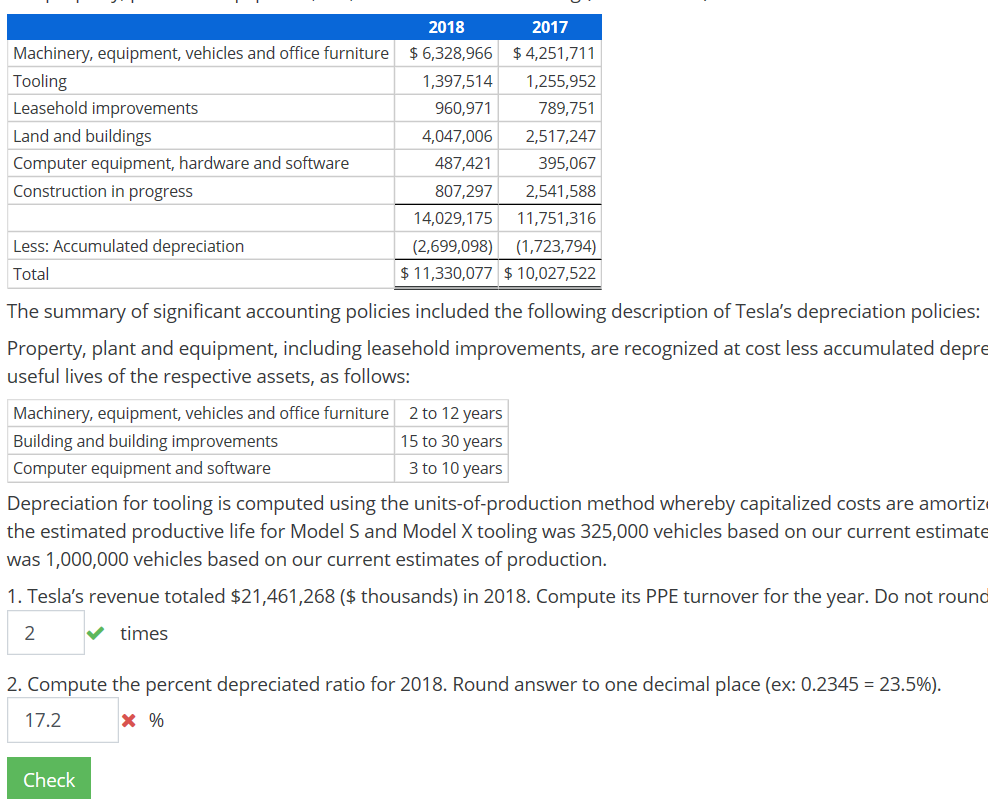

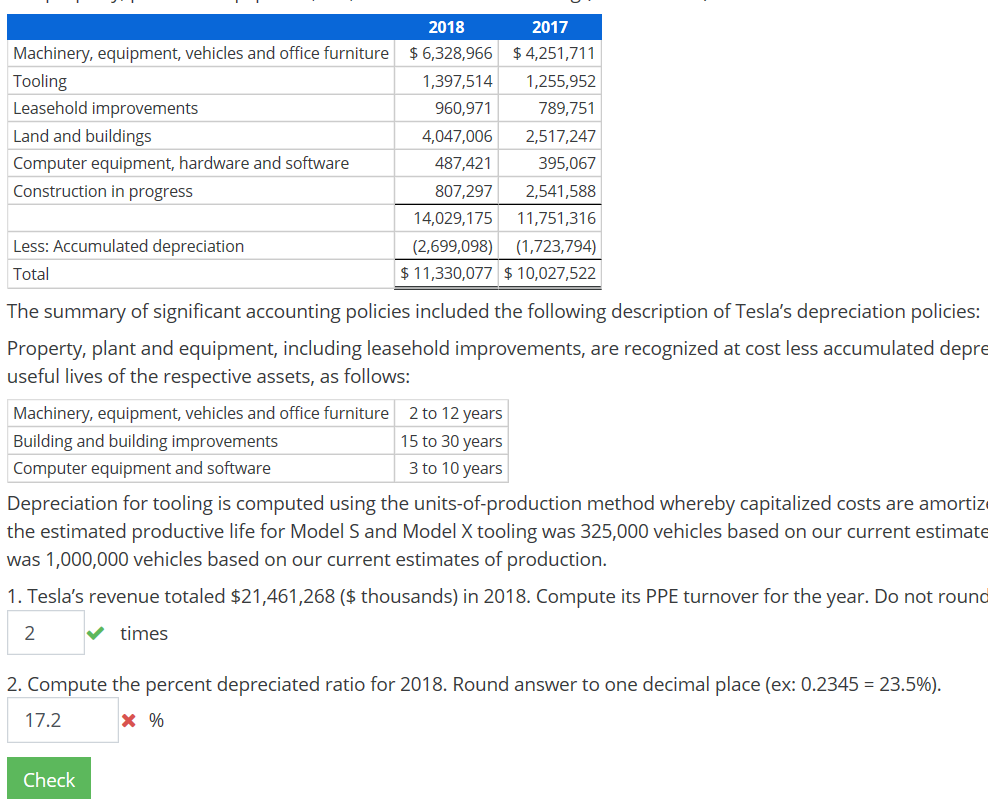

2018 2017 Machinery, equipment, vehicles and office furniture $6,328,966 $ 4,251,711 1,397,514 Tooling Leasehold improvements 1,255,952 960,971 789,751 Land and buildings 4,047,006 2,517,247 Computer equipment, hardware and software 487,421 395,067 Construction in progress 807,297 2,541,588 14,029,175 11,751,316 Less: Accumulated depreciation (2,699,098) (1,723,794) Total $11,330,077 $ 10,027,522 The summary of significant accounting policies included the following description of Tesla's depreciation policies: Property, plant and equipment, including leasehold improvements, are recognized at cost less accumulated depre useful lives of the respective assets, as follows: Machinery, equipment, vehicles and office furniture 2 to 12 years 15 to 30 years Building and building improvements 3 to 10 years Computer equipment and software Depreciation for tooling is computed using the units-of-production method whereby capitalized costs are amortiz the estimated productive life for Model S and Model X tooling was 325,000 vehicles based on our current estimate was 1,000,000 vehicles based on our current estimates of production. 1. Tesla's revenue totaled $21,461,268 ($ thousands) in 2018. Compute its PPE turnover for the year. Do not round 2 times 2. Compute the percent depreciated ratio for 2018. Round answer to one decimal place (ex: 0.2345 23.5%) 17.2 % Check 2018 2017 Machinery, equipment, vehicles and office furniture $6,328,966 $ 4,251,711 1,397,514 Tooling Leasehold improvements 1,255,952 960,971 789,751 Land and buildings 4,047,006 2,517,247 Computer equipment, hardware and software 487,421 395,067 Construction in progress 807,297 2,541,588 14,029,175 11,751,316 Less: Accumulated depreciation (2,699,098) (1,723,794) Total $11,330,077 $ 10,027,522 The summary of significant accounting policies included the following description of Tesla's depreciation policies: Property, plant and equipment, including leasehold improvements, are recognized at cost less accumulated depre useful lives of the respective assets, as follows: Machinery, equipment, vehicles and office furniture 2 to 12 years 15 to 30 years Building and building improvements 3 to 10 years Computer equipment and software Depreciation for tooling is computed using the units-of-production method whereby capitalized costs are amortiz the estimated productive life for Model S and Model X tooling was 325,000 vehicles based on our current estimate was 1,000,000 vehicles based on our current estimates of production. 1. Tesla's revenue totaled $21,461,268 ($ thousands) in 2018. Compute its PPE turnover for the year. Do not round 2 times 2. Compute the percent depreciated ratio for 2018. Round answer to one decimal place (ex: 0.2345 23.5%) 17.2 % Check