Question

Barry is a manager of a public listed company in Sydney and has an annual salary of $200,000. In addition, the employer has provided

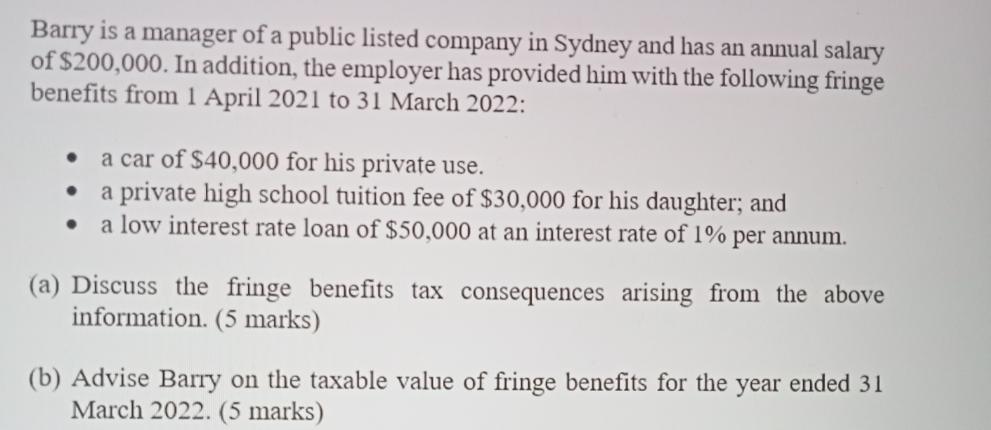

Barry is a manager of a public listed company in Sydney and has an annual salary of $200,000. In addition, the employer has provided him with the following fringe benefits from 1 April 2021 to 31 March 2022: a car of $40,000 for his private use. a private high school tuition fee of $30,000 for his daughter; and a low interest rate loan of $50,000 at an interest rate of 1% per annum. (a) Discuss the fringe benefits tax consequences arising from the above information. (5 marks) (b) Advise Barry on the taxable value of fringe benefits for the year ended 31 March 2022. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Fringe Benefits Provided to Barry Barry has received the following fringe benefits from his employer ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2015

Authors: William H. Hoffman, William A. Raabe, David M. Maloney, James C. Young

38th Edition

978-1305310810, 1305310810, 978-1285439631

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App