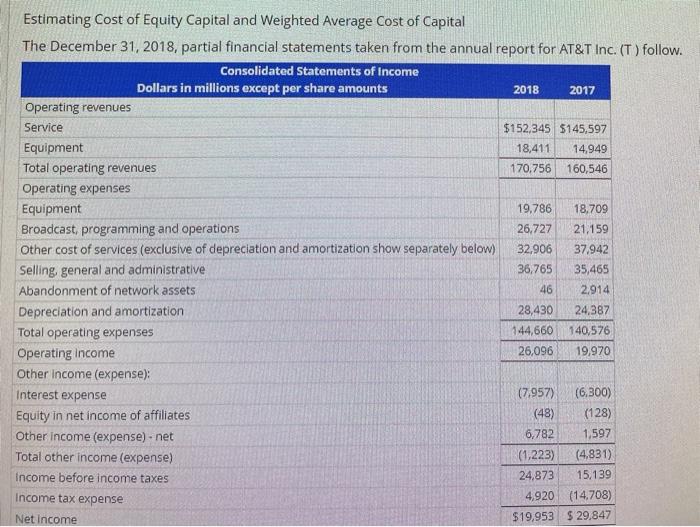

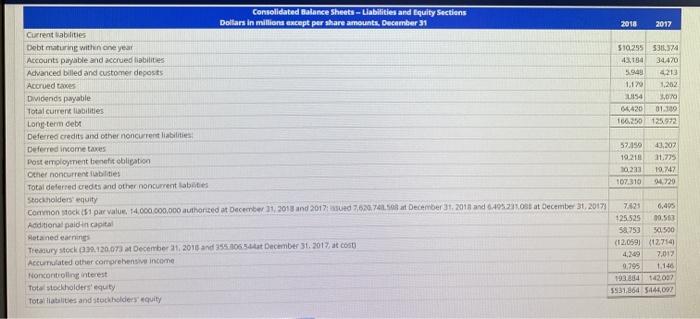

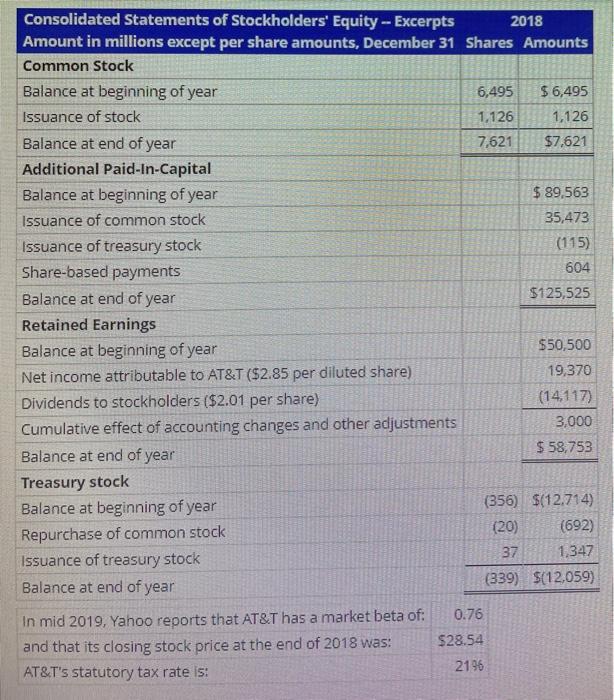

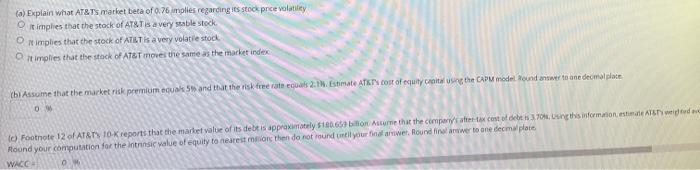

2018 2017 510.29553.374 13130 34.470 5.94 1,129 1,202 1154 3,070 66420 01.10 160250 125.972 Consolidated Balance Sheets -Liabilities and Equity Sections Dollars in millions except per share amounts. December 31 Current abilities Debt mature within one year Accounts payable and accrued liabilities Advanced billed and customer deposits Acorded as Dividends payable Total current abilities Long term debt Deferred credits and other noncurrent liabilities Deferred income taxes Post employment benefit obligation Other noncurrent abilities Total deferred credits and other noncurrent les Stockholders equity Common stock (31 par value 14.000.000.000 authorized at December 11, 2018 and 2017: 7.6207 December 31, 2015 and 6:49%23101 at December 31, 2017 Additional paid in capital Rota ned earning Treasury stock 31.120.073 December 31, 2015 and 355306504 December 31, 2017 at cost Accumulated other comprehensive income Non controlling interest Toto stockholders equity Totalliatalities and stockholders' quity 43,207 31.779 57.150 19.218 10233 107.310 19,747 9720 78125 6,495 125.525 00.563 58.753 50.500 (12.059) (12714 7,017 9.795 1.146 193884 142002 3531,864 5446,00 Consolidated Statements of Stockholders' Equity - Excerpts 2018 Amount in millions except per share amounts, December 31 Shares Amounts Common Stock Balance at beginning of year 6,495 $ 6,495 Issuance of stock 1.126 1,126 Balance at end of year 7,621 $7,621 Additional Paid-In-Capital Balance at beginning of year $ 89,563 Issuance of common stock 35,473 Issuance of treasury stock (115) Share-based payments 604 Balance at end of year $125,525 Retained Earnings Balance at beginning of year $50,500 Net income attributable to AT&T ($2.85 per diluted share) 19,370 Dividends to stockholders ($2.01 per share) (14,117) Cumulative effect of accounting changes and other adjustments 3,000 Balance at end of year $ 58,753 Treasury stock Balance at beginning of year (356) $(12.714) Repurchase of common stock (20) (692) Issuance of treasury stock 1,347 Balance at end of year (339) $(12,059) 0.76 In mid 2019, Yahoo reports that AT&T has a market beta of: and that its closing stock price at the end of 2018 was: $28.54 AT&T's statutory tax rate is: 2196 37 (a) Explain what AT&TS market beta of 0.76 implies regarding its stock prce volatility It implies that the stock of AT&Tis a very stable stock Nimplies that the stock of ATILT is a very volatile stock O implies that the stock of AT&T moves the same as the market index (bl Assume that the market rik premium quals and that the risk free rate equals 2.1. Estimate cost of equity cantante CPM model Round answer to one della 0 to Footnote 12 of AT&TS 10K reports that the market value of its debt is approximately 51806 billion Mature that the compensate cost of debts 370, in this information de Round your computation for the intrinsic value of equity to nearest more then do not round until your indfarrwer. Round Finawwer to one decimal place WACC