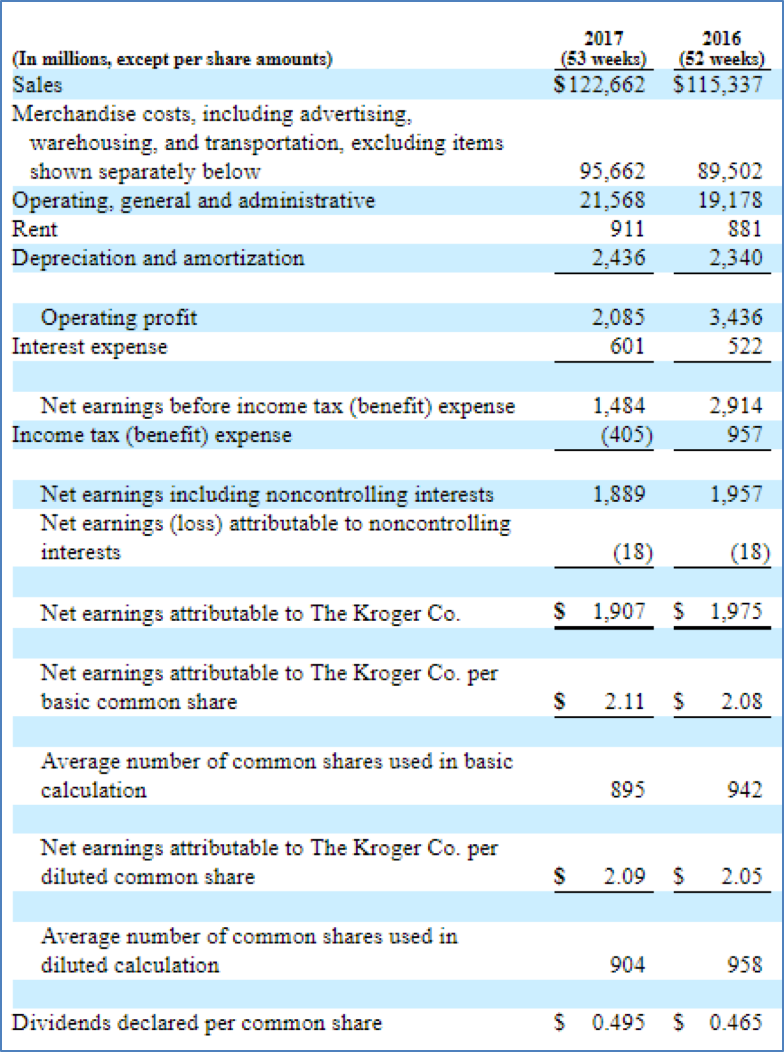

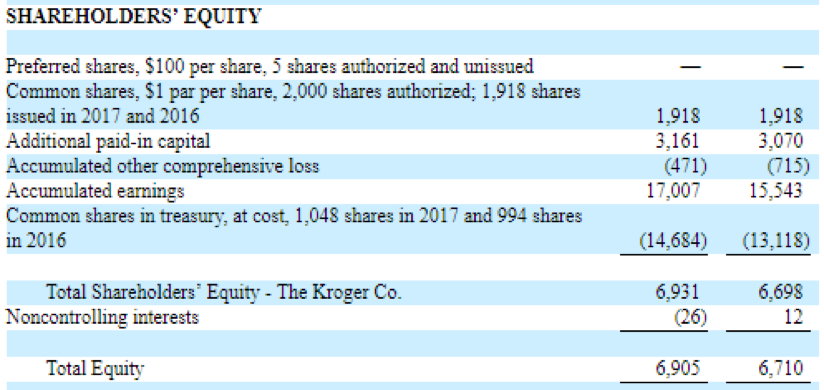

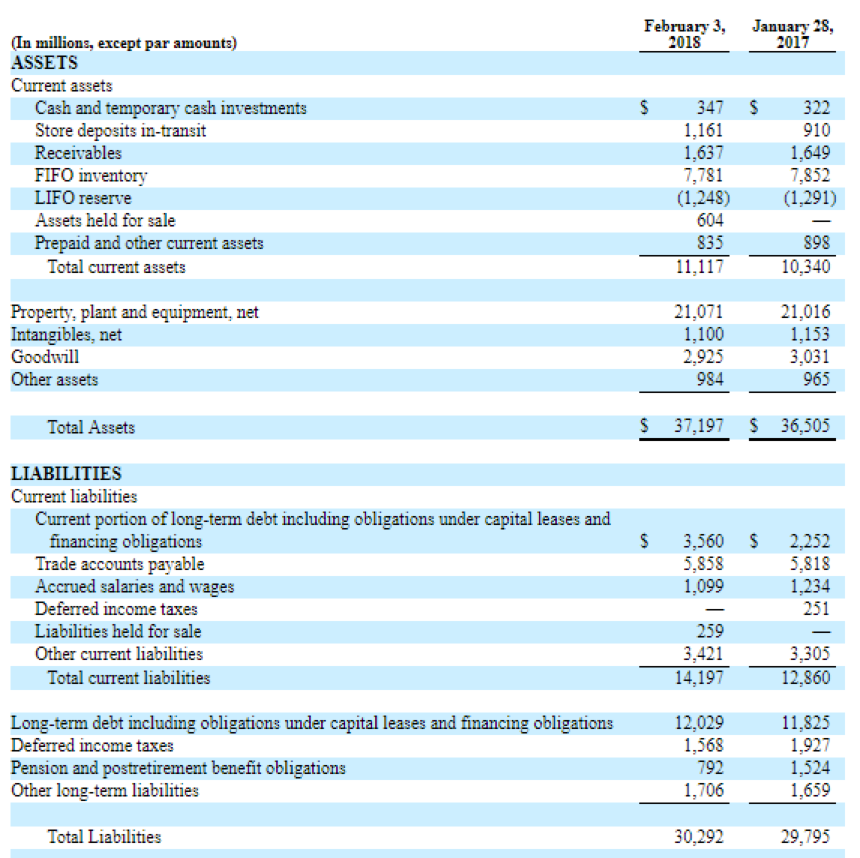

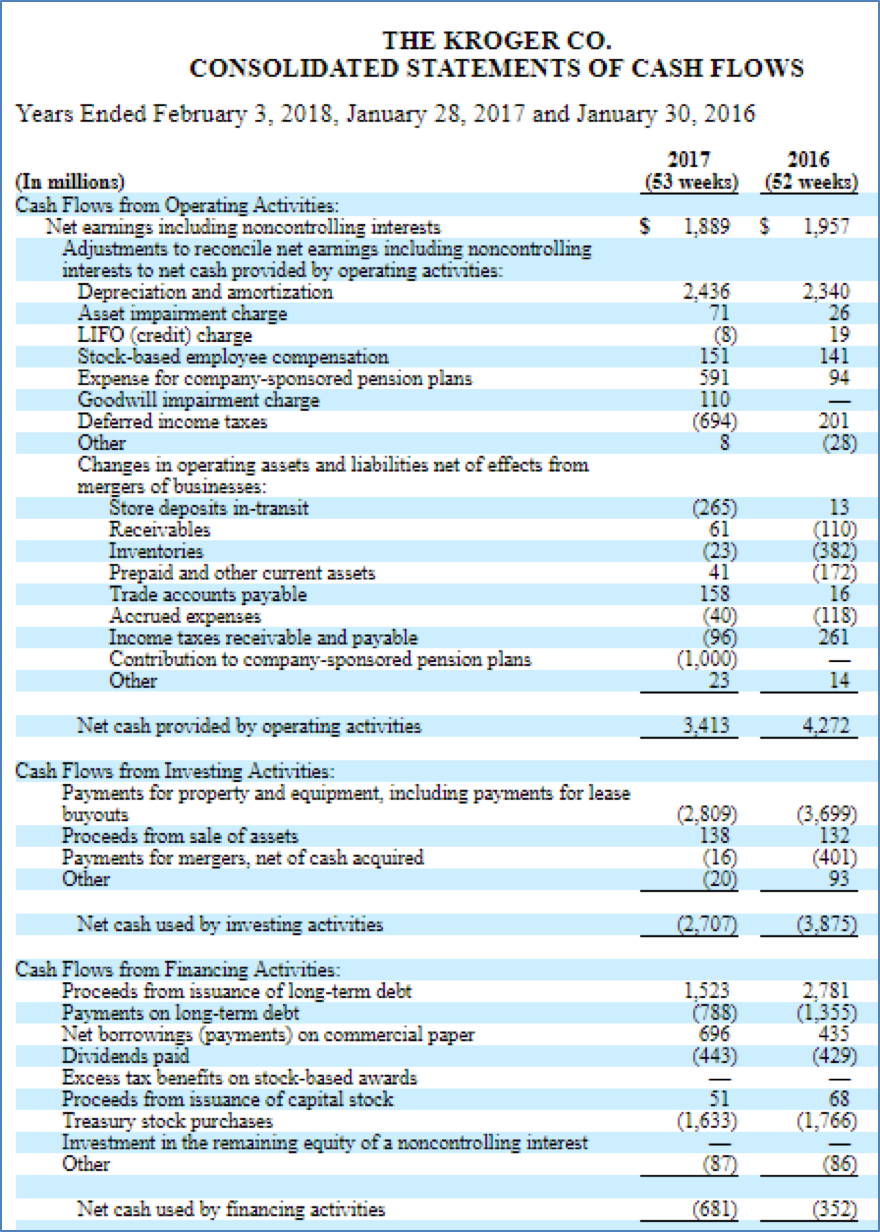

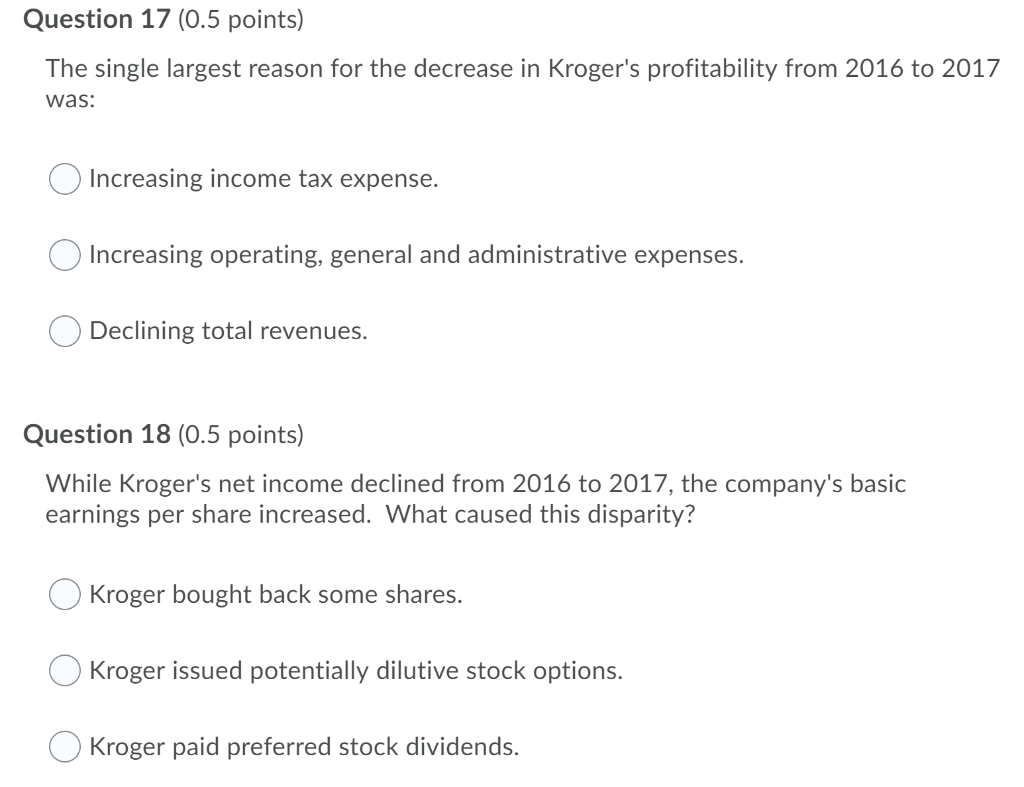

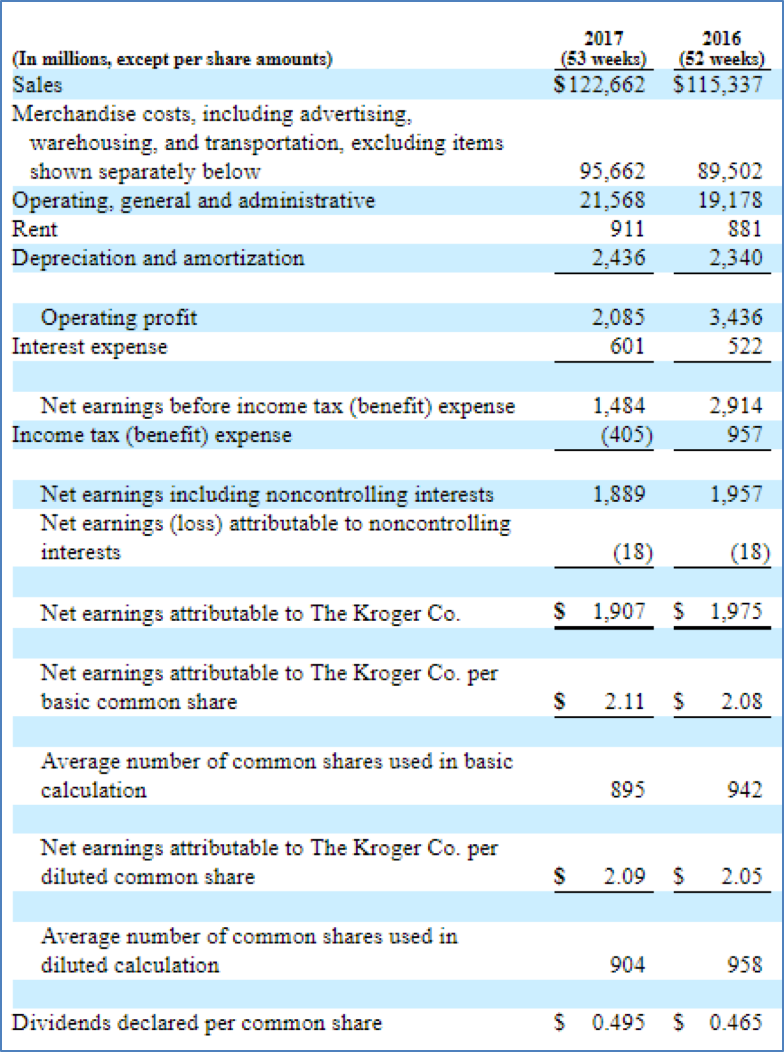

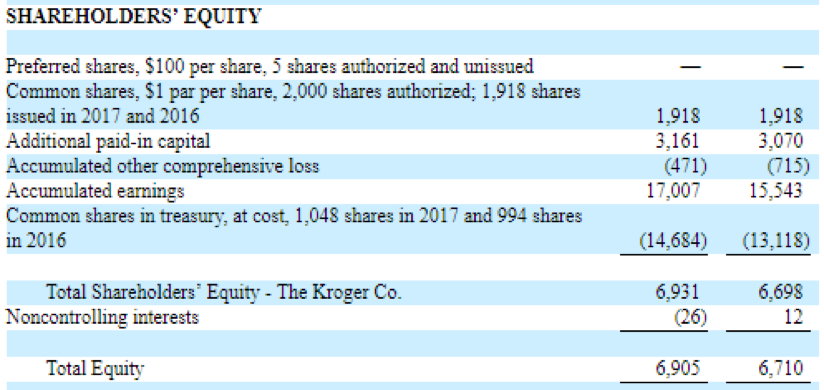

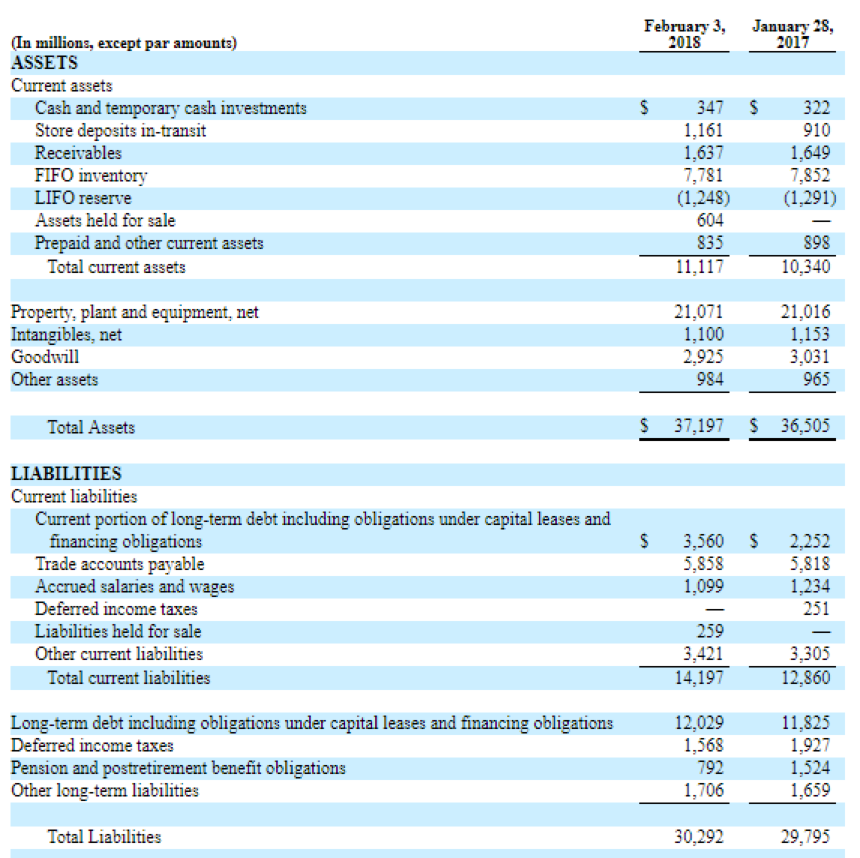

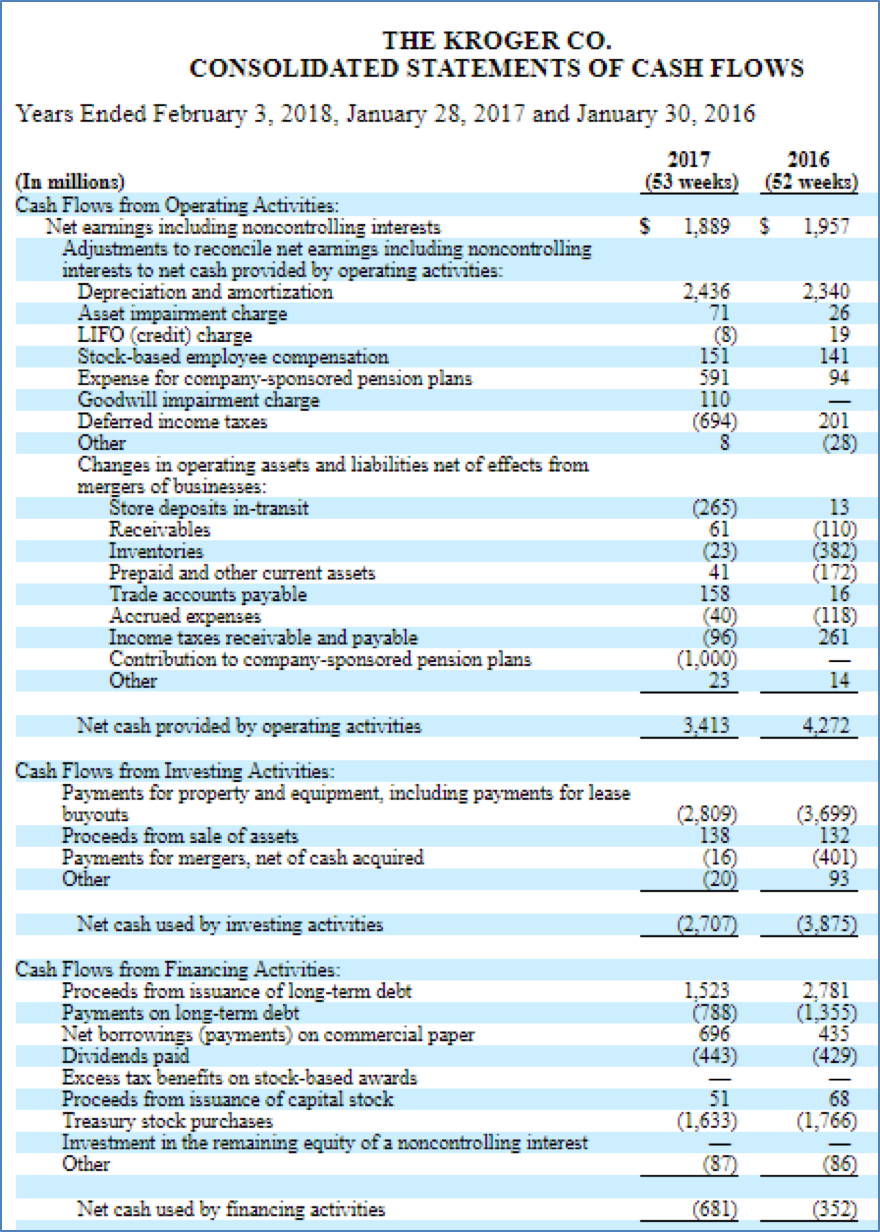

2017 (53 weeks) $122,662 2016 (52 weeks) $115,337 (In millions, except per share amounts) Sales Merchandise costs, including advertising, warehousing, and transportation, excluding items shown separately below Operating, general and administrative Rent Depreciation and amortization 95,662 21,568 911 2,436 89,502 19,178 881 2,340 Operating profit Interest expense 2,085 3,436 601522 Net earnings before income tax (benefit) expense Income tax (benefit) expense 1,484 (405) 2,914 957 1,889 1 .957 Net earnings including noncontrolling interests Net earnings (loss) attributable to noncontrolling interests (18)_ (18) Net earnings attributable to The Kroger Co. $ 1,907 S 1,975 Net earnings attributable to The Kroger Co. per basic common share $ 2.11 $ 2.08 Average number of common shares used in basic calculation 895 942 Net earnings attributable to The Kroger Co. per diluted common share $ 2.09 $ 2.05 Average number of common shares used in diluted calculation 904 958 Dividends declared per common share $ 0.495 $ 0.465 SHAREHOLDERS' EQUITY Preferred shares, $100 per share, 5 shares authorized and unissued Common shares, $1 par per share, 2,000 shares authorized: 1,918 shares issued in 2017 and 2016 Additional paid-in capital Accumulated other comprehensive loss Accumulated earnings Common shares in treasury, at cost, 1,048 shares in 2017 and 994 shares in 2016 1,918 3,161 (471) 17,007 1,918 3,070 (715) 15,543 (14.684) (13.118) Total Shareholders' Equity - The Kroger Co. Noncontrolling interests 6,931 (26) 6,698 12 Total Equity 6,905 6,710 February 3, 2018 January 28, 2017 S (In millions, except par amounts) ASSETS Current assets Cash and temporary cash investments Store deposits in-transit Receivables FIFO inventory LIFO reserve Assets held for sale Prepaid and other current assets Total current assets 347 1,161 1,637 7,781 (1,248) 604 322 910 1,649 7,852 ,822 (1,291) 835 898 10.340 11,117 Property, plant and equipment, net Intangibles, net Goodwill Other assets 21,071 21,016 1,100 1,153 2,925 3,031 984965 Total Assets $ 37,197 $ 36,505 $ $ LIABILITIES Current liabilities Current portion of long-term debt including obligations under capital leases and financing obligations Trade accounts payable Accrued salaries and wages Deferred income taxes Liabilities held for sale Other current liabilities Total current liabilities 3.560 5.858 1,099 2.252 5.818 1,234 251 259 3,421 14,197 3,305 12,860 Long-term debt including obligations under capital leases and financing obligations Deferred income taxes Pension and postretirement benefit obligations Other long-term liabilities 12,029 1,568 792 1,706 11,825 1,927 1,524 1.659 Total Liabilities 30,292 29,795 (8) THE KROGER CO. CONSOLIDATED STATEMENTS OF CASH FLOWS Years Ended February 3, 2018. January 28, 2017 and January 30, 2016 2017 2016 (In millions) (53 weeks) (52 weeks) Cash Flows from Operating Activities: Net earnings including noncontrolling interests $ 1,889 $ 1.957 Adjustments to reconcile net earnings including noncontrolling interests to net cash provided by operating activities: Depreciation and amortization 2,436 2,340 Asset impairment charge 71 26 LIFO (credit) charge 19 Stock-based employee compensation 151 141 Expense for company-sponsored pension plans 591 Goodwill impairment charge 110 Deferred income taxes (694) Other Changes in operating assets and liabilities net of effects from mergers of businesses: Store deposits in-transit (265) 13 Receivables (110) Inventories (23) (382) Prepaid and other current assets (172) Trade accounts payable 158 16 Accrued expenses (40) (118) Income taxes receivable and payable (96) 261 Contribution to company-sponsored pension plans (1,000) Other 94 8 201 (28) 61 41 23 Net cash provided by operating activities 3.413 4,272 Cash Flows from Investing Activities: Payments for property and equipment, including payments for lease buyouts Proceeds from sale of assets Payments for mergers, net of cash acquired Other (2.809) 138 (16) (3.699) 132 (401) 93 (20) Net cash used by investing activities (2.707) (3.875) Cash Flows from Financing Activities: Proceeds from issuance of long-term debt Payments on long-term debt Net borrowings (payments) on commercial paper Dividends paid Excess tax benefits on stock-based awards Proceeds from issuance of capital stock Treasury stock purchases Investment in the remaining equity of a noncontrolling interest Other 1,523 (788) 696 (443) 2.781 (1.355) 435 (429) 51 68 (1,633) (1,766) (86) Net cash used by financing activities (681) (352) Question 17 (0.5 points) The single largest reason for the decrease in Kroger's profitability from 2016 to 2017 was: O Increasing income tax expense. O Increasing operating, general and administrative expenses. O Declining total revenues. Question 18 (0.5 points) While Kroger's net income declined from 2016 to 2017, the company's basic earnings per share increased. What caused this disparity? O Kroger bought back some shares. O Kroger issued potentially dilutive stock options. O Kroger paid preferred stock dividends