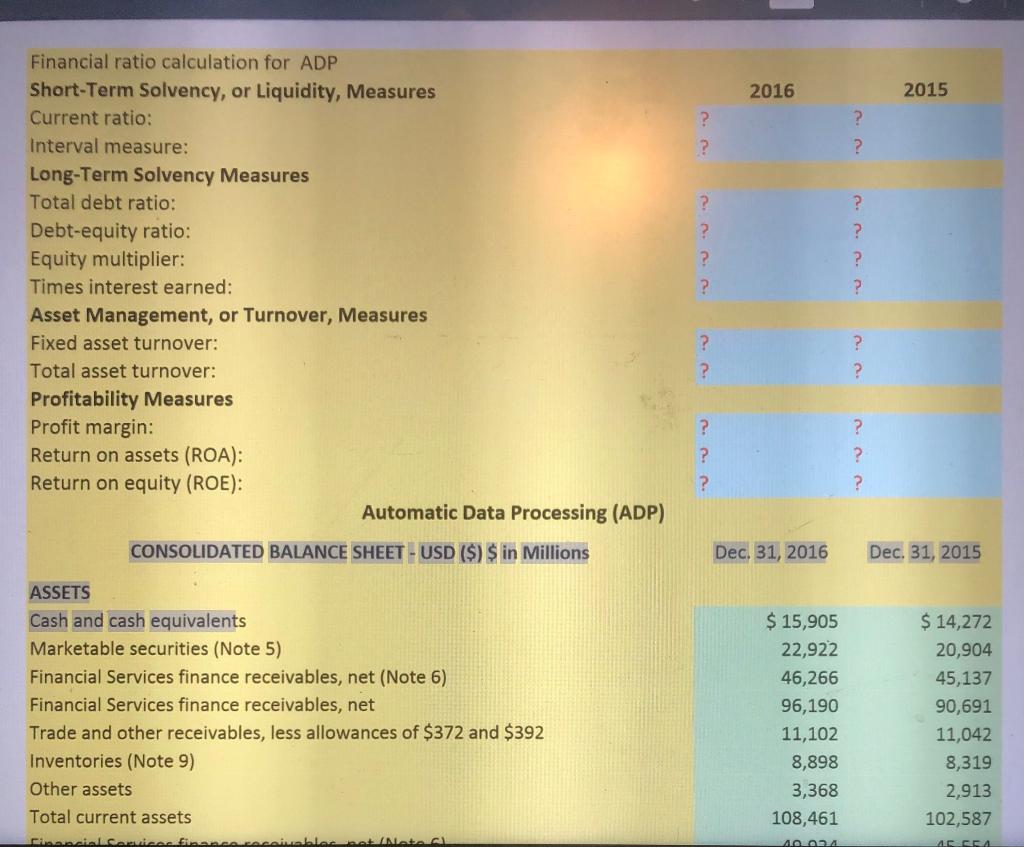

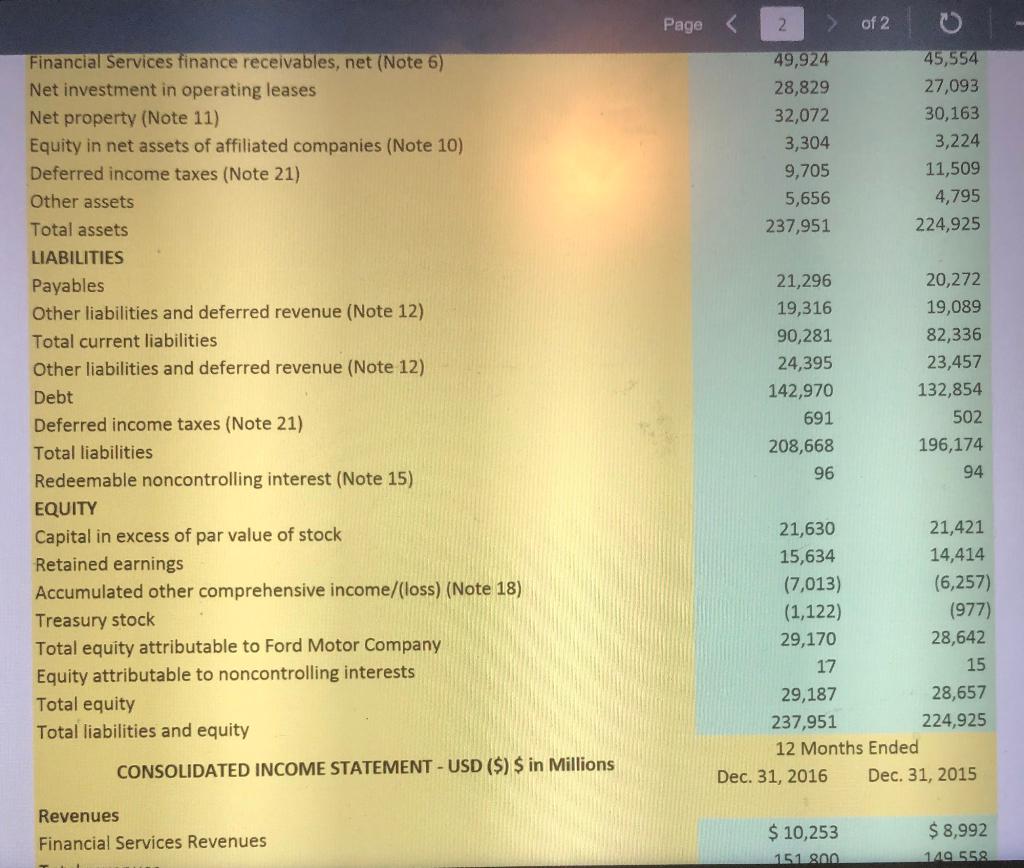

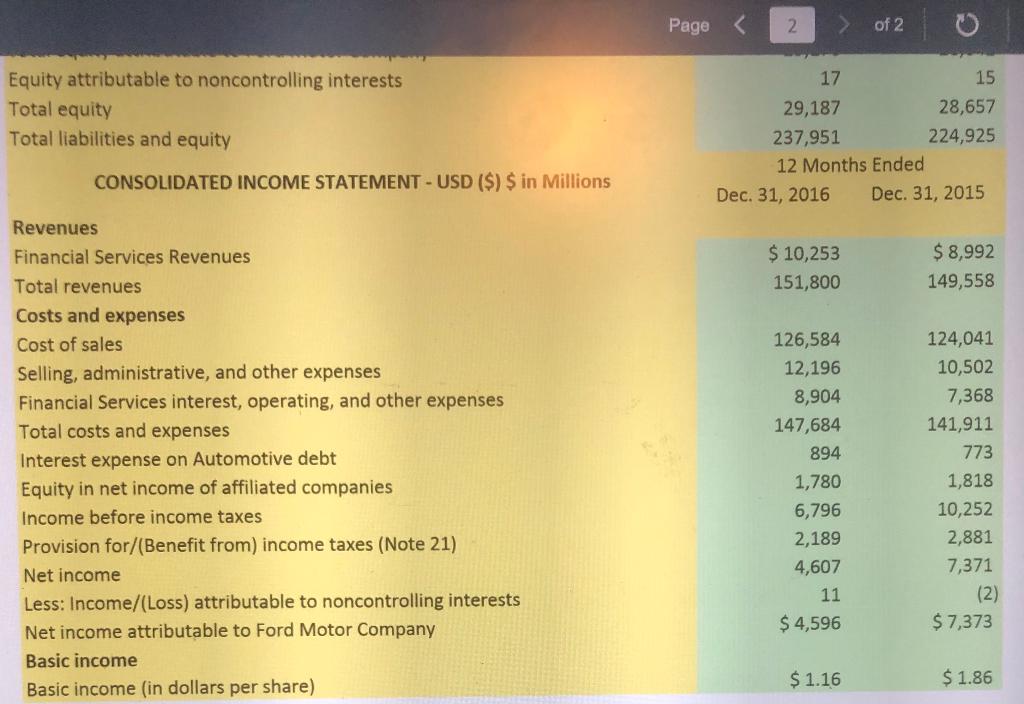

2016 2015 ? ? ? ? ? Financial ratio calculation for ADP Short-Term Solvency, or Liquidity, Measures Current ratio: Interval measure: Long-Term Solvency Measures Total debt ratio: Debt-equity ratio: Equity multiplier: Times interest earned: Asset Management, or Turnover, Measures Fixed asset turnover: Total asset turnover: Profitability Measures Profit margin: Return on assets (ROA): Return on equity (ROE): Automatic Data Processing (ADP) ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? CONSOLIDATED BALANCE SHEET - USD ($) $ in Millions Dec. 31, 2016 Dec. 31, 2015 ASSETS Cash and cash equivalents Marketable securities (Note 5) Financial Services finance receivables, net (Note 6) Financial Services finance receivables, net Trade and other receivables, less allowances of $372 and $392 Inventories (Note 9) Other assets Total current assets $ 15,905 22,922 46,266 96,190 11,102 8,898 3,368 108,461 4004 $ 14,272 20,904 45,137 90,691 11,042 8,319 2,913 102,587 46 CSA Latvia AN Page 2 of 2 49,924 28,829 32,072 3,304 9,705 5,656 237,951 45,554 27,093 30,163 3,224 11,509 4,795 224,925 Financial Services finance receivables, net (Note 6) Net investment in operating leases Net property (Note 11) Equity in net assets of affiliated companies (Note 10) Deferred income taxes (Note 21) Other assets Total assets LIABILITIES Payables Other liabilities and deferred revenue (Note 12) Total current liabilities Other liabilities and deferred revenue (Note 12) Debt Deferred income taxes (Note 21) Total liabilities Redeemable noncontrolling interest (Note 15) EQUITY Capital in excess of par value of stock Retained earnings Accumulated other comprehensive income/(loss) (Note 18) Treasury stock Total equity attributable to Ford Motor Company Equity attributable to noncontrolling interests Total equity Total liabilities and equity 21,296 19,316 90,281 24,395 142,970 691 208,668 96 20,272 19,089 82,336 23,457 132,854 502 196,174 94 21,630 21,421 15,634 14,414 (7,013) (6,257) (1,122) (977) 29,170 28,642 17 15 29,187 28,657 237,951 224,925 12 Months Ended Dec. 31, 2016 Dec. 31, 2015 CONSOLIDATED INCOME STATEMENT - USD ($) $ in Millions Revenues Financial Services Revenues $ 8,992 $ 10,253 151.800 149558 Page 2 of 2 Equity attributable to noncontrolling interests Total equity Total liabilities and equity 17 15 29,187 28,657 237,951 224,925 12 Months Ended Dec 31, 2016 Dec. 31, 2015 CONSOLIDATED INCOME STATEMENT - USD ($) $ in Millions $ 10,253 151,800 $ 8,992 149,558 Revenues Financial Services Revenues Total revenues Costs and expenses Cost of sales Selling, administrative, and other expenses Financial Services interest, operating, and other expenses Total costs and expenses Interest expense on Automotive debt Equity in net income of affiliated companies Income before income taxes Provision for/(Benefit from) income taxes (Note 21) Net income Less: Income/(Loss) attributable to noncontrolling interests Net income attributable to Ford Motor Company Basic income Basic income (in dollars per share) 126,584 12,196 8,904 147,684 894 1,780 6,796 2,189 4,607 11 $ 4,596 124,041 10,502 7,368 141,911 773 1,818 10,252 2,881 7,371 (2) $ 7,373 $ 1.16 $ 1.86