Answered step by step

Verified Expert Solution

Question

1 Approved Answer

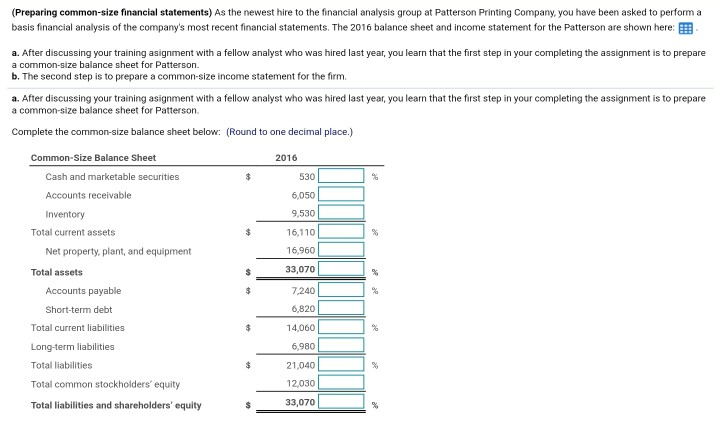

2016 $ % (Preparing common-size financial statements) As the newest hire to the financial analysis group at Patterson Printing Company, you have been asked to

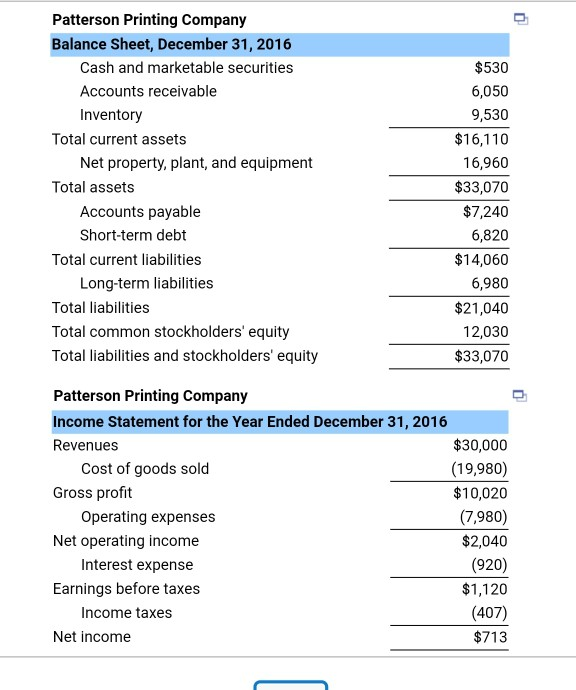

2016 $ % (Preparing common-size financial statements) As the newest hire to the financial analysis group at Patterson Printing Company, you have been asked to perform a basis financial analysis of the company's most recent financial statements. The 2016 balance sheet and income statement for the Patterson are shown here: a. After discussing your training asignment with a fellow analyst who was hired last year, you learn that the first step in your completing the assignment is to prepare a common-size balance sheet for Patterson. b. The second step is to prepare a common-size income statement for the firm. a. After discussing your training asignment with a fellow analyst who was hired last year, you learn that the first step in your completing the assignment is to prepare a common-size balance sheet for Patterson Complete the common-size balance sheet below: (Round to one decimal place.) Common-Size Balance Sheet Cash and marketable securities 530 Accounts receivable 6,050 Inventory 9,530 Total current assets 16,110 Net property, plant, and equipment 16,960 Total assets 33,070 Accounts payable 7,240 Short-term debt 6,820 Total current liabilities 14,060 Long-term liabilities 6,980 Total liabilities 21,040 Total common stockholders' equity 12,030 Total liabilities and shareholders' equity 33,070 $ % % $ % $ % Patterson Printing Company Balance Sheet, December 31, 2016 Cash and marketable securities Accounts receivable Inventory Total current assets Net property, plant, and equipment Total assets Accounts payable Short-term debt Total current liabilities Long-term liabilities Total liabilities Total common stockholders' equity Total liabilities and stockholders' equity $530 6,050 9,530 $16,110 16,960 $33,070 $7,240 6,820 $14,060 6,980 $21,040 12,030 $33,070 Patterson Printing Company Income Statement for the Year Ended December 31, 2016 Revenues $30,000 Cost of goods sold (19,980) Gross profit $10,020 Operating expenses (7,980) Net operating income $2,040 Interest expense (920) Earnings before taxes $1,120 Income taxes (407) Net income $713

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started