Answered step by step

Verified Expert Solution

Question

1 Approved Answer

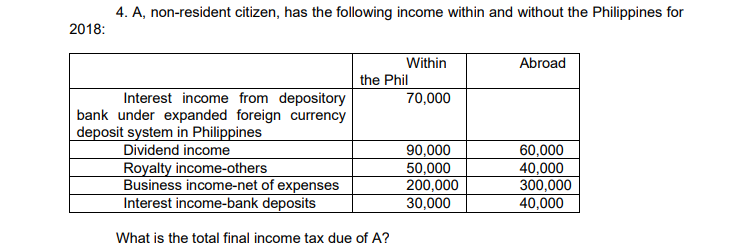

2018: 4. A, non-resident citizen, has the following income within and without the Philippines for Interest income from depository bank under expanded foreign currency

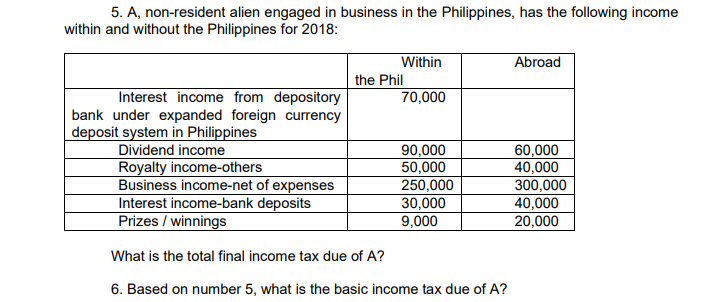

2018: 4. A, non-resident citizen, has the following income within and without the Philippines for Interest income from depository bank under expanded foreign currency deposit system in Philippines Dividend income Within the Phil Royalty income-others Business income-net of expenses Interest income-bank deposits What is the total final income tax due of A? 70,000 90,000 50,000 200,000 30,000 Abroad 60,000 40,000 300,000 40,000 5. A, non-resident alien engaged in business in the Philippines, has the following income within and without the Philippines for 2018: Interest income from depository bank under expanded foreign currency deposit system in Philippines Dividend income Within 70,000 the Phil 90,000 50,000 250,000 30,000 9,000 Royalty income-others Business income-net of expenses Interest income-bank deposits Prizes / winnings What is the total final income tax due of A? 6. Based on number 5, what is the basic income tax due of A? Abroad 60,000 40,000 300,000 40,000 20,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the total final income tax due for A in both scenarios we need to apply the appropriate tax rates to each type of income and then sum up ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started