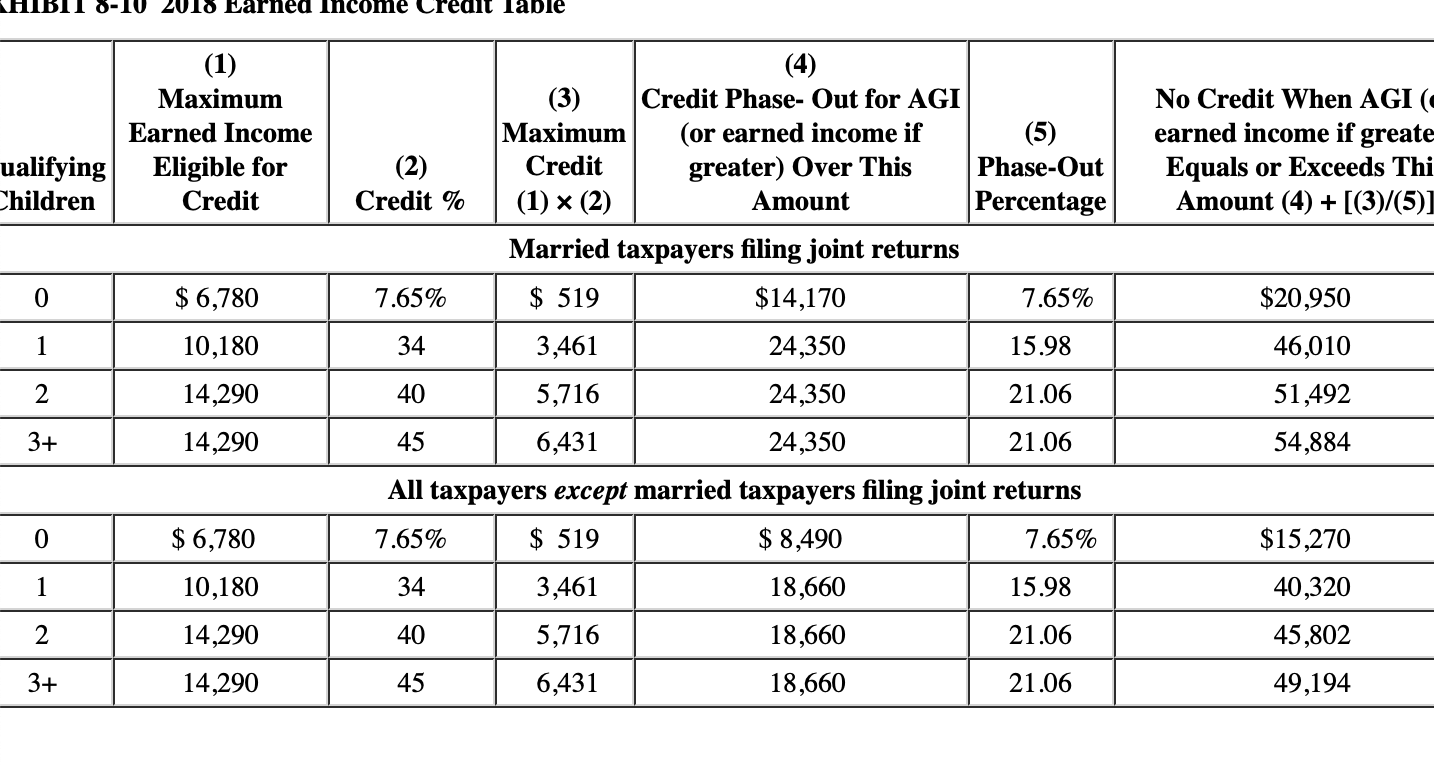

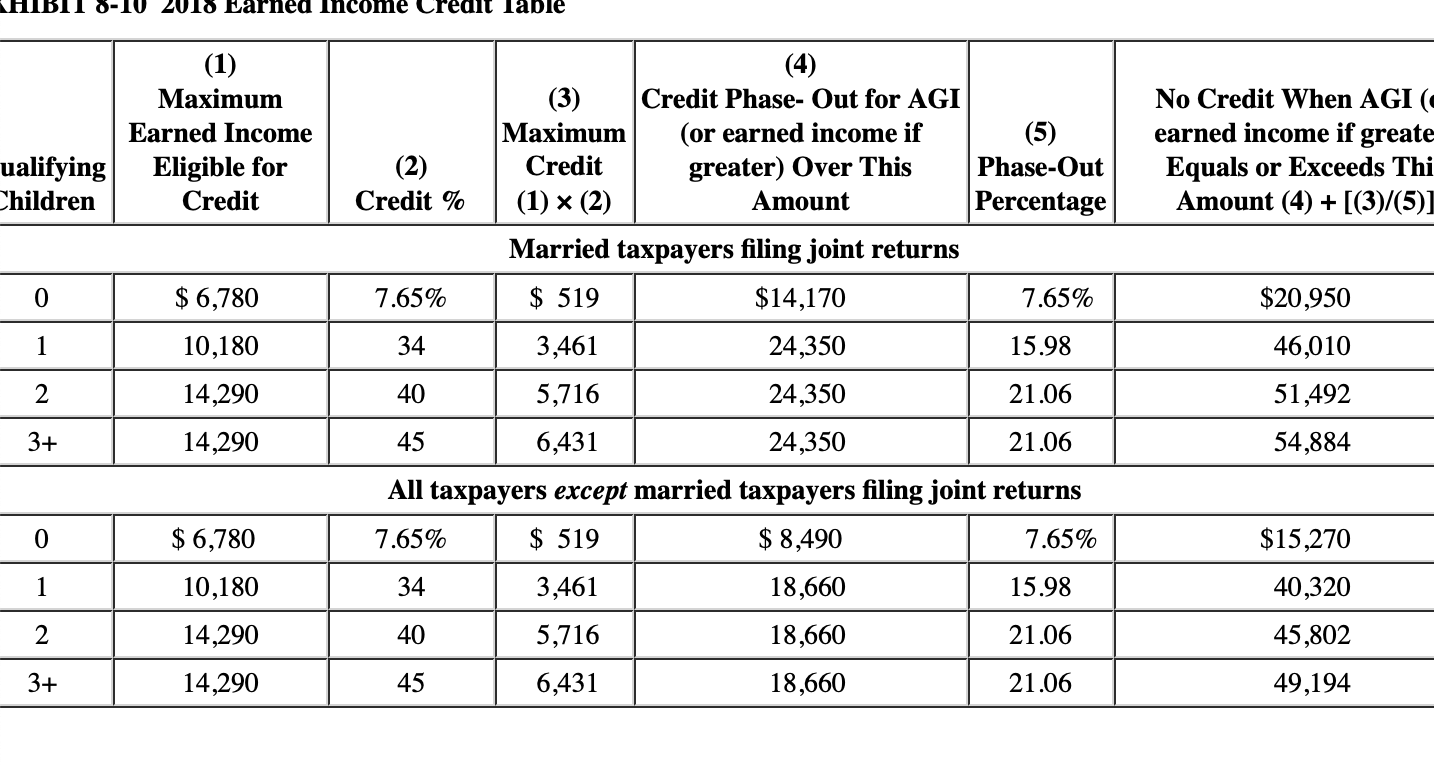

2018 Earned Income Credit lable (1) Maximum Earned Income Eligible for Credit ualifying Children (2) Credit % (4) (3) Credit Phase- Out for AGI Maximum (or earned income if (5) Credit greater) Over This Phase-Out (1) (2) Amount Percentage Married taxpayers filing joint returns $ 519 $14,170 7.65% No Credit When AGI ( earned income if greate Equals or Exceeds Thi Amount (4) + [(3)/(5) 0 $ 6,780 7.65% $20,950 10,180 34 3,461 24,350 15.98 46,010 2 14,290 40 5,716 24,350 21.06 51,492 3+ 14,290 54,884 0 $ 6,780 45 6,431 24,350 21.06 All taxpayers except married taxpayers filing joint returns 7.65% $ 519 $ 8,490 7.65% 34 3,461 18,660 15.98 40 5,716 18,660 21.06 45 6,431 18,660 21.06 10,180 $15,270 40,320 45,802 2 14,290 34 14,290 49,194 [The following information applies to the questions displayed below.] In 2018, Amanda and Jaxon Stuart have a daughter who is 1 year old. The Stuarts are full-time students and they are both 23 years old. Their only sources of income are gains from stock they held for three years before selling and wages from part-time jobs. What is their earned income credit in the following alternative scenarios if they file jointly? Use Exhibit 8-10 . (Leave no answer blank. Enter zero if applicable.) c. Their AGI is $25,000, consisting of $20,000 of wages and $5,000 of lottery winnings (unearned income). (Round your intermediate calculations to the nearest whole dollar amount.) Earned income credit [The following information applies to the questions displayed below.] In 2018, Amanda and Jaxon Stuart have a daughter who is 1 year old. The Stuarts are full-time students and they are both 23 years old. Their only sources of income are gains from stock they held for three years before selling and wages from part-time jobs. What is their earned income credit in the following alternative scenarios if they file jointly? Use Exhibit 8-10 . (Leave no answer blank. Enter zero if applicable.) d. Their AGI is $25,000, consisting of $5,000 of wages and $20,000 of lottery winnings (unearned income). (Round your intermediate calculations to the nearest whole dollar amount.) Earned income credit