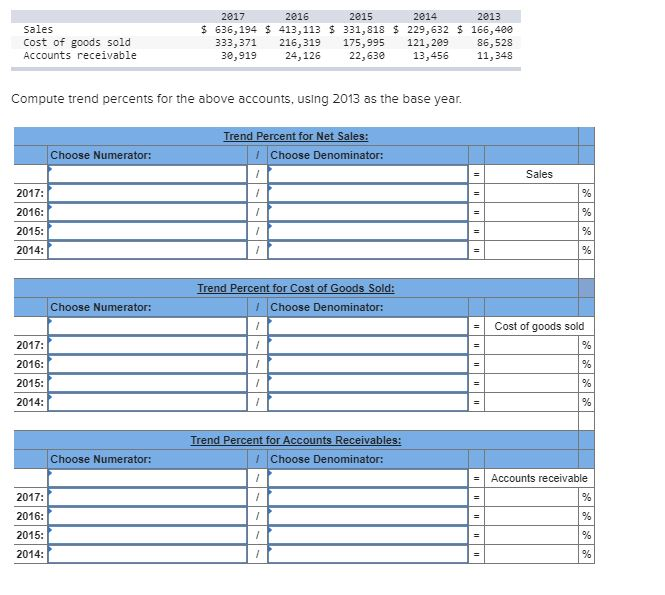

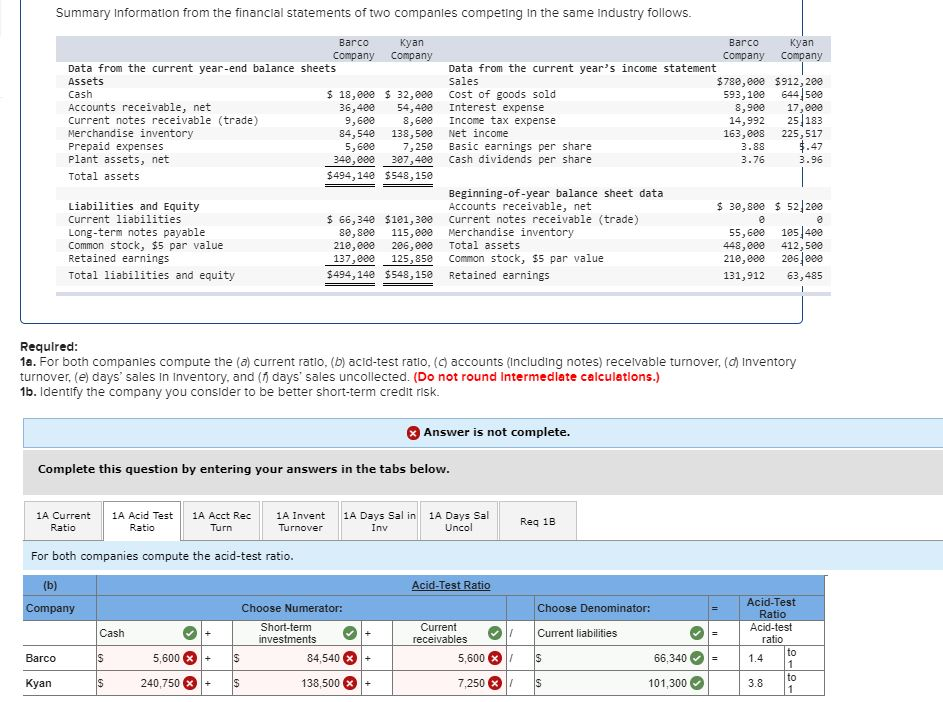

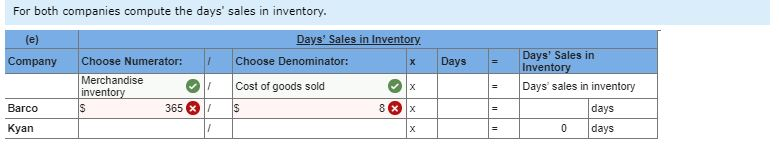

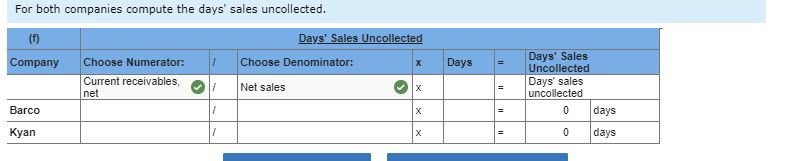

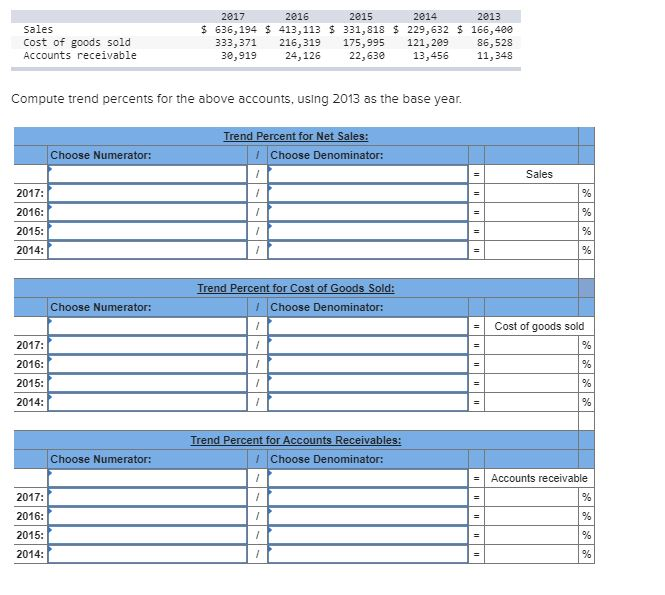

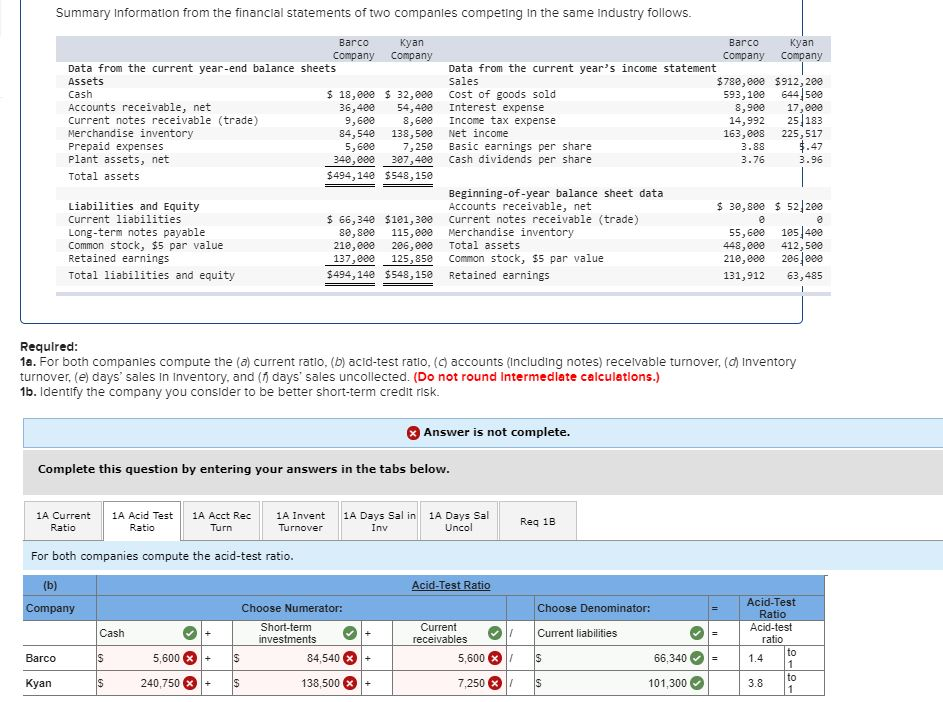

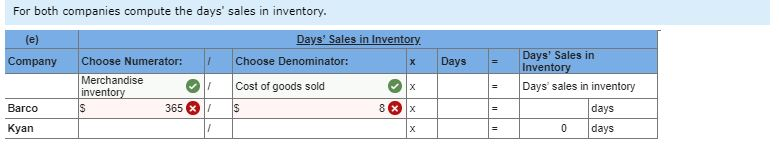

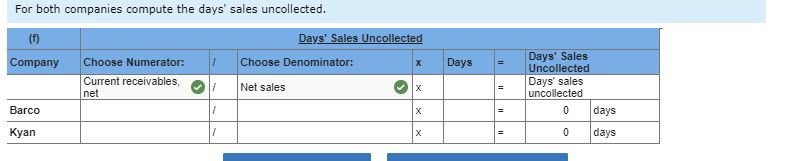

2017 2016 2015 2014 2013 636,194 413,113 331,818 229,632 166,400 86,528 11,348 Sales Cost of goods sold Accounts receivable 216,319 24,126 333,371 175,995 121,209 13,456 22,630 30,919 Compute trend percents for the above accounts, using 2013 as the base year. Trend Percent for Net Sales: Choose Denominator: Choose Numerator: Sales 2017: 2016: % 2015: 2014 Trend Percent for Cost of Goods Sold: Choose Denominator: Choose Numerator: Cost of goods sold 2017: % 2016: % 2015: 2014: Irend Percent for Accounts Receivables: Choose Denominator: Choose Numerator: Accounts receivable 2017: % 2016: 2015: 2014 Summary Information from the financial statements of two companles competing In the same industry follows. Barco an Company Barco an company Company Company Data from the current year-end balance sheets Assets Data from the current year's income statement Sales $780,eee $912,200 593,1ee 8,900 14,992 163,008 644 5ee Cash 18,eee 32,eee 54,400 8,6e0 138,5ee 7,250 307,400 Cost of goods sold Interest expense Income tax expense Net income Accounts receivable, net Current notes receivable (trade) Merchandise inventory 36,400 9,680 84,540 5,600 17,eee 25183 225,517 .47 Prepaid expenses Plant assets, net Basic earnings per share Cash dividends per share 3.88 340,ee0 $494,140 $548,150 3.76 3.96 Total assets Beginning-of-year balance sheet data Accounts receivable, net current notes receivable (trade) Merchandise inventory 30,8ee 52 20e Liabilities and Equity Current liabilities 66,340 $101,300 80,8ee 21e,eee 137,eee $494,140 $ 548,150 Long-term notes payable Common stock, $5 par value Retained earnings 185 400 115,eee 55,6e0 206,eee 125,85e Total assets 448,eee 210,eee 412,500 286 eee Common stock, $5 par value Total liabilities and equity Retained earnings 131,912 63,485 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts (Including notes) recelvable turnover, (d) Inventory turnover. (e) days' sales in Inventory. and ( days' sales uncollected. (Do not round Intermedlete calculetions.) 1b. Identify the company you consider to be better short-term credit risk. Answer is not complete. Complete this question by entering your answers in the tabs below. 1A Acid Test 1A Days Sal in 1A Days Sal Uncol 1A Current Ratio 1A Acct Rec 1A Invent Req 1B Ratio Turn Turnover Inv For both companies compute the acid-test ratio (b) Acid-Test Ratio Acid-Test Ratio Company Choose Numerator: Choose Denominator: Short-term investments Current Acid-test ratio Current liabilities Cash receivables to Barco 5,600 84,540 5,600 66.340 1.4 to 3.8 1 138,500 yan 240,750 7,250 101,300 co + For both companies compute the days' sales in inventory. Days' Sales in Inventory (e) Days' Sales in Inventory Choose Numerator Choose Denominator: Company Days Merchandise inventory Days' sales in inventory Cost of goods sold Barco 365 8 days yan 0 days | For both companies compute the days' sales uncollected. Days' Sales Uncollected (1) Days' Sales Uncollected Days' sales uncollected 0 days Company Choose Numerator: Choose Denominator: | Days Current receivables, Net sales | net Barco | days yan 0