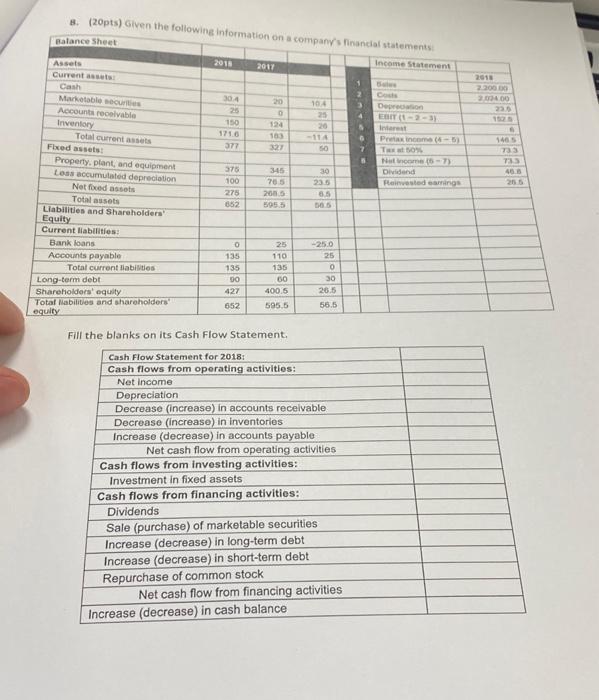

2018 2.2000 201400 225 1995 858 735 B. (20pts) Given the following information on a company's financial statements Balance Sheet Assets 2018 2017 Income Statement Current Cash Coche Marketable sources 30.4 20 104 Den Accounts receivable 25 0 Inventory 150 124 20 Interest 1716 Total currentes -11 Pincome (5) Fixed assets: 377 327 TON Property, plant, and equipment Nume () 375 345 30 Dividend Loss accumulated depreciation 100 705 235 Poinvested emings Not foued assets 275 2005 8.5 Total assets 652 595.5 Liabilities and Shareholders Equity Current liabilities: Bank loans 0 25 -25.0 Accounts payable 135 110 Total current liabilities 135 135 Long-term debt 00 60 30 Shareholders' equity 427 400.5 26.5 Total Habilities and shareholders 595.5 56.5 equity 40 265 NO allos 652 Fill the blanks on its Cash Flow Statement. Cash Flow Statement for 2018: Cash flows from operating activities: Net Income Depreciation Decrease (increase) in accounts receivable Decrease (increase) in inventories Increase (decrease) in accounts payable Net cash flow from operating activities Cash flows from investing activities: Investment in fixed assets Cash flows from financing activities: Dividends Sale (purchase) of marketable securities Increase (decrease) in long-term debt Increase (decrease) in short-term debt Repurchase of common stock Net cash flow from financing activities Increase (decrease) in cash balance 2018 2.2000 201400 225 1995 858 735 B. (20pts) Given the following information on a company's financial statements Balance Sheet Assets 2018 2017 Income Statement Current Cash Coche Marketable sources 30.4 20 104 Den Accounts receivable 25 0 Inventory 150 124 20 Interest 1716 Total currentes -11 Pincome (5) Fixed assets: 377 327 TON Property, plant, and equipment Nume () 375 345 30 Dividend Loss accumulated depreciation 100 705 235 Poinvested emings Not foued assets 275 2005 8.5 Total assets 652 595.5 Liabilities and Shareholders Equity Current liabilities: Bank loans 0 25 -25.0 Accounts payable 135 110 Total current liabilities 135 135 Long-term debt 00 60 30 Shareholders' equity 427 400.5 26.5 Total Habilities and shareholders 595.5 56.5 equity 40 265 NO allos 652 Fill the blanks on its Cash Flow Statement. Cash Flow Statement for 2018: Cash flows from operating activities: Net Income Depreciation Decrease (increase) in accounts receivable Decrease (increase) in inventories Increase (decrease) in accounts payable Net cash flow from operating activities Cash flows from investing activities: Investment in fixed assets Cash flows from financing activities: Dividends Sale (purchase) of marketable securities Increase (decrease) in long-term debt Increase (decrease) in short-term debt Repurchase of common stock Net cash flow from financing activities Increase (decrease) in cash balance