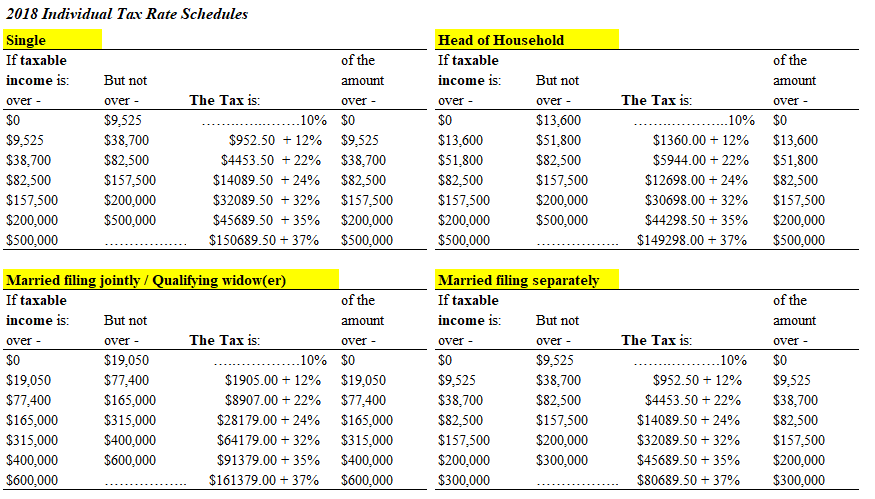

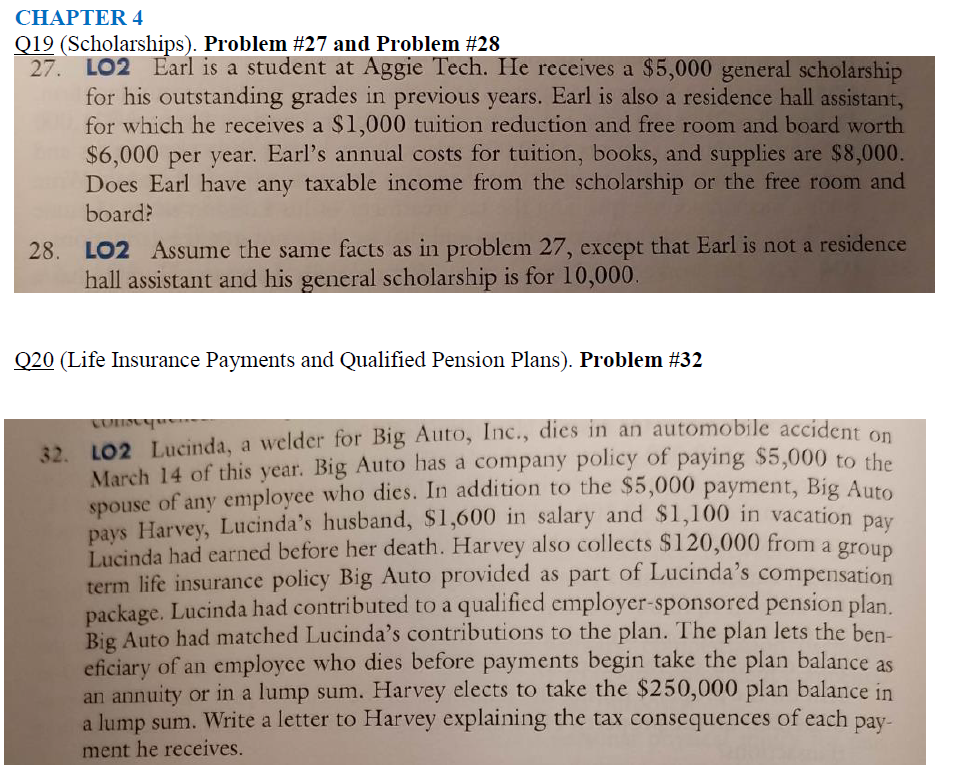

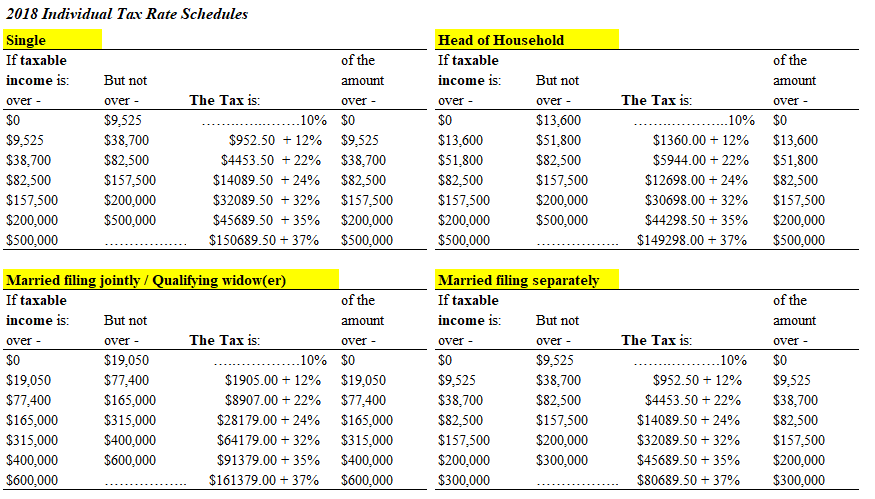

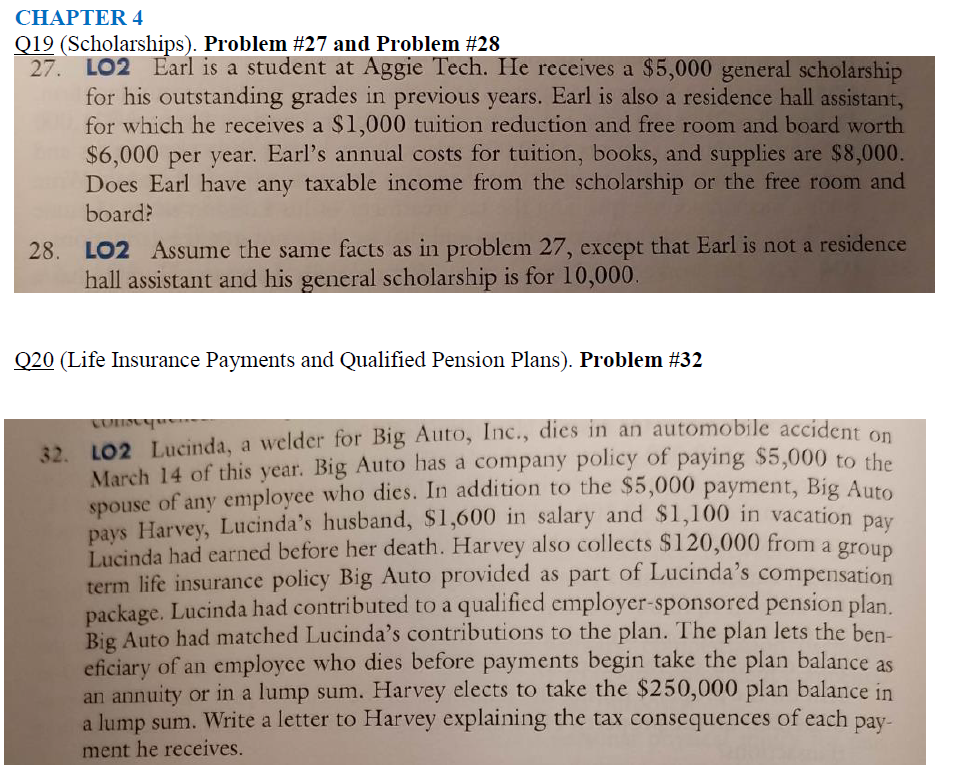

2018 Individual Tax Rate Schedules If taxable income 1s: over - S0 $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 But not over - $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 Head of Household If taxable income 1s: over - S0 $13,600 $51,800 $82,500 $157,500 $200,000 $500,000 amount But not over - $13,600 $51,800 $82,500 $157,500 $200,000 $500,000 amount The Tax is: The Tax is: $952.50+12% $4453.50+22% $14089.50+24% $32089.50+32% $45689.50+35% $150689.50+37% $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 $1360.00 + 12% $5944.00 + 22% $12698.00 24% $30698.00 + 32% $44298.50+35% $149298.00 37% $13,600 $51.800 $82,500 $157,500 $200,000 $500,000 Married filing jointly/ Qualifying widow(er) If taxable income 1s: over - S0 $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 But not over - $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 Married filing separate If taxable income 1s: over - S0 $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 amount But not over - $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 amount The Tax is: The Tax is: $1905.00 + 12% $8907.00 + 22% $28179.00 24% $64179.00 + 32% $91379.00 + 35% $161379.00 37% $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 $952.50 12% $4453.50 22% $14089.50+24% $32089.50 + 32% $45689.50+35% $80689.50+37% $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 CHAPTER 4 Q19 (Scholarships). Problem #27 and Problem #28 27. LO2 Earl is a student at Aggie Tech. He receives a $5,000 general scholarshijp for his outstanding grades in previous years. Earl is also a residence hall assistant, for which he receives a $1,000 tuition reduction and free room and board worth $6,000 per year. Earl's annual costs for tuition, books, and supplies are $8,000. Does Earl have any taxable income from the scholarship or the free room and board? LO2 Assume the same facts as in problem 27, except that Earl is not a residence hall assistant and his general scholarship is for 10,000 28. 020 (Life Insurance Payments and Qualified Pension Plans). Problem #32 LO2 Lucinda, a welder for Big Auto, Inc., dies in March 14 of this year. Big Auto has a company policy of paying $5,000 spouse of any employee who dies. In addition to the $5,000 payment, E pays Harvey, Lucinda's husband, S1,600 in salary and $1, Lucinda had carned before her death. Harvey also collects S120,000 from a term life ins package. Lucinda had contributed to a qualified employer-sponsored pension plan Big Auto had matched Lucinda's contributions to the plan. The plan lets the ben- eficiary of an employce who dies before payments begin take the plan balance as an annuity or in a lump sum. Harvey elects to take the $250,000 plan balance in a lump sum. Write a letter to Harvey explaining the tax consequences of each pay- ment he receives an automobile accident on to the g Auto 100 in vacation pay group urance policy Big Auto provided as part of Lucinda's compensation